Article in Press Printer-friendly PDF file

Article in Press Printer-friendly PDF fileWestside Observer Newspaper

March 2017 at www.WestsideObserver.com

Bait-’-Switch: Laguna Honda Blvd. Senior Housing

Housing Bond Lurches Down a Cliff

Article in Press Printer-friendly PDF file

Article in Press Printer-friendly PDF file

Westside Observer

Newspaper

March 2017 at www.WestsideObserver.com

Bait-’-Switch: Laguna Honda Blvd.

Senior Housing

Housing Bond Lurches Down a Cliff

by Patrick Monette-Shaw

The extent to which voters and taxpayers have been — and continue to be — snookered by Mayor Ed Lee over the Affordable Housing Bond measure should be front-page news. Unfortunately, it isn’t.

Since starting to cover the $310 million Affordable Housing Bond for the Westside Observer, the scope of planned bond spending has shifted dramatically. The bond appears to be lurching down a cliff.

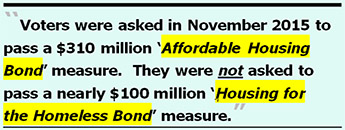

It’s time to speak Truth to Power: Voters were asked in November 2015 to pass a $310 million Affordable Housing Bond measure. They were not asked to pass a nearly $100 million — and growing set-aside — Housing for the Homeless Bond measure. But the latter is what snookered voters will likely wind up getting at the end of the day, part of the bond lurching down the cliff.

It’s time to speak Truth to Power: Voters were asked in November 2015 to pass a $310 million Affordable Housing Bond measure. They were not asked to pass a nearly $100 million — and growing set-aside — Housing for the Homeless Bond measure. But the latter is what snookered voters will likely wind up getting at the end of the day, part of the bond lurching down the cliff.

The oversight body — the Citizens’ General Obligation Bond Oversight Committee (CGOBOC) — has done a terrible job so far holding the Mayor’s Office of Housing and Community Development (MOHCD) accountable for bond spending. CGOBOC received $310,000 — one-tenth of one percent of the gross proceeds of the $310 million Housing Bond — to support CGOBC, but seems to have done little to earn that allocation.

CGOBOC is overseeing $3.6 billion across various bonds in the 11 bonds it still receives reports about. That suggests CGOBOC has been awarded at least $3.6 million from the 11 bonds to do so. How is CGOBOC earning its keep?

CGOBOC has heard from MOHCD on the Affordable Housing Bond only four times: January 28, July 28, and October 3 in 2016, and most recently on January 26, 2017. Successive updates from MOHCD keep shifting planned bond uses, and CGOBOC has done little to reign in MOHCD. Why does planned spending of the bond keep shifting so often? What’s the antidote?

CGOBOC has heard from MOHCD on the Affordable Housing Bond only four times: January 28, July 28, and October 3 in 2016, and most recently on January 26, 2017. Successive updates from MOHCD keep shifting planned bond uses, and CGOBOC has done little to reign in MOHCD. Why does planned spending of the bond keep shifting so often? What’s the antidote?

That’s one of many good questions explored in this update to previous reporting about the bond in the Westside Observer.

As previously reported, between January 28 and July 28, 2016 several major changes occurred to planned bond spending. “Oh wait,” MOHCD seems to have wailed to CGOBOC: “We need more changes!” Then between July 28 and October 3, MOHCD appears to have eliminated the “Middle-Income Buy-In Program” in the Middle-Income main category.

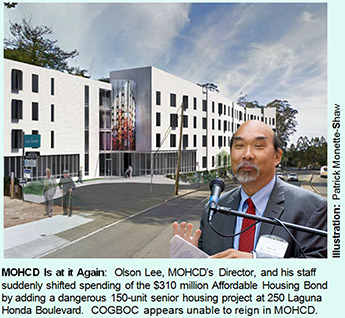

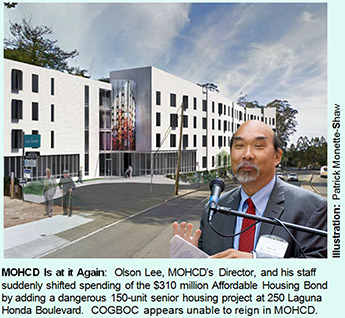

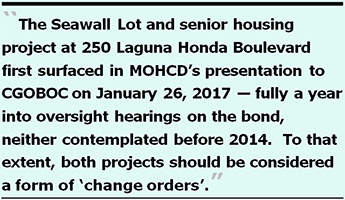

Between October 3, and January 26, 2017 at least two other changes have occurred with planned bond spending: A senior housing project on an inappropriate site on Laguna Honda Boulevard was suddenly added, as was an additional project on Seawall Lot 322-1 that has been the subject of a “Memorandum of Understanding” with MOHCD since at least 2014. Both new projects — neither of which was previously reported to CGOBOC — have been belatedly added to bond spending in what amounts to two massive “change orders.”

Bait–’n–Switch: Laguna Honda Boulevard Senior Housing Project

Although planning for the Affordable Housing Bond began in 2014, and although CGOBOC met three times during 2016 to hear reports from MOHCD about progress on bond spending, almost nobody knew about the proposed 150-unit senior housing project at 250 Laguna Honda until it suddenly appeared in MOHCD’s bond update presentation to CGOBOC on January 26, 2017. It’s a massive “change order,” insofar as it came out of nowhere well into bond oversight hearings.

Although planning for the Affordable Housing Bond began in 2014, and although CGOBOC met three times during 2016 to hear reports from MOHCD about progress on bond spending, almost nobody knew about the proposed 150-unit senior housing project at 250 Laguna Honda until it suddenly appeared in MOHCD’s bond update presentation to CGOBOC on January 26, 2017. It’s a massive “change order,” insofar as it came out of nowhere well into bond oversight hearings.

Neighborhood Concerns About the Project

During CGOBOC’s January 26, 2017 meeting, nine neighbors around 250 Laguna Honda testified during the hearing in opposition — for many very good reasons — against this project. First up was John Farrell, a prominent leader on the West Side who noted that like his neighbors, they are not opposed to affordable housing. He rightly noted that the project doesn’t take into account the already existing heavy traffic on this portion of Laguna Honda Boulevard. He noted the project would result in the closure of a church, a pre-school, and a childhood development center, all of which provide important services to the surrounding community.

Farrell noted there are legitimate concerns of what impact the project will have on the integrity of the hill behind the project, since construction for the project will excavate on the hill. The hill has had landslides in the past. He also testified that the Planning Department itself has recommended that the preschool and the church remain, and the project to be built as “pavilion-style.” The project was initially presented to District 7 Supervisor Norman Yee as a 50-unit project, but it inexplicably grew without warning to a 150-unit project, which suggests that the project may be too large for its small acreage footprint. Farrell noted there are many other ideal alternative locations for this project in the City, including right next door at 375 Laguna Honda Boulevard on Laguna Honda Hospital’s property.

Farrell noted there are legitimate concerns of what impact the project will have on the integrity of the hill behind the project, since construction for the project will excavate on the hill. The hill has had landslides in the past. He also testified that the Planning Department itself has recommended that the preschool and the church remain, and the project to be built as “pavilion-style.” The project was initially presented to District 7 Supervisor Norman Yee as a 50-unit project, but it inexplicably grew without warning to a 150-unit project, which suggests that the project may be too large for its small acreage footprint. Farrell noted there are many other ideal alternative locations for this project in the City, including right next door at 375 Laguna Honda Boulevard on Laguna Honda Hospital’s property.

Neighbor Carolyn Seeley indicated that a 34-page report from the Planning Department raised major concerns relating to the environmental impact, the green belt, and landslides, given the 15 homes that sit above the development that may fall. “The developers have not performed a geological study about the 15 homes above the site, and a geological earthquake fault line runs right through the site,” Selley noted.

There’s those concerns again about lurching down the hill.

For his part, another neighbor, John Steadman, testified to CGOBOC on January 26 that the hill behind the present Forest Hill Christian Church on the site is extremely steep, and all neighbors are very concerned about the stability of the hill and construction of the proposed senior housing project, given proposed excavation. Steadman noted that in 1951 a house located at 50 Castenada Avenue directly above the church’s current parking lot slid down the hill.

For his part, another neighbor, John Steadman, testified to CGOBOC on January 26 that the hill behind the present Forest Hill Christian Church on the site is extremely steep, and all neighbors are very concerned about the stability of the hill and construction of the proposed senior housing project, given proposed excavation. Steadman noted that in 1951 a house located at 50 Castenada Avenue directly above the church’s current parking lot slid down the hill.

Katrina Kranz, who lives on Castenada Avenue, testified the 250 Laguna Honda location is a very isolated spot, with little for seniors to do. She noted the nearest amenities are a French restaurant and a Home Equity Loan business. “There’s no pharmacy, there’s no walkable grocery stores,” Franz noted.

