Article in Print Printer-friendly PDF file

Article in Print Printer-friendly PDF fileWestside Observer Newspaper

June 2017 at www.WestsideObserver.com

Pitting Neighbor Against Neighbor for Affordable Housing

Sanctuary City for Housing Developers

Article in Print Printer-friendly PDF file

Article in Print Printer-friendly PDF file

Westside Observer

Newspaper

June 2017 at www.WestsideObserver.com

Pitting Neighbor Against Neighbor for Affordable Housing

Sanctuary City for Housing Developers

by Patrick Monette-Shaw

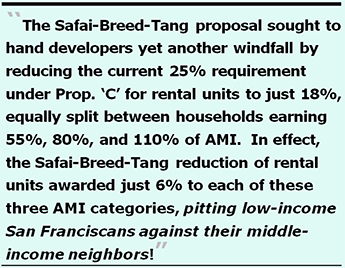

As the debate intensified over what percentage of inclusionary affordable housing must be developed, one proposal authored by Supervisors Ahsha Safai, London Breed, and Katy Tang — with Mayor Lee’s backing — proposed reducing on-site affordable rental units in construction projects building 25 or more dwellings to just 18%.

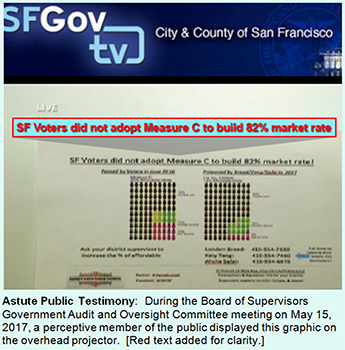

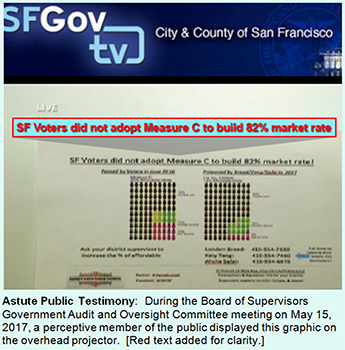

That prompted an astute member of the public to note that voters had not passed Proposition “C” in June 2016 to allow developers to build the remaining 82% of units in a rental housing project of 25 dwellings or more as market-rate rental units, leading to the slide he presented to Supervisors on May 15 during the Land Use Committee’s first hearing on the competing proposals, shown on the right, above.

Indeed, voters passed Prop. “C” in 2016 — which required a 50% + 1 affirmative vote for passage — by a whopping 67.9%. Voters spoke resoundingly that they wanted to double the then 12% on-site affordable housing units to 25%, with 15% affordable to low-income households and another 10% affordable to middle-income households. That would have still allowed housing developers to devote 75% to market-rate units!

Indeed, voters passed Prop. “C” in 2016 — which required a 50% + 1 affirmative vote for passage — by a whopping 67.9%. Voters spoke resoundingly that they wanted to double the then 12% on-site affordable housing units to 25%, with 15% affordable to low-income households and another 10% affordable to middle-income households. That would have still allowed housing developers to devote 75% to market-rate units!

The dueling proposals have been all about quibbling over whether developers will be able to devote 75% vs. 82% of new construction to market-rate housing to increase their bottom-line profits. Obviously, developers want the higher percentage — and Safai, Breed, and Tang are only too happy to oblige.

But in exchange for requiring private developers of new market-rate housing projects of 25 or more units to double affordable housing provisions to 25%, Prop. “C” was also contingent on granting authorization to the Board of Supervisors to set affordable housing requirements in a “trailing ordinance” by removing inclusionary housing requirements out of the City charter, instead of having to seek further voter approval at the ballot box.

But in exchange for requiring private developers of new market-rate housing projects of 25 or more units to double affordable housing provisions to 25%, Prop. “C” was also contingent on granting authorization to the Board of Supervisors to set affordable housing requirements in a “trailing ordinance” by removing inclusionary housing requirements out of the City charter, instead of having to seek further voter approval at the ballot box.

Skullduggery at the Board of Supervisors soon commenced, in part because the Controller’s Statement on Prop. “C” in the voter guide fretted about the potential loss in property tax revenues should developers face restrictions on how much market-rate housing they could develop. Apparently, City Controller Ben Rosenfield was more concerned about the reduction in property tax revenues that would result from lower taxes on assessed values of lower-priced units, and less concerned about developing inclusionary affordable housing units for actual people.

Rosenfield was concerned about money, not people being displaced out of town from skyrocketing housing costs. And apparently, Mayor Ed Lee also appears to be as concerned about lost tax revenue, rather than being concerned about San Franciscans seeking housing.

Rosenfield was concerned about money, not people being displaced out of town from skyrocketing housing costs. And apparently, Mayor Ed Lee also appears to be as concerned about lost tax revenue, rather than being concerned about San Franciscans seeking housing.

It’s very clear that both Lee and Rosenfield want to create a Sanctuary City for Housing Developers to help them maximize their housing project profits, in part to help the City’s property tax base.

