Article

in Press Printer-friendly PDF file

Article

in Press Printer-friendly PDF fileWestside Observer Newspaper

June 2016 at www.WestsideObserver.com

Drunken Sailor City Hall Spending: Another Bait-and-Switch?

Last November’s Affordable Housing Bond Measure Snookered Voters

Article

in Press Printer-friendly PDF file

Article

in Press Printer-friendly PDF file

Westside Observer Newspaper

June 2016 at www.WestsideObserver.com

Drunken

Sailor City Hall Spending: Another Bait-and-Switch?

Last November’s

Affordable Housing Bond Measure Snookered Voters

by Patrick Monette-Shaw

As I wrote in May’s Westside Observer, voters were snookered on last November’s $310 million housing bond measure: Only recently has the City finally admitted that fully 20% of that bond — possibly up to $62 million, or a smaller $20 million chunk — is being set aside for housing for the homeless, something voters were never informed about prior to the November 2015 election. More on this, below.

Add in the $20 million for homeless shelters in the June 2016 bond, and we’re up to $42 million to $82 million in bond financing plus interest for homeless projects, as in “when pigs fly.” That $82 million is on top of the Mayor’s first-year budget for the new Department of Homelessness and Supportive Housing under newly-appointed department head Jeff Kositsky, who fittingly has a tattoo on his right calf featuring a flying pig and who sports matching socks featuring flying pigs. The department Kositsky will head launches July 1, and will have an annual budget of approximately $165 million and a staff of 110.

And shortly after

last November’s election, legislation started circulating

at City Hall to issue up to $95 million in Certificates of Participation

(COP’s)†

for Affordable Housing Projects above and beyond the $310 million

Affordable Housing bond measure voters had just approved. The

COP’s are planning for a Rental Assistance Demonstration

Project (RAD), but it is not yet known how many of the units to

be constructed or acquired, if any, will be earmarked and set

aside for housing the homeless.

And shortly after

last November’s election, legislation started circulating

at City Hall to issue up to $95 million in Certificates of Participation

(COP’s)†

for Affordable Housing Projects above and beyond the $310 million

Affordable Housing bond measure voters had just approved. The

COP’s are planning for a Rental Assistance Demonstration

Project (RAD), but it is not yet known how many of the units to

be constructed or acquired, if any, will be earmarked and set

aside for housing the homeless.

In other words, the City knew last November that the $310 million was an insufficient amount, and were planning on issuing additional COP’s to make up the gap. And for all we know, they may issue even more COP’s for affordable housing, or for housing the homeless, in the near future.

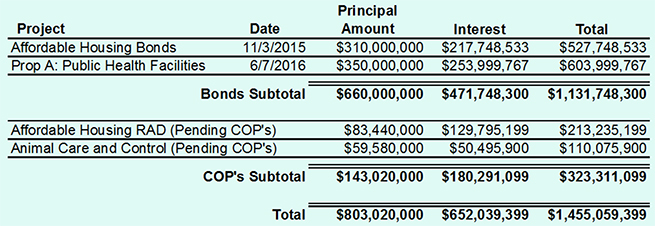

Drunken Sailor’s $1.5 Billion in New Debt Since November

As I also wrote last month, between last November’s $310 million Affordable Housing bond measure and June’s $350 million Public Health and Safety bond measure that voters will probably pass, taxpayers are footing $1.13 billion in principal and interest for two bonds. Add in the two COP’s nearing approval — the housing RAD project and the Animal Care and Control project — that total another $323.3 million, and we’re up to a combined $1.45 billion in principal and interest debt service in a short seven-month period since last November for just four additional projects.

Table 1: New Long-Term Debt Service Since November 2015

Clearly, City Hall’s

drunken sailors have been on a spending spree.

Clearly, City Hall’s

drunken sailors have been on a spending spree.