Marilyn Hsu, another neighbor who supports senior housing — given her widowed Asian mother’s plight finding affordable housing in the City — noted the Forest Hill area is one of the worst areas for seniors because there’s no nearby amenities, and the traffic on Laguna Honda is dangerous. Hsu testified her mother was nearly hit several times trying to access the Forest Hill Muni station due to the traffic. Hsu also noted seniors can’t walk to a nearby store, and the neighborhood is not conducive mentally or physically for seniors to be housed in an isolated area lacking amenities.

Neighbor Pat Lee also addressed CGOBOC members about the stability of the hill, building a large building at the bottom of the it, and the danger of increasing traffic in that stretch on Laguna Honda Boulevard.

Finally, another teacher at the existing Forest Hill pre-school on the proposed site, Sandra Pucinelli, testified seniors would have a difficult life on Laguna Honda since it’s a dangerous street, She, too, noted the lack of nearby facilities since there’s no Laundromat, no grocery stores, and no pharmacies, and it’s a long walk to access public transportation. She noted “Having a senior housing [building] that looks like a housing project from the 1970’s is unacceptable for the neighborhood,” and suggested it should be redesigned so it looks like it belongs in the area.

Not discussed during the January 2017 CGOBOC meeting was that of the 150 senior housing units proposed for 250 Laguna Honda Boulevard, between 30 and 45 will be set aside for the homeless, presumably homeless senior citizens.

Not discussed during the January 2017 CGOBOC meeting was that of the 150 senior housing units proposed for 250 Laguna Honda Boulevard, between 30 and 45 will be set aside for the homeless, presumably homeless senior citizens.

At the end of the hearing, Mr. Farrell noted “When this project is presented to you, we want it to be honest about what’s being presented. What’s [MOHCD] is presenting [to CGOBOC] is not honest.”

Planning Department’s Own Concerns About the Project

In addition to concerns raised by neighbors, the Planning Department has raised significant concerns of its own, since the 250 Laguna Honda project has not been heard, approved, or received permits by the Planning Department or Planning Commission, despite the developer’s “Preliminary Project Assessment” application submitted to Planning in July 2016.

The Planning Department appears to be quite concerned about the project’s proposal to excavate 16 feet below grade. Planning has instructed the developers to submit an “Environmental Evaluation Application” to determine whether California Environmental Quality Act (CEQA) review may be required. Planning also noted that the project may be subject to review by the Department’s Historic Preservation staff; may require a Preliminary Archeological Review (PAR) by a Planning Department archeologist; may require a Transportation Impact Analysis to determine whether the project may result in a significant transportation impact; and because the project site is located within a Seismic Hazard Zone (Landslide Hazard Zone) any new construction on the site is subject to a mandatory Interdepartmental Project Review with a geotechnical study that must be prepared. In addition, a Disclosure Report for Developers of Major City Projects must be submitted to the San Francisco Ethics Commission regarding potential donations that developers may make to nonprofit organizations that communicate with the City and County regarding major development projects.

The Planning Department appears to be quite concerned about the project’s proposal to excavate 16 feet below grade. Planning has instructed the developers to submit an “Environmental Evaluation Application” to determine whether California Environmental Quality Act (CEQA) review may be required. Planning also noted that the project may be subject to review by the Department’s Historic Preservation staff; may require a Preliminary Archeological Review (PAR) by a Planning Department archeologist; may require a Transportation Impact Analysis to determine whether the project may result in a significant transportation impact; and because the project site is located within a Seismic Hazard Zone (Landslide Hazard Zone) any new construction on the site is subject to a mandatory Interdepartmental Project Review with a geotechnical study that must be prepared. In addition, a Disclosure Report for Developers of Major City Projects must be submitted to the San Francisco Ethics Commission regarding potential donations that developers may make to nonprofit organizations that communicate with the City and County regarding major development projects.

The Planning Department confirmed on February 22 that none of these requirements have been met to date, since no additional applications have been submitted, including an Environmental Evaluation Application, a Legislative Amendment Application, and a Building Permit Application specifically referred to in the Planning Department’s October 2016 response to the developer’s Preliminary Project Assessment application. The Preliminary Archeological Review, Transportation Impact Analysis, and Seismic Hazard Zone (Landslide Hazard Zone) Interdepartmental Project Review with a geotechnical study for this project raised as concerns by the Planning Department will be submitted as part of the Environmental Evaluation Application, if and when it is eventually submitted.

Perhaps the Planning Department’s biggest concern is the zoning. Planning noted the parcel is currently zoned RH-1(D), Residential-House, One-Family Detached Zoning District, with height and bulk limits. Planning noted construction of senior housing at a density of 150 units and development above 40 feet in height are not permitted in RH-1(D) zones. The proposed senior housing project is 49-feet high, exceeding current height restrictions.

Perhaps the Planning Department’s biggest concern is the zoning. Planning noted the parcel is currently zoned RH-1(D), Residential-House, One-Family Detached Zoning District, with height and bulk limits. Planning noted construction of senior housing at a density of 150 units and development above 40 feet in height are not permitted in RH-1(D) zones. The proposed senior housing project is 49-feet high, exceeding current height restrictions.

For the project to proceed, it may be necessary to establish a Senior Housing “Special Use District” (SUD) to allow for greater density. A Height District Reclassification for the project would be required to amend the Height and Bulk District Map. Rezoning, and establishment of an SUD with new height controls, are legislative actions requiring Mayoral and Board of Supervisor approval, following Planning Commission approval.

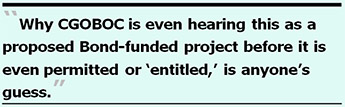

Why CGOBOC is even hearing this as a proposed Bond-funded project before it is even permitted or “entitled,” is anyone’s guess.

Squishing the Elderly into Tiny “Micro-Units”

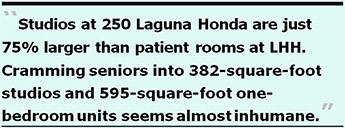

In response to a public records request, MOHCD provided in February a preliminary proposed unit mix of the senior housing on Laguna Honda Boulevard. MOHCD indicated that preliminary plans for the proposed 150 units show 42 (28%) will be studio units averaging 382 square feet, about the size of a micro-unit. Another 107 (71.3%) will be one-bedrooms averaging 595 square feet. All units include kitchens and bathrooms, included in the square foot estimates. There will be just one two-bedroom unit for an on-site building manager.

In response to a public records request, MOHCD provided in February a preliminary proposed unit mix of the senior housing on Laguna Honda Boulevard. MOHCD indicated that preliminary plans for the proposed 150 units show 42 (28%) will be studio units averaging 382 square feet, about the size of a micro-unit. Another 107 (71.3%) will be one-bedrooms averaging 595 square feet. All units include kitchens and bathrooms, included in the square foot estimates. There will be just one two-bedroom unit for an on-site building manager.

Although the 250 Laguna Honda project proposes increasing the number of parking spaces on the property from 49 to 62, their “Preliminary Project Assessment” application provided no spaces for bicycles, which is of concern to the Planning Department.

By way of contrast, patient rooms at Laguna Honda Hospital just up the street average 218 square feet, although the double- and triple-room suites share a single bathroom for each suite. That means the studios at 250 Laguna Honda will be just 75% larger (with only 164 more square feet including a kitchen) than patient rooms at LHH.

Another comparison is that of new rental housing units built nationwide in 2016, the average size of new studio units was 504 square feet, while the average size of one-bedrooms was 752 square feet. That means studio units at 250 Laguna Honda will be 122 square feet smaller and one-bedroom units will be 157 square feet smaller than national averages.

Cramming senior citizens into 382-square-foot studios and 595-square-foot one-bedroom units seems almost inhumane, given that many seniors have multiple pieces of durable medical equipment, including walkers and electric wheelchairs with recharging devices. Then there’s the issue that many seniors need live-in assistants to help them with activities of daily living, like showering and cooking meals. This housing project, as proposed, essentially guarantees that any senior citizen who needs an extra room for family or hired caregivers may not be eligible for these units.

Cramming senior citizens into 382-square-foot studios and 595-square-foot one-bedroom units seems almost inhumane, given that many seniors have multiple pieces of durable medical equipment, including walkers and electric wheelchairs with recharging devices. Then there’s the issue that many seniors need live-in assistants to help them with activities of daily living, like showering and cooking meals. This housing project, as proposed, essentially guarantees that any senior citizen who needs an extra room for family or hired caregivers may not be eligible for these units.