Showdown at the OK Corral: Two Competing Housing Proposals (May 15, 2017)

Proposition “C” in 2016 was tied to a requirement that the City Controller perform an analysis of the threshold of inclusionary housing percentages that might affect production of market-rate housing, and required the analysis be provided to the Board of Supervisors. Prop. “C” explicitly allows the Board of Supervisors to adjust the inclusionary percentages using “trailing” legislation to follow without further voter approval, so there was no guarantee that the percentage increased by voters under Prop. “C” would remain.

Proposition “C” in 2016 was tied to a requirement that the City Controller perform an analysis of the threshold of inclusionary housing percentages that might affect production of market-rate housing, and required the analysis be provided to the Board of Supervisors. Prop. “C” explicitly allows the Board of Supervisors to adjust the inclusionary percentages using “trailing” legislation to follow without further voter approval, so there was no guarantee that the percentage increased by voters under Prop. “C” would remain.

As the Westside Observer reported last March in “Housing Bond Lurches Down a Cliff,” the City Controller released his first inclusionary housing advisory analysis on February 13, 2017 and submitted it to the Board of Supervisors who were expected to debate the Controller’s analysis on Valentine’s Day. But the San Francisco Examiner reported on February 15 that the Board’s discussion was postponed to February 28.

The Board of Supervisors agenda for February 28 did not include any agenda items regarding the Controller’s inclusionary housing analysis to discuss whether the Board will adjust the inclusionary percentages passed by voters in Prop. “C,” nor did the agendas for other Board subcommittee meetings that week, and the discussion wasn’t placed on the full Board of Supervisors March 7 agenda either.

The Board of Supervisors agenda for February 28 did not include any agenda items regarding the Controller’s inclusionary housing analysis to discuss whether the Board will adjust the inclusionary percentages passed by voters in Prop. “C,” nor did the agendas for other Board subcommittee meetings that week, and the discussion wasn’t placed on the full Board of Supervisors March 7 agenda either.

The Board’s discussion languished for over two months.

The Examiner article on February 15 shows that Mayor Lee is concerned that affordable housing threshold requirements will “keep [private sector] investors confident.” That appears to mean that anything to keep the Mayor’s development friends — and Ron Conway — happy, is a good thing.

The two competing proposals to revise the inclusionary housing percentages were first heard by the Board of Supervisors Land Use and Transportation subcommittee, summarized in the May 15 Legislative Digest for the Peskin-Kim version of the proposed amendments, and a separate May 15 Legislative Digest for the Safai-Breed-Tang version of the proposed amendments.

The two competing proposals to revise the inclusionary housing percentages were first heard by the Board of Supervisors Land Use and Transportation subcommittee, summarized in the May 15 Legislative Digest for the Peskin-Kim version of the proposed amendments, and a separate May 15 Legislative Digest for the Safai-Breed-Tang version of the proposed amendments.

Developers can choose between three options to meet inclusionary requirements: Paying a fee in-lieu of constructing affordable units on- or off-site, building affordable units on-site, or building affordable units off-site. Reportedly, the trend has been that developers prefer to pay the “in-lieu-of” fee to the City rather than build the affordable housing units.

Back on March 23, 2017 noted housing experts Peter Cohen and Fernando Marti, co-directors of San Francisco’s Council of Community Housing Organizations (CCHO), published an article on 48Hills.org. CCHO is widely regarded as the most influential and most thoughtful of affordable housing organizations. Their article explored the two competing inclusionary housing proposals, and corrected significant misstatements and mistakes in media reports regarding important facts about the two proposals.

The two men noted there’s a big difference between what Peskin and Kim want, versus what Safai and Breed want, and there are many nuances between the two proposals. Importantly the pair noted that it is only the Peskin-Kim proposal that expands housing opportunities for both low-income and middle-income households, and that the Safai-Breed-Tang proposal reduces one category in order to expand the other category of household incomes. That’s a form of pitting one income level against another, or pitting neighbor against San Francisco neighbor. After all, we should be expanding housing opportunities for all, without reducing anyone else’s opportunities, Cohen and Marti seem to argue.

Side-by-Side Comparison

Side-by-Side Comparison

A side-by-side comparison of the Peskin-Kim vs. Safai-Breed-Tang competing proposals as of May 15 is instructive:

For on-site housing units in construction projects of 25 housing units or more, the Peskin-Kim proposal sought to decrease the current 25% affordable requirement for rental units by 1% to 24%, keeping the current 15% rental units for low-income households, and decreasing the middle-income affordable rental units from 10% to 9%. Their proposal lowered the rental maximums in Prop. “C” from 55% of AMI for low-income renters and 100% of AMI for middle-income renters to 40% to 80% of AMI for lower-income households with average rents at 60% of AMI, and increased AMI from 80% to 120% for middle-income renters with an average rent at 100% of AMI and a maximum rent also at 100% of AMI.