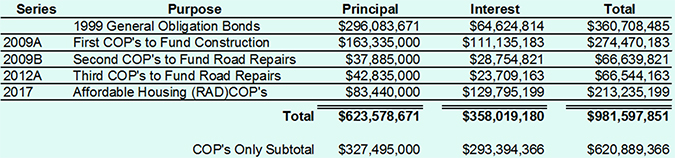

Laguna Honda Hospital Mortgaged to the Max

In May 2009 I reported in “Mortgaging Laguna Honda Hospital’s Future” that the City was leveraging the “residual rental value” of Laguna Honda Hospital’s (LHH) property to issue a COP as long-term debt for doing street improvement projects, and had issued another COP to help pay for the cost overruns of building the new LHH replacement facilities.

I noted in 2009 that the City had issued the two COP’s based on LHH having $575 million in market value. Fast forward seven years to 2016, and the City has already issued a second COP for streets improvement and is poised to issue in the next month a fourth COP for the Affordable Housing RAD program, as reported by the City Controller’s Office. In addition to the 1999 bond to rebuild LHH, there will be four COP’s “leveraged” against LHH, totalling a combined $981.6 million in principal and interest.

Table 2: Principal and Interest Debt Mortgaged Against LHH’s Market Value

Given LHH’s

$575 million market value, reasonable people are concerned that

the nearly $1 billion in long-term debt financing already

leveraged against LHH’s property market value is precariously

out of sync, and alarming. Should the City default for any reason

on the COP’s, the lease holders could theoretically seize

the very assests — the entire hospital — to guarantee

repayment of this excess leveraging. And there’s no guarantee

that the Animal Care and Control Facility COP’s that will

be issued by November 2016 will not

also name LHH as the lease “asset,” since the City is

cagily claiming that they don’t currently know which City

asset will be “leveraged” for the Animal Care COP’s.

Given LHH’s

$575 million market value, reasonable people are concerned that

the nearly $1 billion in long-term debt financing already

leveraged against LHH’s property market value is precariously

out of sync, and alarming. Should the City default for any reason

on the COP’s, the lease holders could theoretically seize

the very assests — the entire hospital — to guarantee

repayment of this excess leveraging. And there’s no guarantee

that the Animal Care and Control Facility COP’s that will

be issued by November 2016 will not

also name LHH as the lease “asset,” since the City is

cagily claiming that they don’t currently know which City

asset will be “leveraged” for the Animal Care COP’s.

I’m not buying it that the City has simply no idea in advance (now) of which City asset it will use to secure the lease financing to issue $110 million in principal and interest debt service for the Animal Care facility! And the $1 billion in “mortgages” already leveraged against LHH is dangerous.

Oversight of the November Housing Bond’’s Rocky Start

In the midst of the worst affordable housing crisis in San Francisco’s recent memory, you might think the City would be responding to the crisis expeditiously. You’d be wrong, since meaningful oversight is noticeably absent, despite the fact that last November’s voter guide indicated in Section 4-A (Bond Accountability Measures, Oversight) on page 156 that the Citiens’ General Obligation Bond Oversight Committee (CGOBOC) would conduct reviews of bond spending. Typically, bond measures are required to report to CGOBOC on a quarterly basis.

Where’s the Regular CGOBOC Meetings and the

Bond Web Site?

Where’s the Regular CGOBOC Meetings and the

Bond Web Site?

Since the bond measure was passed, just one CGOBOC meeting was held on January 28, 2016 to hear a status update from the Mayor’s Office of Housing and Community Development (MOHCD) on progress on spending the bond.

Readers may recall that the Civil Grand Jury was highly critical of MOHCD when the 2013–2014 Civil Grand Jury released a report in June 2014 that was a damning indictment of the lack of transparency at MOHCD, which I reported on in an article in May 2015.

The inaugural hearing regarding the November 2015 bond held on January 28 was pathetic, as neither MOHCD nor CGOBOC had thought ahead about what sort of reporting requirements — evaluative “metrics” to report and evaluate various and diverse categories within the bond — would be applied to the Affordable Housing Bond measure to report project progress. The reporting metrics still haven’t been developed by May 23, 2016.

At the January CGOBOC

meeting, MOHCD’s Ms. Hartley provided CGOBOC members and

members of the public with copies of an 11-page undated report titled “2015 $310 Million Affordable

Housing General Obligation Bond Report” containing an

“Executive Summary,” and also presented a 15-page undated

PowerPoint presentation titled “San

Francisco 2015 Affordable Housing General Obligation Bond: Assessing

Our Needs.”