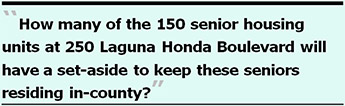

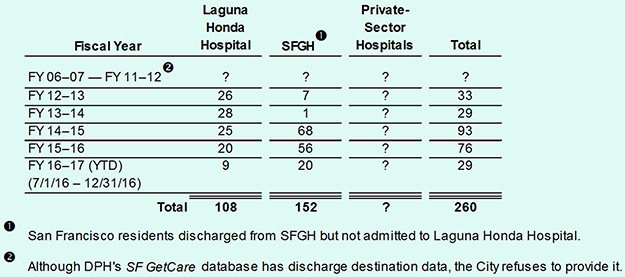

As shown in Table 1 below, between July 1, 2012 and December 31, 2016 our two county hospitals — Laguna Honda Hospital and SFGH — have discharged at least 260 patient’s out-of-county. (The Department of Public Health has refused to report honestly the number of additional LHH out-of-county discharges between July 1, 2006 and June 30, 2012 even though it likely has this historical data.) Rather than dumping elderly San Franciscan’s out-of-county, how many of the 150 senior housing units at 250 Laguna Honda Boulevard will have a set-aside — not for housing the homeless at 30% of the proposed units — but for keeping these seniors and disabled San Franciscans residing in-county?

Table 1: Out-of-County Patient Discharges Four-and-a-Half Fiscal Years

In addition to the patient dumping out-of-county from our two county hospitals, it is not known how many additional out-of-county discharges have been made by other San Francisco private-sector hospitals, skilled nursing facilities, and assisted-living facilities during the same timeframe.

Why isn’t MOHCD using its $3 billion funding stream to develop more skilled nursing facilities and assisted living projects to keep San Francisco seniors in-county?

Homeless Housing Set-Aside Surges to 30% Housing Project

As first reported in April 2015 in “Mayor’s Housing Scam, Redux,” background documents included a February 3, 2015 housing pipeline presentation prepared for the Mayor that noted on page 4 that 20% of the affordable housing to be developed with the proposed bond would be set aside for the homeless.

As first reported in April 2015 in “Mayor’s Housing Scam, Redux,” background documents included a February 3, 2015 housing pipeline presentation prepared for the Mayor that noted on page 4 that 20% of the affordable housing to be developed with the proposed bond would be set aside for the homeless.

And as reported in June 2016 in “Last November’s Affordable Housing Bond Measure Snookered Voters,” a partial verbatim transcript of CGOBOC’s January 28, 2016 meeting was very troubling. Foremost, those minutes omitted mention of comments CGOBOC members made regarding setting aside 20% of the bond — probably at least $20 million, and potentially up to $62 million — for housing-for-the-homeless programs.

The Executive Summary Hartley distributed on January 28, 2016 showed on page 9 that MOHCD’s housing programs serve “vulnerable” San Francisco residents, defining vulnerable populations as 1) Low-income working families, 2) Veterans, 3) Homeless individuals and families, 4) Seniors, 5) Disabled individuals, and 6) transitional-aged youth. But Hartley’s PowerPoint presentation on January 28 listed only four of the six categories (# 1, 2, 4, and 5), omitting homeless people and transitional-aged youth.

A Dirty Little Secret: Bond Wasn’t Earmarked for Homeless Housing

Even CGOBOC members were apparently surprised to learn in January 2016 there would be a set-aside of 20% of the bond to fund housing for the homeless. In January 2017, CGOBOC members were first informed the homeless set-aside might climb to 30% for at least four of the planned projects funded by the Bond. Another surprise for them!

Even CGOBOC members were apparently surprised to learn in January 2016 there would be a set-aside of 20% of the bond to fund housing for the homeless. In January 2017, CGOBOC members were first informed the homeless set-aside might climb to 30% for at least four of the planned projects funded by the Bond. Another surprise for them!

What’s more, the legal text of Prop A in the November 2015 voter guide also stipulated on page 156 that the bond measure would put the question to voters whether the bond should prioritize “vulnerable” populations as including folks “such as” working families, veterans, seniors, and disabled persons. The legal text in the voter guide didn’t mention homeless people or “transitional youth” as being “vulnerable populations.”

The Voter Guide also reported on page 46 that the actual question put before voters on the ballot had not included homeless households as part of the vulnerable populations targeted under this Affordable Housing Bond.

The Voter Guide also reported on page 46 that the actual question put before voters on the ballot had not included homeless households as part of the vulnerable populations targeted under this Affordable Housing Bond.

Leading up the November 2015 election, although some of MOHCD’s background documents had included homeless people in the definition of “vulnerable” San Franciscans, the dirty little secret is that voters were never told — and the voter guide never informed voters — that the bond would dedicate 20% to 30% of the affordable housing to be acquired or constructed for homeless people. There wasn’t one mention in the legal text in the November 2015 voter guide that bond funds would be used to house the homeless, and certainly not at up to 30% of gross bond proceeds.

Fast forward to now. Of the four non-public housing projects that will receive funding under this Bond, the number of units to be set aside for the homeless has suddenly climbed from 20% to potentially up to 30% in each project.

When MOHCD presented its update to CGOBOC on January 26, 2017 four projects have been selected that now say will set aside “at least” 20% of the units for homeless people. One is at 4840 Mission with 114 family apartments, one is at 250 Laguna Honda Boulevard with 150 senior apartments, one is at 500 Turk with 122 family apartments, and one is at 1990 Folsom with 143 family apartments. All four projects stipulate 20% to 30% of the combined 529 units across each of the projects will be set aside for the homeless. That’s a total set-aside for homeless housing of somewhere between 106 and 158 of the 529 new units voters were never informed of prior to the November 2015 bond election.

When MOHCD presented its update to CGOBOC on January 26, 2017 four projects have been selected that now say will set aside “at least” 20% of the units for homeless people. One is at 4840 Mission with 114 family apartments, one is at 250 Laguna Honda Boulevard with 150 senior apartments, one is at 500 Turk with 122 family apartments, and one is at 1990 Folsom with 143 family apartments. All four projects stipulate 20% to 30% of the combined 529 units across each of the projects will be set aside for the homeless. That’s a total set-aside for homeless housing of somewhere between 106 and 158 of the 529 new units voters were never informed of prior to the November 2015 bond election.

It is not known if the homeless housing increase from 20% to 30% as a set-aside for homeless units between January 2016 and January 2017 is due to the Mayor’s creation of the City’s new Department of Homelessness and Supportive Housing, which is advocating for more City resources for the homeless.

If the City really needs a bond dedicated solely for building homeless housing, it would be more honest to place such a bond on the ballot and let voters decide, rather than diverting after-the-fact bond funds promised to develop affordable housing for low- to middle-income residents.

If the City really needs a bond dedicated solely for building homeless housing, it would be more honest to place such a bond on the ballot and let voters decide, rather than diverting after-the-fact bond funds promised to develop affordable housing for low- to middle-income residents.

During CGOBOC’s January 2017 meeting, there appeared to be some quibbling among CGOBOC members and MOHCD’s staff members — Mara Blitzer, MOHCD’s Director of Housing Development, and Benjamin McCloskey, MOHCD’s Deputy Director of Finance and Administration — about whether the homeless housing set-aside is restricted only to the Low-Income Housing category of planned bond spending. MOHCD’s Deputy Director of Housing, Kate Hartley, had clearly informed CGOBOC on January 28, 2016 that “typically [there is] a 20% set aside in all of [MOHCD’s] buildings for homeless households,” presumably including all buildings for Public Housing, Low-Income Housing, and Middle-Income Housing projects.

For his part, McCloskey clarified on January 27, 2017 for CGOBOC members that:

“My recollection is that the bond did not specifically articulate a specific percentage required for any specific population. But it has been City policy to set aside a certain percentage of units in all of our multi-family buildings for people leaving homelessness.” [Emphasis added]

Notably, MOHCD’s January 26, 2017 update to CGOBOC made no mention of specific housing units for vulnerable groups including veterans, people with disabilities, or transitional-aged youth Hartley had documented in January 2016. These vulnerable populations appear to have been all but forgotten in bond spending categories.

Notably, MOHCD’s January 26, 2017 update to CGOBOC made no mention of specific housing units for vulnerable groups including veterans, people with disabilities, or transitional-aged youth Hartley had documented in January 2016. These vulnerable populations appear to have been all but forgotten in bond spending categories.

For every housing unit built or acquired using this Bond funding that is set aside for housing the homeless, there will be a corresponding reduction of new, or preserved, units for low-income and middle-income San Franciscans. MOHCD has acknowledged that there are few funding streams available for middle-income housing, so the impact of diverting middle-income units to units to house the homeless is particularly severe on middle-income households.

Expiring Regulations Preservation

The Expiring Regulations Preservation category of the bond — designed to preserve decades-old Redevelopment Agency-funded affordable housing units facing expiration of their 30-year financing — was removed from bond spending presented to CGOBOC on July 28. MOHCD didn’t inform CGOBOC that the reason it was removed was because bond lawyers finally informed MOHCD that preserving the existing rental units somehow didn’t meet the “bricks-and-mortar” requirements of the bond. Didn’t MOHCD’s legal counsel know that when MOHCD first included this subcategory as a planned bond category? Kate Hartley from the Mayor’s Office of Housing and Community Development noted this category and other categories of planned bond spending were removed from the bond when bond counsel advised the bond could only be spent on “brick-and-mortar” projects. No explanation was provided why existing expiring-regulation “brick” buildings don’t meet some new un-defined criteria as “brick-and-mortar” buildings!