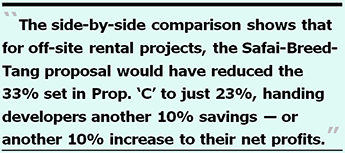

For on-site housing units in construction projects of 25 housing units or more, the Peskin-Kim proposal sought to decrease the current 25% affordable requirement for rental units by 1% to 24%, keeping the current 15% rental units for low-income households, and decreasing the middle-income affordable rental units from 10% to 9%. Their proposal lowered the rental maximums in Prop. “C” from 55% of AMI for low-income renters and 100% of AMI for middle-income renters to 40% to 80% of AMI for lower-income households with average rents at 60% of AMI, and increased AMI from 80% to 120% for middle-income renters with an average rent at 100% of AMI and a maximum rent also at 100% of AMI. The side-by-side comparison linked above shows that for off-site rental projects, the Safai-Breed-Tang proposal would have reduced the 33% set in Prop. “C” to just 23%, handing developers another 10% savings — or another 10% increase to their net profits, depending on your point of view! The reduction to 23% of affordable off-site rental units would be equally distributed between households earning 55%, 80%, and 120% of AMI, with an average of 85% of AMI.

The side-by-side comparison linked above shows that for off-site rental projects, the Safai-Breed-Tang proposal would have reduced the 33% set in Prop. “C” to just 23%, handing developers another 10% savings — or another 10% increase to their net profits, depending on your point of view! The reduction to 23% of affordable off-site rental units would be equally distributed between households earning 55%, 80%, and 120% of AMI, with an average of 85% of AMI.The May 15 competing proposals were continued to the Land Use Committee’s May 22 meeting in order to continue negotiations between the competing proposals.

After the two proposals were continued to May 22, the City’s Chief Economist released a report dated May 12 that noted:

“In every scenario, the Safai/Breed/Tang proposal, which reduces inclusionary requirements, leads to the production of more housing relative to Proposition C, and lower prices for existing housing, at the cost of reducing the number of affordable units, and the value of subsidy generated they generate. Under the Safai/Breed/Tang proposal, the gain to market-rate housing consumers is greater than the loss of affordable housing subsidy.” [emphasis added]

There you have it from the City’s Chief Economist: An admission that the Safai-Breed-Tang proposal reduces the inclusionary requirements, and thereby reduces the number of affordable units.

There you have it from the City’s Chief Economist: An admission that the Safai-Breed-Tang proposal reduces the inclusionary requirements, and thereby reduces the number of affordable units.

This is remarkable, in part because the June 2016 voter guide contained a paid argument in support of Prop. “C” submitted jointly by Supervisor London Breed and former District 10 Supervisor Sophie Maxwell titled “African American Leaders Support Prop C” to provide affordable housing “opportunities.”

Readers may recall that Ms. Breed ran for re-election in November 2016 and only narrowly beat her opponent, Dean Preston, by just 1,784 votes (a 4.3% spread between them). Might it be that Breed supported Prop. “C” in June 2016 as part of her re-election strategy, but five months later changed her tune about affordable housing for African Americans when she joined Supervisor Safai in gutting the number of affordable housing units in May 2017?

“Sanctuary” for Developers to Maximize Profits

48Hills.org reported May 14 on the median household income in San Francisco by ethnicity and also the median household income by San Francisco neighborhood, and astutely reported that “The residents of the ten neighborhoods with the lowest median income earned only 33 percent of the money that the residents of the ten highest-income areas took home.” The 48Hills article also included a quote by Jennifer Fieber of the SF Tenants Union she testified about during a recent hearing:

“Tenants who live in below-market-rate units have to report their income every year ‘and pay the maximum amount they can afford.’ On the other hand, developers who get city favors don’t have to disclose anything: ‘When they [developers] say it doesn’t pencil out, we just believe them’.”

Why doesn’t the City develop regulations that require developers to report their per-project profits?

That 48Hills article also noted that:

That 48Hills article also noted that:

“If the Safai-Breed bill goes through, it would undermine those neighborhood and community-level talks [with developers to increase inclusionary percentages in particular development projects] and allow developers to continue making, in the words of [Supervisor] Peskin, ‘a shit-ton of money’ without paying their share to the community.”

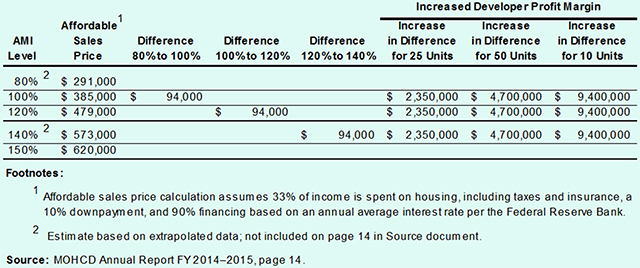

The Mayor’s Office of Housing and Community Development (MOHCD) FY 2014–2015 annual report included an unnumbered table comparing AMI income levels to affordable housing sales prices.

Table 1: Increased Developer Profit Margins

As Table 1 above illustrates, for each 20% increase in AMI levels, developers stand to earn an additional $94,000 in profits on each unit sold. That’s a lot of incentive for developers seeking sanctuary to market housing units to higher income households by increasing the AMI thresholds. This illustrates the significance of all of the lucrative windfalls the Safai-Breed-Tang proposal would hand to developers by way of fiddling ,with and increasing, various AMI thresholds.