At the January CGOBOC

meeting, MOHCD’s Ms. Hartley provided CGOBOC members and

members of the public with copies of an 11-page undated report titled “2015 $310 Million Affordable

Housing General Obligation Bond Report” containing an

“Executive Summary,” and also presented a 15-page undated

PowerPoint presentation titled “San

Francisco 2015 Affordable Housing General Obligation Bond: Assessing

Our Needs.”

The minutes of CGOBOC’s January 28, 2016 meeting reveal the extensive discussion and CGOBOC member questions that occurred regarding reporting “metrics” of the data points CGOBOC expects MOHCD to utilize in reporting progress on the bond were largely omitted from the minutes, reduced to a single sentence, although the minutes do report a handful of goals MOHCD hopes to accomplish. Clearly goals and metrics are not the same thing. How’s that for censorhip?

In response to a records request placed on May 19 for all correspondence between MOHCD and CGOBOC agreeing on what reporting metrics will be used in future MOHCD presentations to CGOBOC, and the actual metrics and reporting formats that have been developed and adopted, the Controller’s Office responded on May 23 saying only that it was “working on your [records] request and will respond with any relevant records as soon as possible” [emphasis added]. In other words, four months following CGOBOC’s January meeting, and six months following passage of the bond last November, the City hasn’t finished developing which metrics will be used to assess performance on this bond.

The legal text for

the bond measure in last November’s voter guide also states

in Section 4-B on page 157 that “the City shall create and

maintain a Web page outlining and describing the bond program,

progress, and activity updates.”

The legal text for

the bond measure in last November’s voter guide also states

in Section 4-B on page 157 that “the City shall create and

maintain a Web page outlining and describing the bond program,

progress, and activity updates.”

On May 16, I submitted a records request to the City Controller’s Office seeking information about the web site that should have been set up by now.

When asked for the web site address and which City department is responsible for creating and maintaining it — both relatively innocuous questions — the Controller’s Office initially responded by invoking Sunshine Ordinance §67.25(b), citing a need for a 10-day delay in which to respond.

When I replied the same date to the Controller that I was prepared to file a complaint with the Sunshine Ordinance Task Force alleging the Controller was wrongly and falsely abusing §67.25(b) for such a simple records request, the Controller quickly changed his tune, saying on May 18:

There is absolutely

no reason for MOHCD to take an entire year between passage of

the Bond in November 2015 and issuing the first bonds possibly

as late as November 2016 to finally get around to creating the

web site promised in the voter guide. And there seems to be no

reason why it is taking MOHCD an entire year to get around to

issuing the bond instrument RFP and rapidly moving along construction

of affordable housing before more San Franciscans are displaced

out-of-county.

There is absolutely

no reason for MOHCD to take an entire year between passage of

the Bond in November 2015 and issuing the first bonds possibly

as late as November 2016 to finally get around to creating the

web site promised in the voter guide. And there seems to be no

reason why it is taking MOHCD an entire year to get around to

issuing the bond instrument RFP and rapidly moving along construction

of affordable housing before more San Franciscans are displaced

out-of-county.

So it appears that even before MOHCD will eventually get around to issuing the bond instruments, the City will more than likely first issue the $95 million in Affordable Housing COP’s before then, apparently because the City can issue COP’s far more quickly than bond instruments.

The 20% Homeless Housing Set-Aside Snickeroo

A partial verbatin transcript of CGOBOC’s Janury 28 meeting is very troubling.

Foremost, CGOBOC’s

January 28 meeting minutes also omitted

any mention of comments CGOBOC members made regarding setting

aside 20% of the bond — probably at least $20 million, and

potentially up to $62 million — for housing-for-the-homelessness

programs.

Foremost, CGOBOC’s

January 28 meeting minutes also omitted

any mention of comments CGOBOC members made regarding setting

aside 20% of the bond — probably at least $20 million, and

potentially up to $62 million — for housing-for-the-homelessness

programs.

