Article in Press Printer-friendly PDF file

Article in Press Printer-friendly PDF fileWestside Observer Newspaper

March 2018 at www.WestsideObserver.com

Funds for Affordable Housing Must Be Made Public

Financing 250 Laguna Honda Senior Housing

Article in Press Printer-friendly PDF file

Article in Press Printer-friendly PDF file

Westside Observer

Newspaper

March 2018 at www.WestsideObserver.com

Funds for Affordable Housing Must Be Made Public

Financing 250 Laguna Honda Senior Housing

by Patrick Monette-Shaw

by Patrick Monette-Shaw

In addition to concerns about the 250 Laguna Honda location being in earthquake and landslide hazard zones, and the stability of the hill that neighborhood residents have raised, there are serious concerns about the sources of funding for the proposed senior housing project to be built on the site.

As George Wooding noted in the February issue of the Westside Observer, the 250 Laguna Honda Boulevard senior housing project being built by Christian Church Homes (CCH) is primarily funded by the Mayor’s Office of Housing and Community Development (MOHCD), a city-funded financing source for low-income and affordable housing.

We need a full and complete disclosure of how this project is being financed, what the total costs are, and what financial qualifications are required to gain approval and from whom. San Franciscans deserve an explanation of this project’s financing. Prying loose the details of the financing has been problematic and demands explanation.

We need a full and complete disclosure of how this project is being financed, what the total costs are, and what financial qualifications are required to gain approval and from whom. San Franciscans deserve an explanation of this project’s financing. Prying loose the details of the financing has been problematic and demands explanation.

After all, California State Constitution Article 1, Section 3(b)(1) provides that people have the right of access concerning conduct of the people’s business, and government records must be open to public scrutiny, including financial records for publicly-financed affordable housing.

After all, California State Constitution Article 1, Section 3(b)(1) provides that people have the right of access concerning conduct of the people’s business, and government records must be open to public scrutiny, including financial records for publicly-financed affordable housing.

Affordable Housing Bond Financing Awarded — Then Yanked

After voters passed the “Prop. A” $310 Affordable Housing Bond in November 2015, bond spending became the purview of San Francisco’s Citizens’ General Obligation Bond Oversight Committee (CGOBOC), which is charged with holding hearings and periodic updates on the progress of bond-funded projects, including hospitals, roadways, parks, and other types of general obligation bonds passed by voters.

CGOBOC held its first hearing on the Affordable Housing Bond on January 28, 2016 shortly after voters approved the bond. CGOBOC met two more times in 2016 (July 28 and October 3), during which time MOHCD continued to stall CGOBOC members about which projects the bond would actually fund.

CGOBOC held its first hearing on the Affordable Housing Bond on January 28, 2016 shortly after voters approved the bond. CGOBOC met two more times in 2016 (July 28 and October 3), during which time MOHCD continued to stall CGOBOC members about which projects the bond would actually fund.

Sometime between October 3, 2016 and January 28, 2017 MOHCD suddenly added the 250 Laguna Honda project to planned bond spending, informing CGOBOC on January 28, 2017 MOHCD had done so, indicating the senior housing project would receive $3 million from the “Prop. A” bond for pre-development expenses.

Average Costs Per Unit

The proposed 150-unit project budgeted at $73.5 million averages $490,000 for the average 535 sq. ft. units, including both “hard costs” (construction only) and “soft costs” (architectural fees, permits, etc.). The initial proposal indicated it would include 42 studios (28%) averaging 382 sq. ft., 107 one-bedroom units (71.3%) averaging 595 sq. ft., and just one 1,051 sq. ft. two-bedroom unit (0.7%) for an on-site building manager.

In contrast, a separate 143-unit project at 1990 Folsom Street being funded by MOHCD and other public funds budgeted at $102.76 million averages $718,611 per unit, but fully 78 of the 143 units (54.5%) are two- and three-bedroom units.