As Table 1 above illustrates, for each 20% increase in AMI levels, developers stand to earn an additional $94,000 in profits on each unit sold. That’s a lot of incentive for developers seeking sanctuary to market housing units to higher income households by increasing the AMI thresholds. This illustrates the significance of all of the lucrative windfalls the Safai-Breed-Tang proposal would hand to developers by way of fiddling ,with and increasing, various AMI thresholds.

When asked on May 17 for an update to the current sales price data by AMI level — which MOHCD conveniently excluded from its FY 2015–2016 Annual Report — MOHCD lamely claimed it does not maintain this data, despite having reported similar data in FY 2014–2015.

Yet another 48Hills.org article — The shape of the housing battle to come — on March 16, 2017 reported that the Safai-Breed proposal pits the middle class against lower-income people. The article reported:

“What Safai and Breed did not say is that they are proposing to reduce the amount of affordable housing available to people who make less than around $50,000.”

And the article further reported that Ken Tray, the political director at the teacher’s union United Educators of San Francisco, said his union doesn’t support the Safai-Breed proposal:

“We are all in this together. We refuse to have teachers pitted against our lower-income brothers and sisters. There is no moral foundation that will pit classroom teachers against our low-income students and their families.”

And finally, the article reported that Gen Fujioka, policy director at the Chinatown Community Development Center, “noted that the Safai-Breed plan ‘is a step backward. It shrinks the amount of affordable housing’.”

And finally, the article reported that Gen Fujioka, policy director at the Chinatown Community Development Center, “noted that the Safai-Breed plan ‘is a step backward. It shrinks the amount of affordable housing’.”

That’s ironic, because the initial inclusionary housing legislation was designed by then-Supervisor Mark Leno back in 2002 to increase, not shrink, the amount of affordable housing built. Is that concept lost on Safai and Breed?

Commendably, the Coalition for San Francisco Neighborhoods (CSFN) submitted testimony dated April 6 to the Board of Supervisors and to the Planning Commission regarding the battle over the two competing inclusionary housing percentages proposals. CSFN’s testimony was intended for the Commission’s April 28 meeting.

CSFN’s testimony noted the Safai-Breed-Tang proposal places more emphasis on middle-income housing, but would result in the displacement of equally-worthy low- and lower-income households who have greater needs than middle-income households. CSFN noted such a major policy change would pit low- and lower-income San Franciscans against San Franciscans with higher incomes, and suggested this policy change should not be undertaken without a more comprehensive review and without a vote of the electorate.

Among other issues CSFN raised, they were also concerned about “ceilings” and “floors” associated with the ranges of AMI levels, such that households with incomes below the “floors” (the bottom end of the AMI ranges) are squeezed out of qualifying for the affordable units.

Among other issues CSFN raised, they were also concerned about “ceilings” and “floors” associated with the ranges of AMI levels, such that households with incomes below the “floors” (the bottom end of the AMI ranges) are squeezed out of qualifying for the affordable units.

Another 48Hills.org article — Safai-Breed housing bill: A $60 million giveaway — on April 26, 2017 reported:

“Developers in San Francisco could stand to pick up an additional $60 million in profits under an affordable housing proposal by Sups. London Breed and Ahsha Safai, a new analysis shows.”

48Hills went on to discuss that the new study was authored by CCHO co-directors Peter Cohen and Fernando Marti.

48Hills went on to discuss that the new study was authored by CCHO co-directors Peter Cohen and Fernando Marti.

The CCHO analysis showed that for a hypothetical construction project of 100 rental housing units, with just 18% of the units deemed affordable, developer’s annual income would be approximately $1 million more. Multiplied by the 3,000 units the City wants to build each year, CCHO concludes developers would be earning $30 million more in profits. But that’s only for rental projects.

CCHO noted incomes from ownership condo projects is even more stark. Increasing the threshold from 96% to 120% of AMI and given average sales prices, developers profits would increase by $2 million. The article reports that by adding things up, developers “could walk away with as much as $60 million in additional profit.”

CCHO’s analysis supports the data presented in Table 1 above. And as one person who posted a comment on-line to 48Hills’ analysis by CCHO wrote:

“Not only is the Breed/Safai legislation terribly misguided in its failure to address the full blown affordable housing crisis that is destabilizing San Francisco, but it actually takes from the neediest and gives to developers. … The Breed/Safai legislation undercuts Prop C and pits middle and low income folks against one another.” [emphasis added]

As well, the San Francisco Examiner carried an article on April 27 by Larry Bush, the co-founder of the group Friends of Ethics, who noted that should the Planning Commission decide to recommend lowering the percentage for inclusionary housing requirements, it would lead to less affordable housing being developed:

“At stake is the amount of housing developers will have to set aside that is affordable … A decision to make this a lower percent would mean more profits for developers and less housing for San Franciscans who live on a paycheck.”