The Executive Summary Hartley distributed on January 28 showed on page 9 that MOHCD’s housing programs serve “vulnerable” San Francisco residents, defining vulnerable populations as 1) Low-income working families, 2) Veterans, 3) Homeless individuals and familes, 4) Seniors, 5) Disabled individuals, and 6) transitional-aged youth. But Hartley’s PowerPoint presentation on January 28 listed only four of the six catgories (# 1, 2, 4, and 5), omitting homeless people and transitional-aged youth.

What’s more, the legal text of Prop A in the November 2015 voter guide also stipulated on page 157 that the bond measure would put the question to voters whether the bond should prioritize “vulnerable” populations as including folks “such as” working familieis, veterans, seniors and disabled persons, but didn’t mention homeless people or “transitional youth” in the legal text as being “vulnerable populations.”

Leading up to November’s election, it is thought none of MOHCD’s other documents had included homeless people in the definition of “vulnerable” San Franciscans.

Indeed, CGOBOC’s

January 28 meeting minutes list the same four vulnerable populations

Hartley listed in her PowerPoint presentation, and the

minutes also omitted any mention of homeless people or

transitional youth in the definition of “vulnerable.”

Indeed, CGOBOC’s

January 28 meeting minutes list the same four vulnerable populations

Hartley listed in her PowerPoint presentation, and the

minutes also omitted any mention of homeless people or

transitional youth in the definition of “vulnerable.”

Worse, the verbatim transcript notes that Hartley and MOHCD were hoping to issue the first “tranche”†† (a French term meaning “slice” of several issues (portions) of the bond to be released in successively numbered series) in the first or second quarter of calendar year 2016, in part because MOHCD wanted to “get out there as soon as possible” on opportunities in the Mission District for site acquistion.

It now appears from records requests to the City Controller that the first “tranche” of the bonds won’t be issued until “the Fall” of 2016. The Controller failed to specify whether that means not until the third or fourth quarter, as if there is no urgency to issuing the first portion of the bonds, whether or not it will involve letting a good deal in the Mission go.

There’s more

bad news in the verbatim transcript: First, MOHCD has no expectations

that loans it makes to non-profit housing developers — probably

the vast majority of loans for the four main categories in the

$310 million bond, with the exception of the DALP and Teacher

Next Door loans — will ever be repaid, because the loans

are structured as “residual receipts,” meaning after

the developers pay their operating expenses, if there are any

“leftover” funds, then a portion may

go back to repay MOHCD. But, typically MOHCD has no expectation

of loan repayments over time.

There’s more

bad news in the verbatim transcript: First, MOHCD has no expectations

that loans it makes to non-profit housing developers — probably

the vast majority of loans for the four main categories in the

$310 million bond, with the exception of the DALP and Teacher

Next Door loans — will ever be repaid, because the loans

are structured as “residual receipts,” meaning after

the developers pay their operating expenses, if there are any

“leftover” funds, then a portion may

go back to repay MOHCD. But, typically MOHCD has no expectation

of loan repayments over time.

Second, one CGOBOC member wondered whether MOHCD had made the “right” allocation decisions to each of the four main categories in the first place. I smell trouble.

Sadly, the next CGOBOC meeting at which MOHCD will present an update on the status of spending on the $310 million bond has been delayed to Thursday, July 28, 2016. Apparently, there is no haste at City Hall to ensure expeditious oversight and accountability of the Affordable Housing Bond measure, leaving voters snookered, again.

Whatever Happened to the Tobacco Settlement Revenue Account?

Back in 1996, then

Board of Supervisors president Angela Alioto authored legislation

to sue Big Tobacco, won her lawsuit, and succeeded in creating

the Tobacco Settlement Revenue (TSR) account, which former City

Attorney Louise Renne tried to claim credit for having been responsible,

which I debunked in an article in July 2010.

Back in 1996, then

Board of Supervisors president Angela Alioto authored legislation

to sue Big Tobacco, won her lawsuit, and succeeded in creating

the Tobacco Settlement Revenue (TSR) account, which former City

Attorney Louise Renne tried to claim credit for having been responsible,

which I debunked in an article in July 2010.