The Expiring Regulations Preservation category of the bond — designed to preserve decades-old Redevelopment Agency-funded affordable housing units facing expiration of their 30-year financing — was removed from bond spending presented to CGOBOC on July 28. MOHCD didn’t inform CGOBOC that the reason it was removed was because bond lawyers finally informed MOHCD that preserving the existing rental units somehow didn’t meet the “bricks-and-mortar” requirements of the bond. Didn’t MOHCD’s legal counsel know that when MOHCD first included this subcategory as a planned bond category? Kate Hartley from the Mayor’s Office of Housing and Community Development noted this category and other categories of planned bond spending were removed from the bond when bond counsel advised the bond could only be spent on “brick-and-mortar” projects. No explanation was provided why existing expiring-regulation “brick” buildings don’t meet some new un-defined criteria as “brick-and-mortar” buildings!

It’s not the only issue Hartley has presented as being MOHCD’s “position.”

MOHCD asserts it is now preserving those units with other funding sources, but didn’t name from which source. It’s worrisome that if CGOBOC won’t have oversight of this subcategory, whether anyone else will. Moving expiring regulations preservation to other funding in MOHCD’s vast Housing Trust Fund is also worrisome.

MOHCD asserts it is now preserving those units with other funding sources, but didn’t name from which source. It’s worrisome that if CGOBOC won’t have oversight of this subcategory, whether anyone else will. Moving expiring regulations preservation to other funding in MOHCD’s vast Housing Trust Fund is also worrisome.

In June 2014, the 2013–2014 Civil Grand Jury issued a blistering report about MOHCD. The Grand Jury worried, in part, that reduction of Housing Trust Funds may result in a permanent loss of funds for other affordable housing goals.

In response to questions raised by CGOBOC member Larry Bush on January 24, MOHCD’s Deputy Director of Finance and Administration, Benjamin McCloskey, distributed a four-page response during CGOBOC’s January 26, 2017 meeting. In response to one question, MOHCD claimed — wrongly — that during drafting of the bond [apparently as early as in 2014] that “there was a strong focus on spending [the bond] which would produce the most new affordable housing. [emphasis in original].”

In the response to the same question, MOHCD claims that while spending funds to assist “existing senior homeowners is a worthwhile endeavor, it was not included as a proposed use of the bonds as approved by voters.” From my perspective, MOHCD may be lying through its teeth.

In the response to the same question, MOHCD claims that while spending funds to assist “existing senior homeowners is a worthwhile endeavor, it was not included as a proposed use of the bonds as approved by voters.” From my perspective, MOHCD may be lying through its teeth.

First, in the legal text of the bond on page 156 in the voter guide, it clearly specifies that the bond would be used, in part, to acquire existing rental housing as affordable housing, not just “new” housing. Only “new” housing is patently untrue.

All along, the focus of bond spending included not just new affordable housing units, but existing ones, too, such as those subject to expiring regulations. Indeed, bond planning documents since at least 2014 had proposed using bond funds to preserve existing rental units, and planned spending $20 million to do so. It wasn’t until July 28, 2016 that MOHCD suddenly removed “expiring regulations preservation” from planned bond spending.

Eddie Stiel, a 25-year resident of the Mission District, notes:

“The fact we’re losing affordable units for low-income people while MOHCD keeps touting new production with relatively high income requirements must be revealed. The potential loss of existing subsidized units is a big deal.”

Second, throughout the legal text for the bond in the voter guide, seniors were repeatedly to be prioritized for assistance.

Second, throughout the legal text for the bond in the voter guide, seniors were repeatedly to be prioritized for assistance.

During a hearing of the Board of Supervisors Government Audit and Oversight Committee (GAO) on October 21, 2016 that touched on expiring regulations preservation, Supervisor Jane Kim said, “Preservation of existing affordable housing stock is just as important as fighting for new housing.”

She echoed the same sentiments during a GAO hearing on February 2, 2017 when Supervisor Aaron Peskin held a hearing regarding the expiring regulations that are affecting approximately 50 units in the 737 Tower building at 737 Post Street. Supervisor London Breed also expressed concern about preserving our current affordable housing stock.

She echoed the same sentiments during a GAO hearing on February 2, 2017 when Supervisor Aaron Peskin held a hearing regarding the expiring regulations that are affecting approximately 50 units in the 737 Tower building at 737 Post Street. Supervisor London Breed also expressed concern about preserving our current affordable housing stock.

During the February hearing a Mr. McDonald, an attorney representing the building’s owner, started out by asserting:

“Apparently, there’s no factual or legal dispute that the [737 Post Street] units are exempt permanently from rent and eviction control at this point. So I think that the only thing to be discussed here today is the equities, and I’m very happy to do that when the time comes.”

Supervisor Peskin noted at the outset of the hearing that out of four properties facing expiring regulations that the City seeks to preserve some units as affordable, the 737 Post building owners — Sequoia Equities — is the only building owner that hasn’t cooperated with the City. Peskin began by noting that 80% of the units at 737 Post have been at market-rate since the beginning of Sequoia’s investment and Sequoia has done extraordinarily well financially. Peskin noted the 50 below-market rate (BMR) units at issue comprise just 20% of the building’s units. That means the other 80% — 200 units — in the building are already market-rate rentals providing significant return on Sequoia’s investment.

Supervisor Peskin noted at the outset of the hearing that out of four properties facing expiring regulations that the City seeks to preserve some units as affordable, the 737 Post building owners — Sequoia Equities — is the only building owner that hasn’t cooperated with the City. Peskin began by noting that 80% of the units at 737 Post have been at market-rate since the beginning of Sequoia’s investment and Sequoia has done extraordinarily well financially. Peskin noted the 50 below-market rate (BMR) units at issue comprise just 20% of the building’s units. That means the other 80% — 200 units — in the building are already market-rate rentals providing significant return on Sequoia’s investment.

When Peskin questioned Cynthia McSherry, an employee of Sequoia, she indicated the building’s ownership had not been interested in previous proposals MOHCD had offered, saying bond financing is gone, a credit enhancement is no longer there, and Sequoia’s cost of its financing has gone up significantly. When Peskin pressed McSherry, she indicated she wasn’t in a position to make decisions for Sequoia’s partnership.

To his credit, Peskin noted he didn’t want to spend his life making Sequoia miserable, but would so if he had to, to resolve the issue. Peskin also noted that if an equitable resolution wasn’t achieved he might ask the City Attorney to explore a lawsuit over Sequoia having failed to disclose to the BMR tenants that rents would being going to market rate, something not disclosed in previous written instruments.

To his credit, Peskin noted he didn’t want to spend his life making Sequoia miserable, but would so if he had to, to resolve the issue. Peskin also noted that if an equitable resolution wasn’t achieved he might ask the City Attorney to explore a lawsuit over Sequoia having failed to disclose to the BMR tenants that rents would being going to market rate, something not disclosed in previous written instruments.

The hearing was continued to GAO’s Call of the Chair to allow time for further negotiations to proceed. We’ll see if MOHCD eventually prevails in preserving the units at 737 Post Street, and whether Peskin’s hearing helped save these 50 units. [Update: As of February 26, there appears to have been some progress made, but the 737 Post expiring regulations units appear to still be under negotiation with Sequoia. A temporary reprieve may have been reached, but it’s apparently not yet a permanent solution.]

Market-Rate Units and “Residual Receipts”

MOHCD has previously indicated that all of the affordable housing to be developed using the $310 Affordable Housing Bond will involve mixed-use projects, including market-rate units, as a way to leverage funding for affordable housing projects. Despite CGOBOC’s four meetings at which MOHCD has presented skimpy and shifting planned uses of the bond, MOHCD has not yet provided CGOBOC members with a breakout of how many market-rate units will be included in every one of the Bond’s planned projects, or whether other mixed-uses may also be included.

MOHCD has previously indicated that all of the affordable housing to be developed using the $310 Affordable Housing Bond will involve mixed-use projects, including market-rate units, as a way to leverage funding for affordable housing projects. Despite CGOBOC’s four meetings at which MOHCD has presented skimpy and shifting planned uses of the bond, MOHCD has not yet provided CGOBOC members with a breakout of how many market-rate units will be included in every one of the Bond’s planned projects, or whether other mixed-uses may also be included.

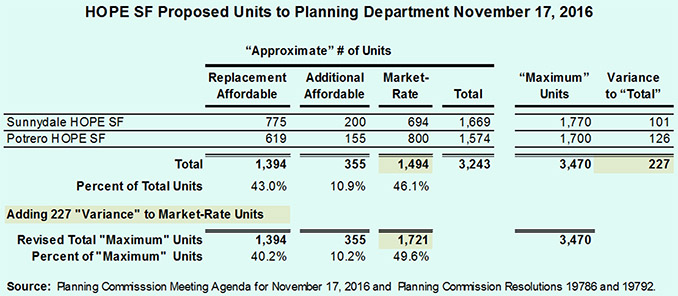

However, based on the agenda for the Planning Commission’s November 17, 2016 meeting, it’s clear that there will be plenty of market rate units developed in the rebuild of public housing on the Sunnydale and Potrero HOPE SF sites. We know that at least 1,494 (46.1%) of the approximate 3,243 units planned in the “Public Housing” category of the bond will be market-rate units shown in Table 2.