The $490,000 per-unit averages costs for the 250 Laguna Honda project drops to just $299,333 per unit, when based on only the “hard costs” (construction only) based on the overall construction budget of $44 million (excluding the $29.5 million budget for “soft costs”).

According to a prominent web site, average construction costs (hard costs only) in San Francisco in 2012 for four- to seven-story multi-family housing projects were $216.69 per square foot, which suggests the studios averaging 382 sq. ft. at 250 Laguna Honda would have construction hard costs of just $82,776 — $210,588 less than the $299,333 average. Similarly, the one-bedroom units at 250 Laguna Honda averaging 595 sq. ft. would have hard costs of just $128,931 — $164,403 less than the $299,333 average. It’s not yet known how much construction costs in San Francisco may have risen since 2012. But why are the average costs of construction of the 250 Laguna Honda project so high since 28% of them are really small studio and one-bedroom units?

250 Laguna Hond “Prop. A” Funds Stripped

Nine months after first adding the 250 Laguna Honda project to planned bond spending, MOHCD changed its mind and notified CGOBOC on November 20, 2017 that the $3 million in “Prop. A” funding for 250 Launa Honda had been re-allocated to another senior housing project at 1296 Shotwell. MOHCD asserted the main reasons for the funding transfer are delays encountered at 250 Laguna due to the historical findings on the site, the associated environmental approvals, and the extensive community outreach underway.

Nine months after first adding the 250 Laguna Honda project to planned bond spending, MOHCD changed its mind and notified CGOBOC on November 20, 2017 that the $3 million in “Prop. A” funding for 250 Launa Honda had been re-allocated to another senior housing project at 1296 Shotwell. MOHCD asserted the main reasons for the funding transfer are delays encountered at 250 Laguna due to the historical findings on the site, the associated environmental approvals, and the extensive community outreach underway.

The 250 Laguna Honda project will now not receive Prop. A bond funding. Now that this project is not under the purview of CGOBOC, details on the financing of the project will be harder to obtain, and there will be less oversight.

Evolving Financing

How this project will be financed is something the whole City should be told, because City funds will probably still be used.

Where will Christian Church Homes come up with alternative financing for the 250 Laguna Honda senior housing? On January 19, 2018 MOHCD indicated it expects to fund the 250 Laguna project using other MOHCD affordable housing sources, such as Inclusionary Housing fees and Jobs Housing Linkage fees. More than likely, MOHCD will tap into its much larger Housing Trust Fund to provide “gap” funding for the Laguna Honda Boulevard senior housing project.

Where will Christian Church Homes come up with alternative financing for the 250 Laguna Honda senior housing? On January 19, 2018 MOHCD indicated it expects to fund the 250 Laguna project using other MOHCD affordable housing sources, such as Inclusionary Housing fees and Jobs Housing Linkage fees. More than likely, MOHCD will tap into its much larger Housing Trust Fund to provide “gap” funding for the Laguna Honda Boulevard senior housing project.

Given the Langan draft geotechnical report describing the dangers of the instability of the hill and the 250 Laguna Honda location being in earthquake and landslide hazard zones, MOHCD indicated on January 17 that it now expects that the project size will likely be reduced by one-third — from 150 units to 100 units. The project’s budget will probably be different from what was presented in the original application. Once costs for stabilizing the hillside are eventually determined and presented, CCH will ostensibly have to provide a revised budget to MOHCD.

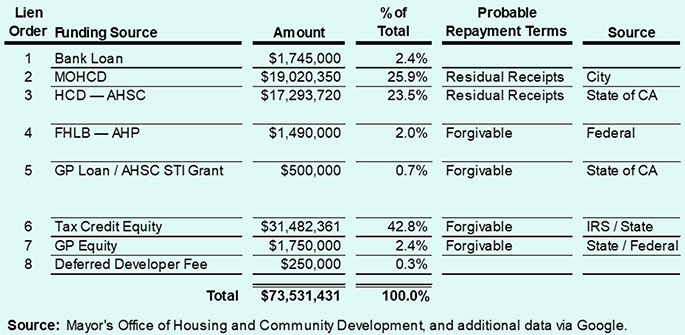

When CCH first applied for Prop A. bond funding, it submitted a project budget in its application, shown in Table 1.