The next day, the San Francisco Examiner carried an article on April 28 by Michael Barba that reported the Planning Commission had recommended the day before that the rental housing proposal by Safai and Breed increase the set-aside for low-income households to 12% from the 6% in the Safai-Breed proposal. The article quoted Supervisor Peskin:

“ ‘This is not a technical change, this is a sweeping piece of public policy about how you divide up the affordable housing pie,’ Peskin said. ‘I appreciate their [Planning’s] recommendations but they’re just that. They’re just recommendations’.” [emphasis added]

Despit e the Planning Commission’s recommendation to increase the rental amounts for low-income households to 12%, Safai and Breed appear to have ignored those recommendations — as just recommendations as Peskin had noted — and the Safai-Breed proposal that advanced to the Board of Supervisors stubbornly clung to cutting low-income rental units to just 6% not only to Supervisor Breed’s constituents in District 5, but low-income African American residents citywide.

Recent Housing Production Performance in San Francisco

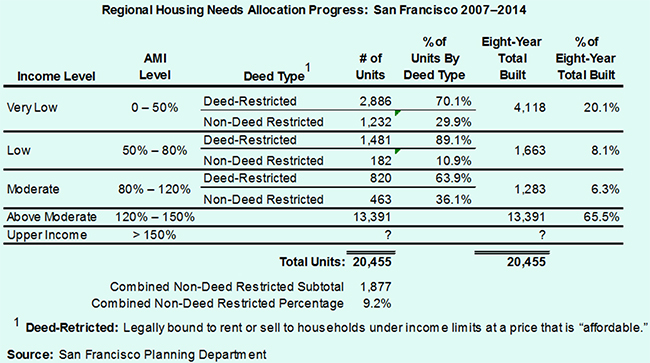

The Regional Housing Needs Assessment (RHNA) process is a state mandate regarding planning for housing in California, which requires that all jurisdictions in the state update the Housing Elements of their General Plans. In the Bay Area, it is the Association of Bay Area Governments (ABAG) that sets the City of San Francisco’s RHNA goals.

The Regional Housing Needs Assessment (RHNA) process is a state mandate regarding planning for housing in California, which requires that all jurisdictions in the state update the Housing Elements of their General Plans. In the Bay Area, it is the Association of Bay Area Governments (ABAG) that sets the City of San Francisco’s RHNA goals.

The two primary goals of the RHNA process are to: 1) Increase the supply of housing, and 2) Ensure that local governments consider the housing needs of persons at all income levels.

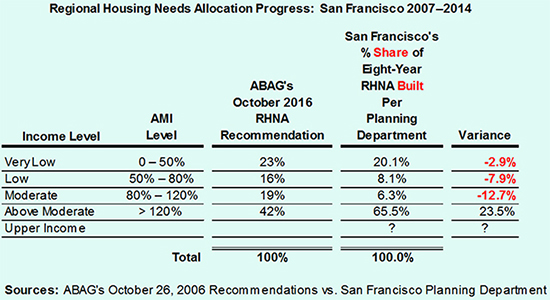

ABAG’s recommendations issued October 26, 2006 for the 2007–2014 period recommended the allocation of housing goals by income categories of housing needs for San Francisco:

Table 2: ABAG Recommendations vs. Actual Housing Built: San Francisco 2007–2014

Table 2 shows that it’s clear San Francisco ended up building housing far differently than what had ABAG recommended in 2006 that the City build. For the “Low-Income” category, San Francisco built just half (8.1%) of the 16% ABAG had recommended, built just one-third (6.3%) of the 19% ABAG had recommended be dedicated to “Moderate-Income” households, and built a staggering 23.5% more than ABAG had recommended for construction of “Above Moderate-Income” households.

Table 2 shows that it’s clear San Francisco ended up building housing far differently than what had ABAG recommended in 2006 that the City build. For the “Low-Income” category, San Francisco built just half (8.1%) of the 16% ABAG had recommended, built just one-third (6.3%) of the 19% ABAG had recommended be dedicated to “Moderate-Income” households, and built a staggering 23.5% more than ABAG had recommended for construction of “Above Moderate-Income” households.

But the share of housing built versus ABG’s recommended share of housing that should have been built in Table 2 above is somewhat deceptive.

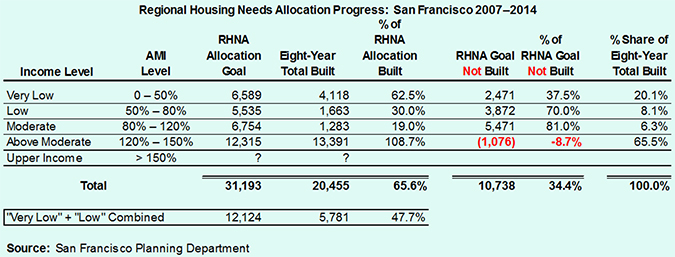

An alternative RHNA report provided by San Francisco’s Planning Department for the eight-year period between 2007 and 2014 illustrates disturbing information: Table 3 below shows San Francisco built 108.7% of the RHNA Allocation Goal for “Above-Moderate” households, built 62.5% of the goal for “Very-Low Income” households, built just 30% of the allocation goal for “Low-Income” households, and built only 19% of the goal for “Moderate-Income” households.