Table 2: Market-Rate Units at Public Housing Sites

The Planning Department’s November 17, 2016 meeting minutes show the agenda item, including the market-rate units was approved. As Table 2 illustrates, by subtracting the total number of “approximate” units (shown in parenthesis on the Planning Commission’s agenda) from the “maximum units,” it appears that between the two HOPE SF locations, another 227 units may be built. Most developers will more than likely want to build the maximum number of units to maximize their profits. The agenda didn’t indicate whether that variance in the maximum number of units would be for affordable units, or for market rate units. It’s doubtful that out of the goodness of their hearts developers will build 227 more affordable units for low-income or middle-income households.

The Planning Department’s November 17, 2016 meeting minutes show the agenda item, including the market-rate units was approved. As Table 2 illustrates, by subtracting the total number of “approximate” units (shown in parenthesis on the Planning Commission’s agenda) from the “maximum units,” it appears that between the two HOPE SF locations, another 227 units may be built. Most developers will more than likely want to build the maximum number of units to maximize their profits. The agenda didn’t indicate whether that variance in the maximum number of units would be for affordable units, or for market rate units. It’s doubtful that out of the goodness of their hearts developers will build 227 more affordable units for low-income or middle-income households.

Although Table 2 shows at least 46.1% of the approximate units are earmarked for market-rate units, if the additional 227 units are built to the maximum limit and are market-rate units, that will push the total of market-rate units to 49.6% (let’s call it half) of the 3,470 maximum units.

Although Table 2 shows at least 46.1% of the approximate units are earmarked for market-rate units, if the additional 227 units are built to the maximum limit and are market-rate units, that will push the total of market-rate units to 49.6% (let’s call it half) of the 3,470 maximum units.

MOHCD keeps asserting to CGOBOC it typically doesn’t expect repayment on loans to Public Housing and low-income affordable housing projects because it claims rents would have to be set much higher. But if between 46.1% and 49.6% of the HOPE SF units will be market-rate, shouldn’t that provide sufficient income from the market-rate rental units to generate enough “residual receipts” revenue after operating expenses to at least pay something back on loans made?

MOHCD’s Kate Hartley has repeatedly noted MOHCD’s position is that “all MOHCD multi-family loans are made on a ‘residual receipts’ basis, and that MOHCD takes loan repayments to the extent ‘surplus cash is available’.” She and other MOHCD staff have also repeatedly indicated MOHCD is focusing on “mixed use developments” to help supplement financing of the $310 million bond of affordable housing projects.

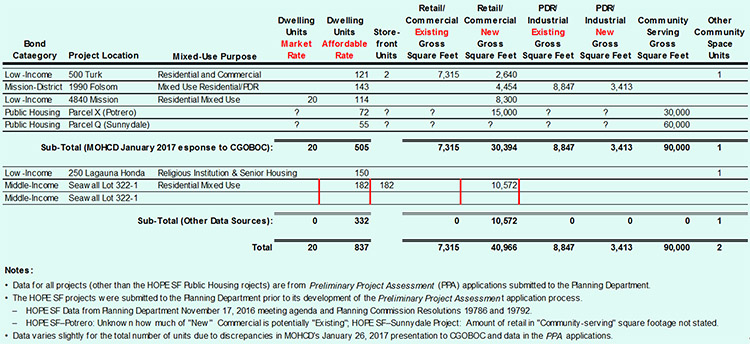

Table 3 below shows mixed uses include market-rate housing units, along with various types of commercial and industrial facilities, presumably to increase rental income for the market rate and commercial facilities to augment cash flow of projects. And the mixed uses presumably would help ensure the market-rate and commercial rents contribute towards increasing the residual receipts to enable loan repayments.

Table 3 below shows mixed uses include market-rate housing units, along with various types of commercial and industrial facilities, presumably to increase rental income for the market rate and commercial facilities to augment cash flow of projects. And the mixed uses presumably would help ensure the market-rate and commercial rents contribute towards increasing the residual receipts to enable loan repayments.

Table 3: Mixed Use-Facilities in Bond-Funded Projects

Details of the mixed-use purposes of each project are taken from the Preliminary Project Assessment applications to the Planning Department for 500 Turk, 1990 Folsom, 4840 Mission, 250 Laguna Honda, and the Seawall Lot project, and from Planning Commission Resolution 19786 (HOPE SF–Sunnydale) and Resolution 19792 (HOPE SF–Potrero).

Between the 1,494 to potentially 1,676 market-rate units that may be built on the HOPE SF public housing sites as a mixed-use project, the market-rate units at 4840 Mission Street, and the various commercial and PDR industrial projects in other bond-funded projects, shouldn’t there be additional revenue streams other than rent on housing units?

Between the 1,494 to potentially 1,676 market-rate units that may be built on the HOPE SF public housing sites as a mixed-use project, the market-rate units at 4840 Mission Street, and the various commercial and PDR industrial projects in other bond-funded projects, shouldn’t there be additional revenue streams other than rent on housing units?

Unfortunately, CGOBOC has not asked one question about whether the market-rate and commercial mixed-use rents will help increase residual receipts for loan repayment.

CGOBOC needs to aggressively insist that MOHCD provide CGOBOC with the number of market-rate units and other mixed uses of each of the bond-funded projects as part of the planned metrics assessing bond spending to address the “residual receipts” nonsense.

Middle-Income Housing Category Restricts Seawall Lot 322-1's Middle-Income Units?

A project at Seawall Lot 322-1 first surfaced in MOHCD’s presentation to CGOBOC on January 26, 2017 just like the senior housing project at 250 Laguna Honda Boulevard first surfaced. Both projects mysteriously appeared after October 3, 2016, fully a year into CGOBOC hearings on oversight of the bond.

A project at Seawall Lot 322-1 first surfaced in MOHCD’s presentation to CGOBOC on January 26, 2017 just like the senior housing project at 250 Laguna Honda Boulevard first surfaced. Both projects mysteriously appeared after October 3, 2016, fully a year into CGOBOC hearings on oversight of the bond.

To that extent, both projects should be considered to be a form of “change orders,” insofar as neither project had been contemplated before 2014 as being part of planned spending of the Affordable Housing Bond. And neither project had been presented to CGOBOC during any of MOHCD’s three presentations to CGOBOC during 2016. Both projects are huge changes to bond spending from MOHCD’s previous reports to CGOBOC.

Although Sewall Lot 322-1’s web site indicates 200 units will be built, the Preliminary Project Assessment application for the Seawall Lot project obtained from the Planning Department shows that the developers applied for just 182 units.

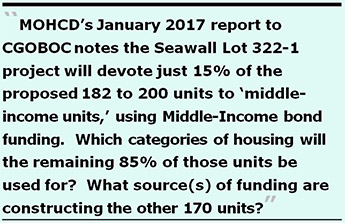

Remarkably page 24 of MOHCD’s January 2017 report to CGOBOC notes the Seawall Lot 322-1 project will devote just 15% of the proposed 182 to 200 units to “middle-income units,” despite using the Middle-Income category of the bond to do so. Just 27 to 30 of the proposed units will be for middle-income applicants. Wait! What?

Remarkably page 24 of MOHCD’s January 2017 report to CGOBOC notes the Seawall Lot 322-1 project will devote just 15% of the proposed 182 to 200 units to “middle-income units,” despite using the Middle-Income category of the bond to do so. Just 27 to 30 of the proposed units will be for middle-income applicants. Wait! What?

MOHCD plans to use a substantial chunk (thought to be $7 million) of the $80 million Middle-Income Housing main category of the bond for the Seawall Lot 322-1 project, and then restrict those middle-income units to just 15%? Which categories of housing will the remaining 85% (170) of those units be used for (market-rate? low-income?), and what source(s) of funding are constructing the other 170 units? Are the additional 170 units funded by MOHCD’s other revenue streams?

Seawall Lot 322-1 claims it will develop 130 units of family housing, and another 70 units of housing for senior citizens, for a total of 200 affordable housing units. It is not yet known whether Seawall Lot 322-1 is a mixed-use project that may include market-rate units above the 2,000 to 5,000 square feet of commercial space in the project. Current estimates of sea level rise show the site won’t be affected by the year 2050, but small portions of the site are identified as likely to be inundated by sea level increases by the year 2100.

Under current State law, lease of this site for affordable housing will end in 2094. Affordable housing would not be allowed on the site after 2094, unless the Port and MOHCD negotiate by then to develop a strategy to extend the use of affordable housing past the expiration of the 75-year lease. Is the entire project “affordable housing,” or will only the 15% of middle-income units face the lease expiration?