Table 1: Initial Project Budget Submitted by CCH

The initial budget shown in Table 1 reveals that fully $71.5 million (97.3%) of the proposed financing will be funded by sources other than from CCH, and at least $54.2 million (73.8%) doesn’t require repayment. The majority of an eventual revised budget will probably also not be subject to repayment.

The initial budget shown in Table 1 reveals that fully $71.5 million (97.3%) of the proposed financing will be funded by sources other than from CCH, and at least $54.2 million (73.8%) doesn’t require repayment. The majority of an eventual revised budget will probably also not be subject to repayment.

Lien Order 2 and 3 classified as “residual receipts” totals $36.3 million, and Lien Orders 4 through 7 totals $35.2 million classified as “forgivable” in terms of repayment terms. This suggests CCH will be on the hook to come up with just $2 million of the total project costs.

The $31.5 million tax credit equities (42.8% of funding) is clearly something of interest to CCH, just as the tax credits for re-development of El Bethel Arms was of great interest to CCH.

The $31.5 million tax credit equities (42.8% of funding) is clearly something of interest to CCH, just as the tax credits for re-development of El Bethel Arms was of great interest to CCH.

MOHCD asserts that the project developer will be responsible for obtaining all financing. The developer will apply for 4% tax credits and a bond allocation, Affordable Housing Program loan, MOHCD gap funding, AHSC funding if they are competitive, and any other state or federal funding for which they are eligible.

About Residual Receipts

Kate Hartley, then-Deputy Director of MOHCD, informed CGOBOC members on January 28, 2016 that MOHCD typically doesn’t expect repayment of “residual receipts.” Residual receipts are revenues received in excess of operating costs, such that if projects claim high operating costs and no residual revenue left over, repayment isn’t expected. It’s not yet known whether the California HCD – AHSC residual receipt funding is required to be repaid in full, or at all.

Kate Hartley, then-Deputy Director of MOHCD, informed CGOBOC members on January 28, 2016 that MOHCD typically doesn’t expect repayment of “residual receipts.” Residual receipts are revenues received in excess of operating costs, such that if projects claim high operating costs and no residual revenue left over, repayment isn’t expected. It’s not yet known whether the California HCD – AHSC residual receipt funding is required to be repaid in full, or at all.

Kiss the $19 million city-issued residual receipt funding goodbye.

Kiss the $19 million city-issued residual receipt funding goodbye.

By contrast, the $17.3 million in residual receipts funding provided by California’s Department of Housing and Community Development under its HCD-AHSC program requires 0.42% interest repayment annually, calculated against the principal amount of the loan, to fund HCDs monitoring efforts over for the 55-term of the loan. CCH would be required to repay $72,631 annually of its HCD-AHSC residual receipts funding for the 250 Laguna Honda project, and at the end of the 55 years the remaining unpaid balance of the $19 million loan requires full repayment, plus 3% interest. If the State can require full residual receipt repayment, why can’t the City of San Francisco?

About Tax Credit Equity Funding

About Tax Credit Equity Funding

CCH’s reliance that $31.5 million in tax credit equity financing will actually be secured for the 250 Laguna Honda project is far from certain, may be in jeopardy, and may be pure conjecture.

MOHCD’s Eugene Flannery confirmed on January 29 that projects applying for MOHCD funding submit an estimated amount of tax credit equity to be obtained from the sale of their allocation of low income housing tax credits. The Low-Income Housing Tax Credit program is administered by the IRS. Through the tax code, tax credits are allocated to each state by formula, and each state creates an implementation plan governed by a state agency, which in California is the California Tax Credit Allocation Committee (CTCAC).