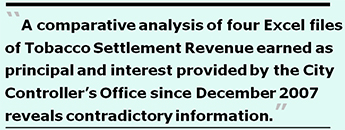

A comparative analysis of four Excel files of TSR earned as principal and interest provided by the City Controller’s Office since December 2007 reveals contradictory information. In the first file in December 2007 then-City Controller Ed Harrington indicated $149.4 million had been received in the TSR account by then, and the City projected it would earn an additional $790 million through the year 2060, for a combined total of $939.4 million.

In an updated file on July 9, 2010, the Controller indicated $203.8 million had been received through June 2010, and projected an additional $950.5 million but only through the year 2045, for a combined total of $1.115 billion. For unexplained reasons, projected earnings were shortened by 15 years through just 2045.

Another updated file on April 20, 2016 reported actual TSR’s received to date had climbed to $303 million, and lowered the projected revenue for future years to just $206.8 million, reducing the projected revenue to just through the year 2030, for a combined total of just $509.8 million, not the $1.115 billion.

Future TSR revenue

projections not only shrank by 30 years, but also shrank by $743,685,039

from data previously provided this author in July 2010. In response

to a records request about the 30-year period, the Controller’s

lame partial response on May 23 was that projections now only

go “through 2030 due to the fact that the City does not have

debt outstanding past 2030,” which of course is complete

nonsense, since the November 2015 Prop A Affordable Housing bond

incurs City debt through at least the year 2039, and more nonsensical

because the City had previously reported projected revenue through

2060.

Future TSR revenue

projections not only shrank by 30 years, but also shrank by $743,685,039

from data previously provided this author in July 2010. In response

to a records request about the 30-year period, the Controller’s

lame partial response on May 23 was that projections now only

go “through 2030 due to the fact that the City does not have

debt outstanding past 2030,” which of course is complete

nonsense, since the November 2015 Prop A Affordable Housing bond

incurs City debt through at least the year 2039, and more nonsensical

because the City had previously reported projected revenue through

2060.

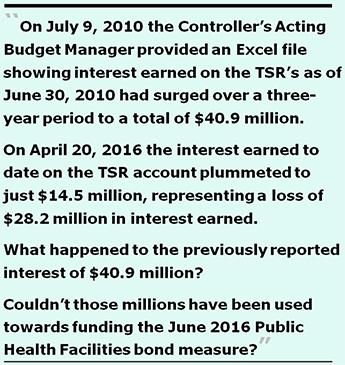

Incredibly Shrinking Interest Earned on the TSR Account

Back in 2007, former City Controller Ed Harrington provided information on the TSR’s, and indicated that as of December 2007, the City had already earned $32.387 million in interest on the TSR revenue received. On July 9, 2010, Nadia Feeser, the Controller’s Acting Budget Manager, provided an Excel file showing that interest earned on the TSR’s as of June 30, 2010 had surged over a three-year period to a total of $40.9 million in interest earned.

So imagine my surprise

when I received a file from the Controller’s Office on April

20, 2016 showing that the interest earned to date on the TSR account

had plummeted to just $14.5 million, representing a loss of $28.2 million in interest

earned that had been reported in July 2010. What happened to the

previously reported interest of $40.9 million? Couldn't those

millions have been used towards funding the June 2016 Public Health

Facilities bond measure?

So imagine my surprise

when I received a file from the Controller’s Office on April

20, 2016 showing that the interest earned to date on the TSR account

had plummeted to just $14.5 million, representing a loss of $28.2 million in interest

earned that had been reported in July 2010. What happened to the

previously reported interest of $40.9 million? Couldn't those

millions have been used towards funding the June 2016 Public Health

Facilities bond measure?

The Controller’s May 23 lame response invoked another 10-day extension to provide an explanation of why there’s a gap of $28.2 million in interest already earned to date that had been previously reported.

Ohter TSR Anomalies

First, on May 4, the Controller’s Office finally provided another Excel file prepared by Hiu Ching “Cherie” Wan, an accountant for the Controller, showing TSR expenditures from revenue received, which appears to contradict other public records from the City Controller. A modified version of that file shows that the TSR account has received $319.968 million through April 24, which is exactly $17 million more than the $302.968 million in revenue the control reported to me on April 20 as TSR revenue through June 30, 2016. How can the Controller’s Office be off by $17 million across the two files provided to me just days apart?