Under current State law, lease of this site for affordable housing will end in 2094. Affordable housing would not be allowed on the site after 2094, unless the Port and MOHCD negotiate by then to develop a strategy to extend the use of affordable housing past the expiration of the 75-year lease. Is the entire project “affordable housing,” or will only the 15% of middle-income units face the lease expiration?

Notably, the Port Commission had reviewed the proposed affordable housing concept on the Port’s Seawall property and MOU terms at its October 22, 2013 meeting, after State Assembly Bill 2649 was passed permitting lifting public trust use restrictions from the Seawall site to allow development of affordable housing.

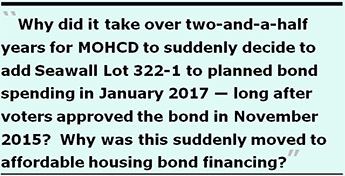

MOHCD executed a Memorandum of Understanding (MOU) with the Port Authority of San Francisco on April 30, 2014 to develop Seawall Lot 322-1 as affordable housing. The Port Commission had approved the MOU a month-and-a-half earlier on, March 11, 2014 by adopting Resolution 14-16.

One reasonable question is: Why did it take over two-and-a-half years for MOHCD to suddenly decide to add Seawall Lot 322-1 to planned bond spending in January 2017 — long after voters approved the bond in November 2015? Another question is: Why did MOHCD suddenly add this project to bond spending a full year after CGOBOC began holding bond oversight hearings in January 2016, since MOHCD knew it had been planning this MOU as far back as October 2013? More importantly, hadn’t MOHCD already locked in place other of its funding sources for the Seawall Lot 322-1 project before signing the MOU in 2014? Why was this suddenly moved to affordable housing bond financing?

About the Mix of Unit Sizes …

Separate from the issue of square-footage “micro-unit sizes” not only at the proposed 250 Laguna Honda but perhaps at the other project locations, there’s another issue involving the mix of unit sizes between studio units and three-bedroom units.

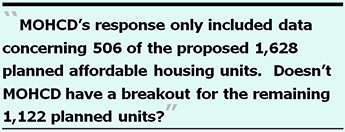

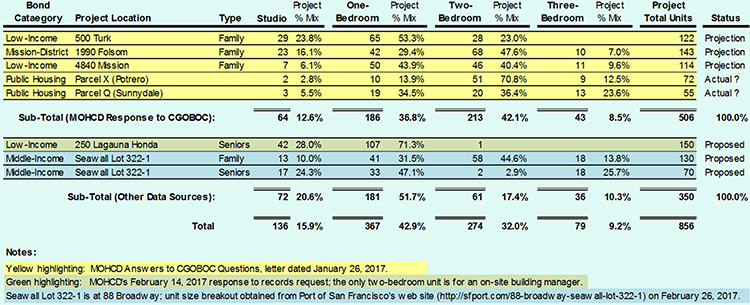

CGOBOC member Larry Bush — who was appointed to CGOBOC by the Civil Grand Jury — had asked MOHCD on January 24 about the breakout of the mix of unit sizes in the bond-funded projects. Remarkably, MOHCD’s response only included data concerning 506 of the proposed 1,628 planned affordable housing units. Are we to believe seriously that if MOHCD doesn’t have at its fingertips the breakout of units for the remaining 1,122 planned units?

CGOBOC member Larry Bush — who was appointed to CGOBOC by the Civil Grand Jury — had asked MOHCD on January 24 about the breakout of the mix of unit sizes in the bond-funded projects. Remarkably, MOHCD’s response only included data concerning 506 of the proposed 1,628 planned affordable housing units. Are we to believe seriously that if MOHCD doesn’t have at its fingertips the breakout of units for the remaining 1,122 planned units?

Mr. Bush raised the issue concerned, in part, by the number of families fleeing San Francisco who are unable to locate affordable housing for their growing families. He’s concerned about whether there is any assessment on the need for family-sized housing, and wondered whether there is a legal definition of family-sized housing for planning and permitting of projects in the City.

Importantly, Bush notes:

“San Francisco has not found a way to create units that are flexible and adjustable to allow a one-bedroom to become a one-bedroom and studio combo to better provide for home health care, or to allow a parent or family member to join the household. Partly this appears to be due to a reluctance at [the] Planning [Department] to think outside the box, that families include families of affection as well as blood, or that people form temporary families in order to afford living in the city.

Another equally important factor appears to be restrictions on some funding sources from the state and feds that don’t allow for flexibility. The challenge is that we are putting up housing that will occupy a site for 20–30–40 years as though the housing needs of San Franciscans won’t alter during that time.

We need a San Francisco standard that accommodates us better than the policy set by funders. For now, it’s important to begin asking those questions, because otherwise we will never find answers that fit our needs.”

Mr. Bush is right to raise these concerns.

MOHCD presented the skimpy details in Table 4 below, which was fleshed out by other publicly-available data for an additional 350 units funded by the affordable housing bond.

Table 4: Planned Unit Sizes

Table 4 shows that of only half of the 1,628 planned units, fully 58.8% of the units will be studio and one-bedroom units, and just 32% will be two-bedroom units still too small for many families.

This stands in stark contrast to requirements in San Francisco’s Affordable Housing Fund Prop. B passed by voters in November 2008, which required that at least 50% of units funded must be two bedroom, or larger, units. Prop. B also required that 75% of the Fund must be used to acquire or develop new housing units for San Franciscans earning 80% or less of AMI (area median income).

[Note: The 2008 Affordable Housing Fund ballot measure is not to be confused with the Housing Trust Fund (HTF) voters passed in 2012. The 2008 ballot measure involved a budget set-aside using a dedicated percentage of annual property taxes based on assessed property values that the City Controller had fretted about, whereas the 2012 ballot measure involved a different set-aside simply raiding the General Fund. Of interest, neither the 2012 HTF nor the 2015 Affordable Housing Bond, addressed the mix of studio units vs. two- and three-bedroom units. In FY 2015–2016 ending June 30, 2016 the City appropriated $1 million to the AHF funded by the prior year’s fund balance, and an additional $25.6 million to the HTF from the General Fund.]

[Note: The 2008 Affordable Housing Fund ballot measure is not to be confused with the Housing Trust Fund (HTF) voters passed in 2012. The 2008 ballot measure involved a budget set-aside using a dedicated percentage of annual property taxes based on assessed property values that the City Controller had fretted about, whereas the 2012 ballot measure involved a different set-aside simply raiding the General Fund. Of interest, neither the 2012 HTF nor the 2015 Affordable Housing Bond, addressed the mix of studio units vs. two- and three-bedroom units. In FY 2015–2016 ending June 30, 2016 the City appropriated $1 million to the AHF funded by the prior year’s fund balance, and an additional $25.6 million to the HTF from the General Fund.]

When it comes down to it, I’m reminded of a portion of the lyrics in a Joni Mitchell a song released in October 1994:

Peg O’Connell died today

She was a cheeky girl

A flirt

They just stuffed her in a hole!

Surely to God you’d think at least some bells should ring!

One day I’m going to die here too

And they’ll plant me in the dirt

— Joni Mitchell

— Joni Mitchell

“Magdalene Laundries” on her

Turbulent Indigo Album

Have we been reduced to just stuffing and planting folks into smaller-sized micro-unit holes, and call it “housing”?

What Else Has Changed?

Ms. Hartley has also presented it is MOHCD’s “position” that affordable housing production requires flexibility in order to deal with legislative changes and changing market conditions. She has indicated “[MOHCD] will need to make such adjustments for our Prop A-funded projects along the way.”

The idea that “flexibility” is required to deal with legislative changes and changing market conditions throughout the bond appears to be an excuse to not firmly nail down actual bond spending categories to allow MOHCD to come back to CGOBOC again, and change spending categories mid-stream and mid-bond. This is preposterous. It’s a recipe for disaster by claiming “flexibility” will justify additional changes that may well catch CGOBOC off guard at the end of the Bond program.

The idea that “flexibility” is required to deal with legislative changes and changing market conditions throughout the bond appears to be an excuse to not firmly nail down actual bond spending categories to allow MOHCD to come back to CGOBOC again, and change spending categories mid-stream and mid-bond. This is preposterous. It’s a recipe for disaster by claiming “flexibility” will justify additional changes that may well catch CGOBOC off guard at the end of the Bond program.

After reporting about shifting planned uses of the bond in November 2016 in “Housing Delays = Justice Denied,” additional information has come to light.

Top-Loss Catalyst Fund

As reported in “Mayor’s Housing Scam, Redux” in April 2015, in 2014 a “Findings and Recommendations” document prepared by the Mayor’s Housing Work Group recommended forming a public–private partnership “accelerator fund.” MOHCD planned to allocate $20 million from the Affordable Housing Bond to create a “top-loss catalyst fund” as the accelerator fund to leverage City funding with other third-party investors to fund affordable housing development.