Once a project sponsor has a tax credit allocation from CTCAC, the sponsor enters into an agreement with a private investor to purchase the credits at a market price. The tax credit equities aren’t loans and, therefore, aren’t paid back to the corporation or to CTCAC. They’re essentially gifts that only require the developer keep the project “affordable” for 55 years.

Once a project sponsor has a tax credit allocation from CTCAC, the sponsor enters into an agreement with a private investor to purchase the credits at a market price. The tax credit equities aren’t loans and, therefore, aren’t paid back to the corporation or to CTCAC. They’re essentially gifts that only require the developer keep the project “affordable” for 55 years.

Presumably, after 55 years the project can be flipped from “affordable” housing to market-rate units. No wonder they’re so lucrative to, and coveted by, developers like CCH.

Flannery indicated the amount each dollar of tax credit is worth to private market investors purchasing tax credits has been dropping. During 2016 the local value of tax credits has dropped significantly, from approximately $1.15 to 95-cents per credit — a 17.4% percent decline in value. Flannery also asserted that across MOHCD’s portfolio of affordable housing in development, MOHCD is seeing reductions in the amount of equity generated from sale of low-income housing tax credits to private investors.

Flannery indicated the amount each dollar of tax credit is worth to private market investors purchasing tax credits has been dropping. During 2016 the local value of tax credits has dropped significantly, from approximately $1.15 to 95-cents per credit — a 17.4% percent decline in value. Flannery also asserted that across MOHCD’s portfolio of affordable housing in development, MOHCD is seeing reductions in the amount of equity generated from sale of low-income housing tax credits to private investors.

In addition, Flannery asserted that, among other things, the amount of tax credit equity financing eventually obtained for the senior housing at 250 Laguna may hinge on 1) The change in project size — ostensibly the number of units eventually constructed, 2) Total costs of the project (we still have no idea about the costs for revetment and stabilization of the hillside will add to the project budget), and 3) The value of tax credits actually available, given recent changes in the tax code.

What Flannery did not mention is that competition for tax credits that may be available is intense, because the low-income housing tax credits aren’t restricted just to 100% affordable housing projects, they’re available to for-profit developers, too.

What Flannery did not mention is that competition for tax credits that may be available is intense, because the low-income housing tax credits aren’t restricted just to 100% affordable housing projects, they’re available to for-profit developers, too.

For-profit developers who are required to include a percentage of their projects as below-market rate (BMR) units in jurisdictions like San Francisco having inclusionary housing minimum percentages are apparently allowed to submit applications for tax credit equity financing on the BMR units.

One example of this is Axis Development Corporation, a for-profit developer, which obtained multi-family housing revenue housing bond financing from San Francisco’s Board of Supervisors in December 2017 for a 117-unit market-rate project at 2675 Folsom Street.

The deal for 2675 Folsom calls for 20 percent — 23 units — of the development’s 117 units to be affordable housing. Of the 23, 19 will be reserved for residents making 50% or less of Area Median Income (AMI). Although some media reports indicated another four units will be capped at 100% of AMI (just barely BMR), the CTCAC low-income tax credit equity award indicates that the 23 units will all be capped at 50% of AMI. The CTCAC award notes that 8 of the 23 units will be SRO/Studio units, charging $1,009 in proposed monthly rents.

In addition, the deal requires that Axis purchase eight units of existing, off-site housing and bring them into MOHCD’s small sites program to preserve buildings with few units currently housing rent-controlled, low-income tenants who are at risk of being displaced. The building(s) Axis buys will be transferred to a Mission-District non-profit to maintain as affordable housing.

In addition, the deal requires that Axis purchase eight units of existing, off-site housing and bring them into MOHCD’s small sites program to preserve buildings with few units currently housing rent-controlled, low-income tenants who are at risk of being displaced. The building(s) Axis buys will be transferred to a Mission-District non-profit to maintain as affordable housing.