The Controller’s

May 23 partial response to the records request claimed that the

difference between the two files is because the March 20 file

did not include the $17 million in TSR revenues deposited into

the Tobacco and Education Prevention Fund. In fact, whether that

$17 million was deposited directly into the TSR account or directly

into the Education Fund, the fact remains it is nonetheless revenue

earned from the Tobacco Settlement lawsuit, and common sense says

it should be recorded as revenue earned from the TSR lawsuit,

regardless of which sub-fund it is deposited into.

The Controller’s

May 23 partial response to the records request claimed that the

difference between the two files is because the March 20 file

did not include the $17 million in TSR revenues deposited into

the Tobacco and Education Prevention Fund. In fact, whether that

$17 million was deposited directly into the TSR account or directly

into the Education Fund, the fact remains it is nonetheless revenue

earned from the Tobacco Settlement lawsuit, and common sense says

it should be recorded as revenue earned from the TSR lawsuit,

regardless of which sub-fund it is deposited into.

Second, between TSR revenues and actual expenditures for both the LHH Project, and the debt service on the General Obligation Bond to rebuild LHH, the City has expended $74.5 million less from revenues it received for these two purposes. Shouldn’t revenue earmarked for specific purposes actually be spent on them?

And finally, Ms. Wan’s file shows that the Controller transferred $52.95 million from the TSR account to the General Fund for the Department of Public Health, possibly for DPH’s operating expenses rather than for capital construction expenses, and has expended another $3 million for the City’s “Community Living Fund” (CLF). Most observers had believed the CLF allocations were supposed to come from annual appropriations from the General Fund, not from the TSR account.

Between the two expenditures,

the Controller appears to have diverted $56 million from the TSR

fund for what should have been General Fund appropriations, and

that $56 million could also have been used towards funding the

June 2016 Public Health Facilities bond measure.

Between the two expenditures,

the Controller appears to have diverted $56 million from the TSR

fund for what should have been General Fund appropriations, and

that $56 million could also have been used towards funding the

June 2016 Public Health Facilities bond measure.

Conclusion

As I have previously written, now more than ever San Franciscans deserve to have a Charter amendment creating a Board or a Commission having oversight over MOHCD. Until that happens, we’ll still be getting screwy reporting about, and screwy spending of, scarce Affordable Housing funds, snookering voters even more.

Monette-Shaw is an open-government accountability advocate, a patient advocate, and a member of California’s First Amendment Coalition. He received a James Madison Freedom of Information Award from the Society of Professional Journalists-Northern California Chapter in 2012. He can be contacted at monette-shaw@westsideobserver.

Footnotes

† COP’s

are a form of borrowing money through the use of commercial paper

or other short-term indebtedness to issue lease financing debt

as the funding source for capital projects that can be authorized

by the stroke of the Board of Supervisors pens. COP’s are

generally based on lease agreements, with the borrower serving

as the lessee and another entity serving as the lessor and issuer

of the bonds. Typically, COP’s require use of other City

infrastructure assets pledged as collateral. As a lease-financing

scheme, the City leases other City-owned property to the lenders

as the collateral for the debt, and enters into a re-lease with

the lenders to re-occupy the facilities, with the re-lease payments

paying down the principal and interest on the debt.

† COP’s

are a form of borrowing money through the use of commercial paper

or other short-term indebtedness to issue lease financing debt

as the funding source for capital projects that can be authorized

by the stroke of the Board of Supervisors pens. COP’s are

generally based on lease agreements, with the borrower serving

as the lessee and another entity serving as the lessor and issuer

of the bonds. Typically, COP’s require use of other City

infrastructure assets pledged as collateral. As a lease-financing

scheme, the City leases other City-owned property to the lenders

as the collateral for the debt, and enters into a re-lease with

the lenders to re-occupy the facilities, with the re-lease payments

paying down the principal and interest on the debt.

†† Definition of tranche: “A division or portion of a pool or whole; specifically: An issue of bonds derived from a pooling of like obligations (as securitized mortgage debt) that is differentiated from other issues especially by maturity or rate of return.”