As reported in “Mayor’s Housing Scam, Redux” in April 2015, in 2014 a “Findings and Recommendations” document prepared by the Mayor’s Housing Work Group recommended forming a public–private partnership “accelerator fund.” MOHCD planned to allocate $20 million from the Affordable Housing Bond to create a “top-loss catalyst fund” as the accelerator fund to leverage City funding with other third-party investors to fund affordable housing development.

The catalyst fund was problematic for a number of reasons, including being proposed as an “off-balance-sheet” fund. Off-balance sheet (OBS) financing means an entity doesn’t include liabilities on its balance sheet. Readers may recall Enron Corporation’s collapse and eventual bankruptcy in 2001 were directly tied to use of OBS scams hiding billions of dollars in debt.

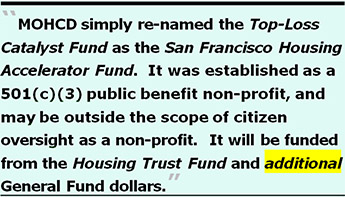

Since the Observer’s November 2016 article was published, MOHCD simply re-named the Top-Loss Catalyst Fund, as the San Francisco Housing Accelerator Fund. It was established as a 501(c)(3) public benefit non-profit on November 3, 2016. The Accelerator Fund’s purpose is to:

“Support affordable housing, community development and economic development for the City and County of San Francisco’s low, moderate- and middle-income households, individuals and communities, by lending to, investing in, and directly acquiring affordable housing real estate assets.”

In response to that November article, Benjamin McCloskey, MOHCD’s Deputy Director of Finance and Administration indicated by e-mail on February 17 that to date, MOHCD has not yet disbursed any funding to the newly-renamed San Francisco Housing Accelerator Fund, but MOHCD anticipates disbursing Housing Trust Fund and additional General Fund dollars to the re-named Accelerator Fund in the near future.

This is alarming, in part, because voters passed Prop. C in November 2012 to create the Housing Trust Fund (HTF) by initially diverting $20 million from the City’s General Fund to the HTF, an amount that will gradually increase to $50.8 million annually by the year 2043. Now in the fourth fiscal year (FY 2016–2017) set to end just four months from now, the City is on target to divert $28.4 million from the General Fund to the HTF. Next fiscal year, starting July 1, 2017 that amount will increase to $31.2 million.

When the HTF was put before voters in 2012, the City Controller’s statement in the voter guide noted — surprise? — that Prop. C was not in compliance with the voter-adopted policy prohibiting budget set-asides. The HTF’s main source of funding is a budget-aside, nonetheless.

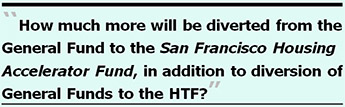

Over the 30-year life of the legislation, by the year 2043 a staggering $1.34 billion will have been diverted from the General Fund to the HTF. How much more will be diverted from the General Fund to the San Francisco Housing Accelerator Fund, in addition to diversion of General Funds to the HTF?

Over the 30-year life of the legislation, by the year 2043 a staggering $1.34 billion will have been diverted from the General Fund to the HTF. How much more will be diverted from the General Fund to the San Francisco Housing Accelerator Fund, in addition to diversion of General Funds to the HTF?

Other concerns are that the San Francisco Housing Accelerator Fund will be outside the scope of CGOBOC’s bond oversight function, may not have any other oversight body to oversee it, may continue to use an OBS funding mechanism, and more than likely, may be outside the scope of any citizen oversight because it is a 501(c)(3) non-profit. Stay tuned to what happens to the General Fund as MOHCD’s voracious appetite for funding continues to grow. It’s hard to tame a hungry beast.

After having already diverted — by snagging — $1.34 billion from the General Fund for the HTF, the proposed Accelerator Fund now wants do to snag more General Funds, without approval by voters at the ballot box?

Middle-Income Rental Program

The “Middle-Income Rental Program” subcategory was also suddenly eliminated from the “Middle-Income Housing” main category of planned bond spending presented to CGOBOC on July 28. MOHCD had never provided any description about how this Middle-Income Rental Program was to have been structured.

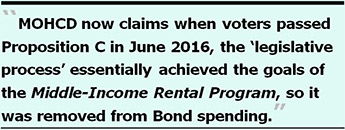

MOHCD claimed in November 2016 that in order to increase the inclusionary housing requirement for all market-rate projects, the Middle-Income Rental Program would assist in purchasing additional affordable units in market-rate projects. MOHCD now claims that when voters passed Proposition C in June 2016, the “legislative process” placing that measure on the June ballot essentially achieved the goals of the Middle-Income Rental Program, so it was removed from the Affordable Housing Bond spending. Hogwash!

MOHCD claimed in November 2016 that in order to increase the inclusionary housing requirement for all market-rate projects, the Middle-Income Rental Program would assist in purchasing additional affordable units in market-rate projects. MOHCD now claims that when voters passed Proposition C in June 2016, the “legislative process” placing that measure on the June ballot essentially achieved the goals of the Middle-Income Rental Program, so it was removed from the Affordable Housing Bond spending. Hogwash!

I’m not buying MOHCD’s explanation. I’m not convinced any legislative process actually created Middle-Income Rental Housing remedies by simply increasing the inclusionary housing requirement, since the June 2016 ballot measure is contingent on the City Controller’s on-going analyses of what threshold inclusionary housing goals (percentages) begin to adversely affect production of housing.

What MOHCD didn’t address in its explanation, is that Prop C in 2016 was tied the City Controller’s analysis of the threshold of inclusionary housing percentages and required the analysis be provided to the Board of Supervisors. Prop C explicitly allows the Board of Supervisors to adjust the inclusionary percentages without further voter approval, so there is no guarantee that the percentage increased by voters under Prop C will remain, and we might find that San Francisco is right back to square one, and still in need of a meaningful Middle-Income Rental Program funded in part by the Affordable Housing Bond. We may find that MOHCD eliminated this program without any real “goals” having actually been “achieved.”

Indeed the San Francisco Examiner reported on February 15 that the Controller’s first advisory analysis was released on February 13, 2017 and submitted to the Board. Although Supervisors were expected to debate the analysis on Valentine’s Day, that discussion was postponed to February 28. The Examiner reported Mayor Lee is concerned that affordable housing threshold requirements will “keep [private sector] investors confident.” That appears to mean anything to keep the Mayor’s development friends — and Ron Conway — happy, is a good thing.

[March 3 Update: When this article was completed and posted on-line on March 1, the Board of Supervisors agenda for February 28 did not include any agenda items regarding the Controller’s inclusionary housing analysis to discuss whether the Board will adjust the inclusionary percentages passed by voters in Prop C, nor did the agendas for other Board subcommittee meeting that week. Nor was this inclusionary housing analysis placed on the full Board’s March 7 agenda.]

It also suggests that if the inclusionary housing percentages passed by voters last June will more than likely be reduced by the Board of Supervisors, it will make the Middle-Income Rental Project in the Bond more necessary than ever, not something that should have been eliminated by MOHCD.

It also suggests that if the inclusionary housing percentages passed by voters last June will more than likely be reduced by the Board of Supervisors, it will make the Middle-Income Rental Project in the Bond more necessary than ever, not something that should have been eliminated by MOHCD.

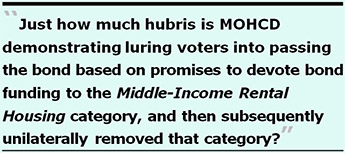

The legal text of the Affordable Housing Bond clearly stated in Section 3-E on page 156 in the November 2015 voter guide that a portion of the bond would use used to create “Middle-Income Rental Housing.”

Just how much hubris is MOHCD demonstrating luring voters into passing the bond based on promises to devote bond funding to the Middle-Income Rental Housing category, and after voters approved the Bond, subsequently unilaterally removed that category based on the flimsy excuse a legislative “fix” had later surfaced making it no longer needed?

“Metrics” to Assess Bond Performance

Back in January 2016 when CGOBOC held its first hearing on the Affordable Housing Bond, several CGOBOC members expressed the need to develop “metrics” to assess bond spending. Throughout 2016, MOHCD has stalled in developing in collaboration with CGOBCO any meaningful metrics.

MOHCD’s presentation to CGOBOC on October 3, 2016 consisted merely of MOHCD’s September 12 responses to questions CGOBOC members had raised during its July 28 meeting. The September 12 response promised that MOHCD would provide a full report at CGOBOC’s January 2017 meeting, including metrics by which CGOBOC would assess the various bond-funded affordable housing projects. But when MOHCD presented to CGOBOC on January 26, 2017 detailed metrics weren’t presented. Sadly, CGOBOC has not exhibited much of a spine in insisting MOHCD develop — and stick to — meaningful metrics to assess bond-funded projects.

MOHCD’s presentation to CGOBOC on October 3, 2016 consisted merely of MOHCD’s September 12 responses to questions CGOBOC members had raised during its July 28 meeting. The September 12 response promised that MOHCD would provide a full report at CGOBOC’s January 2017 meeting, including metrics by which CGOBOC would assess the various bond-funded affordable housing projects. But when MOHCD presented to CGOBOC on January 26, 2017 detailed metrics weren’t presented. Sadly, CGOBOC has not exhibited much of a spine in insisting MOHCD develop — and stick to — meaningful metrics to assess bond-funded projects.