It’s not clear whether the 23 BMR units and the eight small-site units are both eligible for tax credit equity financing. But Axis received $5.3 million in tax credits from CTCAC.

Eventually, if the value of tax credit equity funds is shrinking as Flannery asserted and the proposed senior housing at 250 Laguna Honda is reduced by 50 units, both factors will yield less in credits than CCH estimated and was banking on. And CCH will have to compete with for-profit developers like Axis for the low-income housing tax credits.

MOHCD indicated expectations of tax equity credit projections typically change over time, and MOHCD has been seeing declines in the amount of tax credit equities sold over time. MOHCD apparently expects it may be on a path to have to increase its share of project costs to bridge gaps from other funding sources for the 250 Laguna Honda project.

MOHCD indicated expectations of tax equity credit projections typically change over time, and MOHCD has been seeing declines in the amount of tax credit equities sold over time. MOHCD apparently expects it may be on a path to have to increase its share of project costs to bridge gaps from other funding sources for the 250 Laguna Honda project.

MOHCD indicated tax credit equity financing won’t be determined until six months before construction would be begin at the site and indicated that CCH has not yet submitted an application to CTCAC for the low-income housing tax credits.

CCHs financial interest in tax credit equity financing for the 250 Laguna Honda project mirrors its financial interest in the tax credits for re-development of the El Bethel Arms project. It’s worth looking at the lawsuit filed by El Bethel Baptist Church.

El Bethel Baptist Church vs. Christian Church Homes Lawsuit

Tax credit equites are so lucrative because of the potential to re-sell them to for-profit investors, that back in 2012 CCH advocated — apparently aggressively — for re-development project of El Bethel Arms, a senior housing project owned by El Bethel Baptist Church. CCH strongly favored the re-development proposal because CCH stood to receive a $2.5 million re-development fee. The proposal sought to sell the Arms to investors for 15 years under a low-income housing tax credit program.

CCH eventually became the project manager, asset manager, and property manager for re-development of the Arms. It’s not known whether CCH stood to earn even more as the property manager, in addition to its re-development fee, since CCH had already held a contract for 20 years to manage El Bethel Arms.

CCH eventually became the project manager, asset manager, and property manager for re-development of the Arms. It’s not known whether CCH stood to earn even more as the property manager, in addition to its re-development fee, since CCH had already held a contract for 20 years to manage El Bethel Arms.

A series of six contracts were signed by Lillian Peck — an El Bethel Arms board of directors’ member in her 80’s — on behalf of the Arms’ Board of Directors between August 13, 2013 (the initial development services agreement) and June 2014. Peck was allegedly misled into believing the Baptist Church would retain 51% ownership during the 15 years, when in fact the agreements reduced the Church’s ownership of the tax credits to just 1%.

On January 16, 2018 San Francisco Superior Court Judge Richard Ulmer issued his tentative decision in Phase I in the El Bethel Arms, Inc., et al. vs. Christian Church Homes, et al. trial that the six agreements could be, and are, rescinded [Court case number CGC-15-546236]. Ulmer’s tentative decision stemmed from El Bethel’s initial May 2016 lawsuit.

On January 16, 2018 San Francisco Superior Court Judge Richard Ulmer issued his tentative decision in Phase I in the El Bethel Arms, Inc., et al. vs. Christian Church Homes, et al. trial that the six agreements could be, and are, rescinded [Court case number CGC-15-546236]. Ulmer’s tentative decision stemmed from El Bethel’s initial May 2016 lawsuit.

Ulmer’s tentative ruling noted CCH had little to say in its written closing argument about some evidence presented during the trial. Ulmer noted evidence presented at trial “establishes undue influence at the least [on Ms. Peck], if not outright fraud.” Ulmer noted “The picture the evidence paints is not pretty.”

Phase II of the trial, when it begins, will consider any “relief” — presumably, financial relief — from rescinding the six agreements, should Ulmer’s tentative decision be sustained.