Table 3: Regional Housing Needs Allocation Progress: San Francisco 2007–2014

Of note, MOHCD’s FY 2014–2015 Annual Report tried to downplay the amount of housing developed between 2007–2014 by income level, since MOHCD creatively combined “Very Low” and “Low” income levels into a single category it creatively called “Low Income” (everything below 80% of AMI), asserting that of the housing built 47.7% of the allocation goal had been met for low-income households. That’s obviously not all true.

Of note, MOHCD’s FY 2014–2015 Annual Report tried to downplay the amount of housing developed between 2007–2014 by income level, since MOHCD creatively combined “Very Low” and “Low” income levels into a single category it creatively called “Low Income” (everything below 80% of AMI), asserting that of the housing built 47.7% of the allocation goal had been met for low-income households. That’s obviously not all true.

First, just 30% of the RHNA goal for “Low-Income” households had been met, and 62.5% of the RHNA allocation goal was met for “Very-Low Income” households, which admittedly pencils out to a combined average of 47.7%. Again, it’s notable that only 30% of the “Low-Income” goal had actually been met, while just 19% of the “Moderate Income” goal was reached, and a staggering 108.7% of the goal for “Above Moderate” income households was met.

Second, of the 20,455 housing units that were actually built, just 28.2% were built for the two low-income categories, while only 6.3% of the units built were for “Moderate Income” households, and the remaining 65.5% of units built were for “Above Moderate” income households. Unfortunately, the RHNA reports from the Planning Department do not document what proportion of the “Above Moderate” housing goals or actual housing constructed actually went to “Upper Income” households earning more than 150% of AMI, further driving up developer profit margins.

It is thought that the “Upper Income” category is probably all market-rate housing units, and perhaps a good chunk of the “Above Moderate” units may also be market-rate units.

It is thought that the “Upper Income” category is probably all market-rate housing units, and perhaps a good chunk of the “Above Moderate” units may also be market-rate units.

Then there’s the issue of the RHNA goals that were not met in the eight-year period between 2007 and 2014. Fully 10,738, or 34.4%, of units were not built of the RHNA target goals. Table 3 also shows that 81% of the “Moderate-Income,” 70% of the “Low Income,” and 37.5% of the “Very-Low Income” RHNA goals were not built.

Why aren’t those unmet goals rolled over and added onto the subsequent eight-year reporting period for 2015–2022? Or does ABAG simply “forgive” the municipality for not having built those units, and everyone simply forgets that the RHNA goals weren’t met?

Why aren’t those unmet goals rolled over and added onto the subsequent eight-year reporting period for 2015–2022? Or does ABAG simply “forgive” the municipality for not having built those units, and everyone simply forgets that the RHNA goals weren’t met?

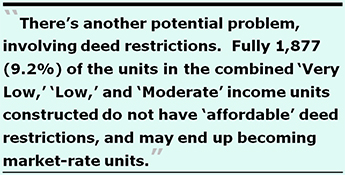

Table 4 below highlights another potential problem, involving deed restrictions. Fully 1,877 (9.2%) of the units in the combined “Very Low,” “Low,” and “Moderate” income units constructed do not have “affordable income limit” deed restrictions. That portends that years from now (or evensooner), those units that do not have deed restrictions to maintain them as affordable units may face rent increases and may end up becoming market-rate units.

So we may end up being right back in the same situation as the problem with “expiring regulations preservation” where previously  affordable units are lost to conversion to market-rate units at the end of 25- to 30-year legal contracts, called “covenants,” or other expiring deed restrictions. It is notyet known how many of the deed-restricted units do have the typical 55-year deeds or covenants that may also eventually expire, and faceconversion to market-rate units.

affordable units are lost to conversion to market-rate units at the end of 25- to 30-year legal contracts, called “covenants,” or other expiring deed restrictions. It is notyet known how many of the deed-restricted units do have the typical 55-year deeds or covenants that may also eventually expire, and faceconversion to market-rate units.

Table 4: Regional Housing Needs Allocation Progress: San Francisco 2007–2014

Deed-restricted units are legally bound to rent or sell to households under income limits at a price to guarantee affordability of those units for a minimum time period, usually 55 years.

Deed-restricted units are legally bound to rent or sell to households under income limits at a price to guarantee affordability of those units for a minimum time period, usually 55 years.

Notably, neither the “Above Moderate” nor the “Upper Income” income units face deed restrictions to set sales prices that are “affordable.” They aren’t guaranteed to be affordable. It’s clear developers are looking for the sky’s-the-limit at setting market-rate sales prices!

And predictably, data provided by the Planning Department ofRHNA planning goals for the eight-year period between 2015 and 2022 shows the same disturbing trends as in the 2007–2014 RHNA allocation, despite the fact that we are just two years in to new the eight-year cycle. Of the 12,536 RHNA 2015–2022 goal for “Above Moderate-Income” households, 6,592 (55.5% of the eight-year goal) have already been built  within the first two years of the eight-year period. We are again on track for excessive production of “Above Moderate Income” housing, just as we were for 2007–2014!

within the first two years of the eight-year period. We are again on track for excessive production of “Above Moderate Income” housing, just as we were for 2007–2014!