In November 2016, MOHCD claimed that the “best metrics to measure the use of bond funds” are just three measures: 1) The number of households served, 2) The number of units created, and 3) Per-unit costs. MOHCD asserted the reason it hasn’t submitted metrics in a detailed format to CGOBOC yet is because the projects are still in predevelopment, and MOHCD leverages bond funds with outside financing sources that must adjust to market conditions.

MOHCD’s three skimpy metrics are completely insufficient. CGOBOC should insist on expanding the metrics to be used. It’s totally unacceptable MOHCD may seek to adjust the assessment metrics based on “market conditions,” as if situational ethics may require changing what’s being measured based on market forces. If you are measuring something, shouldn’t the measurement be irrespective of market conditions? This seems to be a cagey approach to shift the metrics to allow MOHCD off of the hook in sticking to predefined metrics.

CGOBOC members in January 2016 suggested several metrics, including the dollar amount allocated per project, the Area Median Income (AMI) targets, number of new units constructed vs. number of existing housing units preserved, household size, demographics targeted (e.g., targeted populations such as the homeless, seniors, veterans, teachers, families, etc.), and the Supervisorial districts in which projects are actually developed.

There are other important metrics that should be added, including how many market-rate vs. below-market-rate units, the square footage of additional commercial/retail and PDR (Production, Distribution, and Repair) facilities, and other community benefit amenities that are involved in each project. This is important precisely to assess whether loans made should be repaid given sufficient “residual receipts” from various kinds of rents from projects that involve a large number of market-rate units and commercial/retail tenants paying rents towards financing of the total project costs. Another important metric is the mix of units developed in each project (studios vs. one-, two-, and three-bedroom units).

There are other important metrics that should be added, including how many market-rate vs. below-market-rate units, the square footage of additional commercial/retail and PDR (Production, Distribution, and Repair) facilities, and other community benefit amenities that are involved in each project. This is important precisely to assess whether loans made should be repaid given sufficient “residual receipts” from various kinds of rents from projects that involve a large number of market-rate units and commercial/retail tenants paying rents towards financing of the total project costs. Another important metric is the mix of units developed in each project (studios vs. one-, two-, and three-bedroom units).

After all, since the Bond specially provides that one-tenth of one percent (0.1%) — fully $310,000 — of the $310 million bond is earmarked to support CGOBOC’s audit functions. It appears CGOBOC may not be earning its keep by insisting on developing metrics MOHCD should be subject to throughout progress reporting to CGOBOC.

Now fully one-and-a-half years into CGOBOC hearings on this bond, CGOBOC needs to stop pussy-footing around development of metrics it will be adopt. CGOBOC needs to adopt them now, and then not permit the metrics to be adjusted going forward based on the flimsy rationale of “market conditions.”

Change Orders

As reported in the Westside Observer’s November 2016 issue, change orders are a big problem in City politics, exposed in the San Francisco Weekly’s September 15 article “5 Corrupt Ways to Influence San Francisco Politics.”

One reason for this is public construction projects are typically awarded to the low bidder, which bids are all too often way too low. Contractors then start submitting change orders to make up the difference to generate profits.

One reason for this is public construction projects are typically awarded to the low bidder, which bids are all too often way too low. Contractors then start submitting change orders to make up the difference to generate profits.

Two glaring problems with change orders on this Affordable Housing Bond have recently surfaced.

First, in the initial draft of CBOBOC’s January 26, 2017 meeting minutes (still subject to further revision and adoption), CGOBOC’s chairman, Brian Larkin, disingenuously claimed CGOBOC has “no authority in regard to whether [or how] funds are [eventually] used as bonds approved by the citizens of the City.” That’s complete nonsense. Larkin’s blowing smoke, one indicator he’s not qualified to be CGOBOC’s chairperson.

Larkin has a background in construction management, and he’s right believing that CGOBOC shouldn’t micromanage change orders for things involving a $20 increase, for example, to the price of a toilet seat. But for larger change orders — unforeseen site conditions, design errors, design omissions, and four other change order categories — that may involve hundreds of thousands or millions of dollars, CGOBOC should be taking a very keen interest in change orders and whether bond funds are being spent as approved by voters. CGOBOC should not abandon oversight of change orders on how bond funds are actually used.

Broadly speaking, consider for example bonds approved to build specific neighborhood parks. If the Recreation and Parks Department promised to use bond funds to renovate a park at X-Y-Z location, and then did not do that, is Larkin saying CGOBOC has no authority to inquire why the X-Y-Z park location was never renovated? Alternatively, if the bond to rebuild Laguna Honda Hospital had been used to fund renovations at Sharp Park, instead, is Larkin telling us that CGOBOC has no “authority” to ask why bond funds intended for LHH may have been used on Sharp Park, instead? If so, Larkin’s slip is showing.

Broadly speaking, consider for example bonds approved to build specific neighborhood parks. If the Recreation and Parks Department promised to use bond funds to renovate a park at X-Y-Z location, and then did not do that, is Larkin saying CGOBOC has no authority to inquire why the X-Y-Z park location was never renovated? Alternatively, if the bond to rebuild Laguna Honda Hospital had been used to fund renovations at Sharp Park, instead, is Larkin telling us that CGOBOC has no “authority” to ask why bond funds intended for LHH may have been used on Sharp Park, instead? If so, Larkin’s slip is showing.

Speaking more specifically, the Affordable Housing Bond was intended — and has been repeatedly presented to CGOBOC — to fund four main categories of affordable housing: Public Housing ($80 million), Low-Income Housing ($100 million), Mission [District] Neighborhood Housing ($50 million), and Middle-Income Housing ($80 million).

Is CGOBOC’s Chair Larkin saying that if MOHCD later changes spending of the bond towards the end, and eliminates entire main categories of planned spending (for example, the $50 million set-aside for the Mission District), or reallocates portions of main categories of spending (for example, $30 million of the $80 million allocated to the Middle-Income Housing main category), that CGOBOC will have no authority over how those funds are eventually spent? This is classic misdirection, at its worst.

Second — a problem almost as ominous — MOHCD claimed in November 2016 that despite project contingencies built in, and loan documents, that contain requirements involving change orders, the Affordable Housing Bond might cap only specific projects in the “Low-Income Housing” and “Public Housing” main categories. Does that portend that change orders involving the “Mission-District Housing” and “Middle-Income Housing” main categories may not be capped when it comes to change orders? How much might that end up costing?

But more worrisome is that MOHCD asserted last November that it would have to cover any change orders on the bond-funded projects that exceed contingency values with other, non-Prop A funds at MOHCD’s disposal.

This leads us back to the same concern the Civil Grand Jury had expressed regarding loans being repaid to the Housing Authority to prevent the Housing Trust Fund (HTF) from being tapped for public housing repairs, rather than for construction of new affordable housing. If there are change orders and cost over-runs on the Housing Bond projects that are made “whole” from other MOHCD funding sources, will those potential change order cost overruns lead to even more losses in new affordable housing construction intended by the HTF? If so, this portends there will be virtually no oversight of change orders on this Affordable Housing bond.

This leads us back to the same concern the Civil Grand Jury had expressed regarding loans being repaid to the Housing Authority to prevent the Housing Trust Fund (HTF) from being tapped for public housing repairs, rather than for construction of new affordable housing. If there are change orders and cost over-runs on the Housing Bond projects that are made “whole” from other MOHCD funding sources, will those potential change order cost overruns lead to even more losses in new affordable housing construction intended by the HTF? If so, this portends there will be virtually no oversight of change orders on this Affordable Housing bond.

CGOBOC should insist on being told about the extent and cost of change orders on each of these housing bond-funded projects that may be picked up by other MOHCD funding sources, so citizens can get a handle on how much change orders on the housing bond are then robbing Peter to Pay Paul from other MOHCD funding sources.

Also of note, MOHCD presented to CGOBOC on January 26, 2017 that the housing bond includes funding for four projects, at 500 Turk Street (122 affordable housing units), 1990 Folsom (143 affordable housing units), 4840 Mission Street (114 affordable housing units), and Seawall Lot 322-1, a.k.a. 88 Broadway (200 affordable housing units). But according to the Planning Commission on February 16, none of those four projects – or the proposed senior housing project at 250 Laguna Honda Boulevard — have been heard, approved, or received permits by the Planning Department or Planning Commission at this time.

That means that to the extent any of these five planned projects fail to gain Planning approval, MOHCD may come back to CGOBOC and switch out another “change order” by substituting some other project at the last minute. Why is CGOBOC even hearing these projects, if none of them have gained Planning Commission approval?

To date, MOHCD has made sweeping changes to how the Affordable Housing Bond funds will be allocated to various projects since it first began presenting to CGOBOC, and those changes to bond spending deserve in-depth inquiry.

What’s Next?