According to Superior Court records, four of the six agreements were with CCH; the other two agreements were with a firm providing security services at the Arms. The Court records and Ulmer’s tentative decision are compelling reading.

Judge Ulmer’s tentative decision indicates three related lawsuits had been consolidated into one — only for purposes of the trials — given related parties and similar issues. Ulmer sought to consolidate the cases to eliminate duplicative “discovery,” and duplicative depositions for the efficiency of the Superior Court and the parties involved.

El Bethel Terminates Christian Church Homes

In 2013 Keva McNeill had become El Bethel Church’s new pastor and soon became an El Bethel Arms board member. The six agreements were subsequently challenged in San Francisco Superior Court by El Bethel Church’s new Board of Directors, which had been appointed in the summer of 2014, shortly after some of the agreements had been signed.

In 2013 Keva McNeill had become El Bethel Church’s new pastor and soon became an El Bethel Arms board member. The six agreements were subsequently challenged in San Francisco Superior Court by El Bethel Church’s new Board of Directors, which had been appointed in the summer of 2014, shortly after some of the agreements had been signed.

El Bethel’s new Board voted in 2016 to halt the redevelopment project and replaced (terminated) CCH as El Bethel Arms’ management company in March 2016, apparently ending El Bethel Church’s 20-year relationship with CCH. Court records allege El Bethel’s new Board also terminated the other two contracts on April 30, 2015 and June 2, 2015, ending another 20-year relationship.

The lawsuit — El Bethel Arms, Inc., et al. vs. Christian Church Homes, et al., filed May 11, 2016 [case number CGC-16-551933] — sought under breach-of-contract to rescind the agreements Lillian Peck had signed granting CCH the various contracts.

Another cause of action included in El Bethel’s initial complaint was that CCH had complete control of the finance and financial accounting records for both El Bethel Arms and El Bethel Terrace (separate properties). El Bethel’s lawsuit sought a Court order requiring CCH to provide a full financial accounting of both properties for the past 10 years.

Another cause of action included in El Bethel’s initial complaint was that CCH had complete control of the finance and financial accounting records for both El Bethel Arms and El Bethel Terrace (separate properties). El Bethel’s lawsuit sought a Court order requiring CCH to provide a full financial accounting of both properties for the past 10 years.

Court records suggest Ms. Peck was allegedly misled into wrongly believing El Bethel Church would retain 51% ownership of the Arms, a mistaken “fact” CCH employee Falisha Walls had heard from CCH’s CEO, Donald Stump. Walls was assigned to “coach” Peck into signing the agreements. But El Bethel’s lawsuit alleged CCH had drafted the agreements Ms. Peck had signed, with CCH’s intent being to take full control of 99% of the housing tax equity credits.

After Peck signed the agreements, Walls and her supervisor at CCH each received $50,000 bonuses. CCH also awarded another $100,000 bonus to another El Bethel contractor, pushing total bonuses to $200,000.

At trial, CCH portrayed Walls as a “disgruntled former employee.” Why would an employee awarded a $50,000 bonus possibly be disgruntled?

On January 31, 2018 an objection to Ulmer’s proposed ruling was filed seven days before a scheduled Court hearing on February 8. That hearing was postponed to March 1.

On January 31, 2018 an objection to Ulmer’s proposed ruling was filed seven days before a scheduled Court hearing on February 8. That hearing was postponed to March 1.

On February 8, the Superior Court’s web site posted a court notice of an “unconditional” partial settlement that indicated El Bethel and Christian Church Homes had each dismissed their respective lawsuits “with prejudice” (meaning neither entity can re-open their lawsuits), leaving just the party who had filed an objection to Ulmer’s tentative decision as the remaining party to be considered on March 1.

Both El Bethel and CCH are required to file their respective dismissal with prejudice notices with the Superior Court 30 days after February 8, but neither dismissal notices have been posted to the Superior Court’s web site as of this writing.