The Sudden “Deal” Struck for Inclusionary Housing (Two Days Later on May 17, 2017)

The dueling proposals for Inclusionary Housing amendments between Supervisors Peskin and Kim vs. Supervisors Safai, Breed, and Tang purportedly reached a “deal” on Wednesday, May 17 that was reported in the San Francisco Examiner on Friday, May 19.

Unfortunately, the actual “compromise” legislation was not posted to the Board of Supervisors web site in advance of its Land Use Committee hearing on Monday May 22. Lacking both a Legislative Analysis and the actual compromise legislation itself, there was no way to confirm or analyze details of the proposed “deal” prior to the deadline to submit this article for publication in the Westside Observer.

Unfortunately, the actual “compromise” legislation was not posted to the Board of Supervisors web site in advance of its Land Use Committee hearing on Monday May 22. Lacking both a Legislative Analysis and the actual compromise legislation itself, there was no way to confirm or analyze details of the proposed “deal” prior to the deadline to submit this article for publication in the Westside Observer.

In brief, the Examiner reported that the “deal” hashed out would require that “developers of large rental projects with at least 25 units who choose to build affordable housing on-site would be required to designate 18% of units as affordable,” and that number would grow to 19% in 2018 and then gradually grow an additional 5% to 24% by 2027.

Great! We’ll only have to wait for another decade to get back up to the 24% of affordable on-site units that the Peskin-Kim proposal had proposed. That’s another decade in which developers will be making another shit-load of profits!

Great! We’ll only have to wait for another decade to get back up to the 24% of affordable on-site units that the Peskin-Kim proposal had proposed. That’s another decade in which developers will be making another shit-load of profits!

The Examiner’s article noted that the agreement “deal” reached would decrease the percentage of affordable housing that developers must build on-site under Prop. “C”, “except for in the two neighborhoods most impacted by the housing crisis until further study.” The Examiner didn’t indicate which two neighborhoods might be exempted from the “deal.”

The Examiner also reported that the rental amounts initially proposed by Safai-Breed-Tang would be changed from a 6% split to each AMI category, into three tiers of rentals:

One reasonable question is: How much affordable housing will be lost during the 10-year period that it takes to move the dial back up to 24% for rental housing in 2027?

One reasonable question is: How much affordable housing will be lost during the 10-year period that it takes to move the dial back up to 24% for rental housing in 2027?

The Examiner reported no details about sales (ownership) units, or how the “deal” may have reached compromises on ownership units.

On a thud, the Examiner concluded its reporting saying that the revised “proposal is expected to reach the Land Use and Transportation Committee on Monday [May 22] and the full Board of Supervisors for a vote Tuesday [on May 23].”

Land Use and Transportation Committee Hearing (May 22, 2017)

Notably, the legal language of the compromise amendments to the inclusionary housing ordinance was not placed on the Board of Supervisors web site for members of the public to examine 72 hours in advance of the Land Use hearing on May 22 in order to adequately understand and prepare testimony regarding the proposed new “deal.”

Notably, the legal language of the compromise amendments to the inclusionary housing ordinance was not placed on the Board of Supervisors web site for members of the public to examine 72 hours in advance of the Land Use hearing on May 22 in order to adequately understand and prepare testimony regarding the proposed new “deal.”

One City Hall staffer wrongfully opined that “substantive amendments to a properly agendized item can be proposed for the first time [during a] committee [hearing], and public comment may be taken thereupon at that time. The Committee may then take action upon the agendized item.”

That’s complete nonsense, and ignored that way back in 2011 the San Francisco Sunshine Ordinance Task Force had ruled that the previous Land Use and Economic Development Committee had failed to provide substantive amendments to the Park Merced development agreement and had committed official misconduct for having failed to provide those amendments to members of the public before the amendments were considered in Committee.

As reported in the July 2012 Westside Observer article “Who Killed Sunshine?”:

“On September 27, 2011 the Sunshine Task Force heard a complaint from Parkmerced resident Pastor Lynn Gavin that Board of Supervisors President David Chiu and the board’s Land Use and Economic Development Committee — composed by Supervisors Eric Mar, Malia Cohen, and Scott Wiener — had violated local and state open-meeting laws by sneaking in 14 pages of amendments to the Parkmerced development deal only minutes before approving it. Pastor Gavin asserted the amendments were so drastic that the Board’s agenda didn’t accurately reflect the real deal under consideration, and that voting to approve it without sufficient time for review by members of the public violated open-meeting laws. The Sunshine Task Force ruled in Gavin’s favor, finding Wiener and the other three supervisors had committed official misconduct, and referred the four Supervisors to the Ethics Commission for enforcement.”

Someone at City Hall must have gotten through to the Chairperson of the Land Use Committee, Supervisor Mark Farrell, who continued the two competing inclusionary housing proposals now combined into a single proposal to the Land Use Committee’s June 5 meeting. At least now members of the public will have time to see a single consolidated version of the combined “deal,” and there will be time to post both a Legislative Analysis and the final legislation to the Board of Supervisors web site prior to June 5.