The partial settlement agreement between El Bethel and CCH are confidential, so both parties in the case are bound by non-disclosure agreements requiring they not reveal details of the settlements. So, it’s not known whether El Bethel received any financial relief — if only for the $200,000 in bonuses CCH had awarded — or whether CCH provided El Bethel with the full financial accounting records for both the El Bethel’s Arms and the El Bethel Terrace properties for the past 10 years.

The partial settlement agreement between El Bethel and CCH are confidential, so both parties in the case are bound by non-disclosure agreements requiring they not reveal details of the settlements. So, it’s not known whether El Bethel received any financial relief — if only for the $200,000 in bonuses CCH had awarded — or whether CCH provided El Bethel with the full financial accounting records for both the El Bethel’s Arms and the El Bethel Terrace properties for the past 10 years.

According to a knowledgeable observer, it’s thought the partial settlement agreements indicate that El Bethel and CCH have completely severed all of their business relationships.

It now appears all six of the contracts Ms. Peck had signed — the four development contracts and the two owner representative agreements “that were intended to illegally take possession of a 355-unit affordable housing property worth $70 million” — have been rescinded, allowing El Bethel Baptist Church to retain ownership of its two housing projects.

It now appears all six of the contracts Ms. Peck had signed — the four development contracts and the two owner representative agreements “that were intended to illegally take possession of a 355-unit affordable housing property worth $70 million” — have been rescinded, allowing El Bethel Baptist Church to retain ownership of its two housing projects.

Laguna Honda Project’s Undoing?

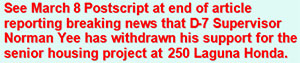

After CCH submitted a Preliminary Project Assessment (PPA) application to the Planning Department on July 6, 2016 for the 250 Laguna Honda Project, the Planning Department issued its preliminary response on October 4, 2016 noting that the PPA application was valid for 18 months, would expire on April 4, 2018, and a new PPA will be required.

After CCH submitted a Preliminary Project Assessment (PPA) application to the Planning Department on July 6, 2016 for the 250 Laguna Honda Project, the Planning Department issued its preliminary response on October 4, 2016 noting that the PPA application was valid for 18 months, would expire on April 4, 2018, and a new PPA will be required.

It’s unknown whether Judge Ulmer’s final decision in the El Bethel case may affect in any way the financing of CCH’s 250 Laguna Honda senior housing project.

In response to a records request for financial arrangements between CCH and Forest Hill Church, Stump noted CCH is not paying for, or providing, any special benefits to any Forest Hill Church board members for their roles or functions related to development of affordable housing at Laguna Honda Boulevard. Stump noted that Forest Hill Christian Church is selling its property to CCH for less than full market value in order to benefit the construction of affordable housing on the site.

In response to a records request for financial arrangements between CCH and Forest Hill Church, Stump noted CCH is not paying for, or providing, any special benefits to any Forest Hill Church board members for their roles or functions related to development of affordable housing at Laguna Honda Boulevard. Stump noted that Forest Hill Christian Church is selling its property to CCH for less than full market value in order to benefit the construction of affordable housing on the site.

It’s thought CCH is looking to acquire the 250 Laguna Honda property from the Forest Hill Church at below market purchase of just $3 million to $3.5 million. Sale of the property to CCH has not occurred yet.

It’s also thought that the minimum fair market value of the property is approximately $10 million ($500,000 per lot times 20 lots), less demolition costs if all the existing structures are demolished. The $10 million estimate is based on tax records showing the lot is 70,950 sq. ft. (approximately 1.6 acres), and zoned RH-1(D) for single-family homes, for a minimum of 20 single-family homes at approximately 3,500 sq. ft. per lot.

It’s also thought that the minimum fair market value of the property is approximately $10 million ($500,000 per lot times 20 lots), less demolition costs if all the existing structures are demolished. The $10 million estimate is based on tax records showing the lot is 70,950 sq. ft. (approximately 1.6 acres), and zoned RH-1(D) for single-family homes, for a minimum of 20 single-family homes at approximately 3,500 sq. ft. per lot.

However, the estimated market value doesn’t consider the Planning Department’s preliminary determination the existing church on the property is architecturally significant for its Expressionist design, nor does it take into consideration the impact of the integrity of the hill, which has had landslides in the past. Both may have an adverse impact on the market value of the parcel.

Stump noted that CCH has no knowledge of what the Forest Hill Church will actually do with the sale proceeds, but asserted that the Church has said the proceeds will be used to further the Church’s ministry and mission, including church-sponsored programs benefiting the community, as well as supporting outside organizations that provide community services.

Stump noted that CCH has no knowledge of what the Forest Hill Church will actually do with the sale proceeds, but asserted that the Church has said the proceeds will be used to further the Church’s ministry and mission, including church-sponsored programs benefiting the community, as well as supporting outside organizations that provide community services.

But if Forest Hill Church really wants to use proceeds from selling the property to further the Church’s ministry, why on earth would it sell the property for below value, at potentially less than one-third of the full market value? The potential sales agreement has not been made available to see whether the Forest Hill Church may be receiving other monetary or non-monetary benefits by selling for below market value.

After CCH’s questionable practices in the El Bethel Arms re-development project that Judge Ulmer stopped just short of categorizing as fraud, how can San Franciscans trust CCH’s plans to develop the senior housing project at 250 Laguna Honda Boulevard?

Hopefully, the 17.4% drop in tax credit equity value to private market investors, the yet unknown costs to stabilize the hillside behind 250 Laguna Honda, and the 50-unit reduction will kill CCH’s plans to develop this senior housing on the site, penciling the project out as simply financially unfeasible. Why would private investors snap up tax equity credits knowing the property is in landslide and earthquake hazard zones?

Hopefully, the 17.4% drop in tax credit equity value to private market investors, the yet unknown costs to stabilize the hillside behind 250 Laguna Honda, and the 50-unit reduction will kill CCH’s plans to develop this senior housing on the site, penciling the project out as simply financially unfeasible. Why would private investors snap up tax equity credits knowing the property is in landslide and earthquake hazard zones?

This desperately-needed senior housing project clearly needs to be moved to a seismically-safe alternative location and needs a full and complete disclosure of the project’s financing.

Postscript: Supervisor Yee Withdraws Support for This Senior Housing Project

On March 8, after this article was completed, news broke that Supervisor Norman Yee withdrew his support for the senior housing project at 250 Laguna Honda Boulevard, primarily due to concerns about seismic safety of the hillside. It’s unknown whether Yee’s support for the project may have been weakened by the salacious details exposed in court during the El Bethel lawsuit. Yee wrote, in part:

“In light of the totality of these concerns and a limited amount of funding available to see it through to the end of a long and uncertain entitlement process, I am compelled to withdraw my support for this project. I do so with a sense of regret and am grateful to Forest Hill Church and CCH for making the effort to bring a much needed resource to our District.”

A possibility exists for another project at the same location, but the same geotechnical concerns remain so any developer will face the same challenges that CCH had faced. MOHCD may still try to push the project through, but the likelihood MOHCD would succeed is extremely low. It’s also unknown how CCH may respond to the loss of Yee’s support.

A possibility exists for another project at the same location, but the same geotechnical concerns remain so any developer will face the same challenges that CCH had faced. MOHCD may still try to push the project through, but the likelihood MOHCD would succeed is extremely low. It’s also unknown how CCH may respond to the loss of Yee’s support.

Monette-Shaw is a columnist for San Francisco’s Westside Observer newspaper, and a member of the California First Amendment Coalition (FAC) and the ACLU. He operates stopLHHdownsize.com. Contact him at monette-shaw@westsideobserver.com.