Someone at City Hall must have gotten through to the Chairperson of the Land Use Committee, Supervisor Mark Farrell, who continued the two competing inclusionary housing proposals now combined into a single proposal to the Land Use Committee’s June 5 meeting. At least now members of the public will have time to see a single consolidated version of the combined “deal,” and there will be time to post both a Legislative Analysis and the final legislation to the Board of Supervisors web site prior to June 5.

After all, Farrell admitted during the May 22 hearing that there have been “massive changes” and the Inclusionary Ordinance may now be 40 pages long, none of which had been made public prior to the May 22 hearing.

Several people who provided oral public comment on May 22 noted that the inclusionary housing legislation that we’ve had for the past 15 years would become all but moot, given the HOME-SF legislation proposed by Supervisor Katy Tang and the Mayor that they are ramming through the Board of Supervisors, since housing developers will likely opt to use the less stringent HOME-SF formulas for density bonuses rather than complying with the Inclusionary Housing Ordinance, because developers will apparently be able to choose which Ordinance they will follow. And those HOME-SF units may only end up being 700 square feet in size (or smaller), hardly conducive to family housing.

CSFN president George Wooding’s article in the May 2017 Westside Observer — “Tang’s Radical Housing Proposal” — was right on target with his warnings that Supervisor Tang’s HOME-SF proposal is toxic, since it pits middle-income households against lower-income households!

CSFN president George Wooding’s article in the May 2017 Westside Observer — “Tang’s Radical Housing Proposal” — was right on target with his warnings that Supervisor Tang’s HOME-SF proposal is toxic, since it pits middle-income households against lower-income households!

Peter Cohen, co-director of CCHO, testified on May 22, in part:

“We are concerned that we have a separate inclusionary [affordable housing] ordinance that is not consistent with that [HOME-SF]. So we do ask that these two mirror each other. If ‘inclusionary’ [goals] is not embedded in HOME-SF, at least they should mirror each other.”

Cohen and others who testified similarly during the May 22 hearing are correct that the HOME-SF and Inclusionary Housing ordinances should “mirror” each other regarding affordable housing requirements. Otherwise, developers will choose the more lucrative HOME-SF affordable housing requirements rather than the inclusionary requirements.

Cohen and others who testified similarly during the May 22 hearing are correct that the HOME-SF and Inclusionary Housing ordinances should “mirror” each other regarding affordable housing requirements. Otherwise, developers will choose the more lucrative HOME-SF affordable housing requirements rather than the inclusionary requirements.

Granting “Sanctuary” to Developers

Are we granting developers “sanctuary” from building affordable housing? And are we granting them sanctuary permission to reap as many profits as they can eke out over the next ten years?

The public speaker on May 15 who asserted voters had not given permission at the ballot box to hand over 82% of all new housing construction to developers seeking to build more and more market-rate housing was absolutely prescient. Then there’s the concern of pitting San Franciscans of different income levels against one another.

The public speaker on May 15 who asserted voters had not given permission at the ballot box to hand over 82% of all new housing construction to developers seeking to build more and more market-rate housing was absolutely prescient. Then there’s the concern of pitting San Franciscans of different income levels against one another.

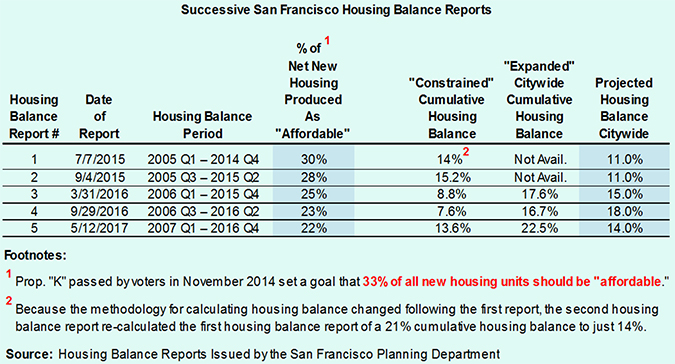

There’s a final clue about development of affordable housing from the Housing Balance Reports that Supervisor Jane Kim managed to require be provided from the Planning Department. Table 5 below paints a disturbing vision:

Table 5: Production of “Affordable” Units Over a Ten-Year “Rolling” Basis

In 2015, Supervisor Jane Kim sponsored legislation requiring the Planning Department to provide housing balance reports every six months, on a “rolling” ten-year basis under City Ordinance 53-15, involving a look-back every six months to the then previous ten years.

In 2015, Supervisor Jane Kim sponsored legislation requiring the Planning Department to provide housing balance reports every six months, on a “rolling” ten-year basis under City Ordinance 53-15, involving a look-back every six months to the then previous ten years.

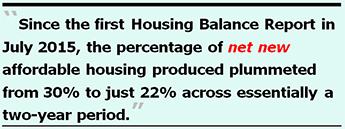

Since the first Housing Balance Report in July 2015, the percentage of net new affordable housing produced has plummeted from 30% to just 22% across essentially a two-year period, suggesting that as the ten-year rolling periods continue to roll along the number of net new affordable units may continue plummeting even more. After all, once an eight-year “price-point” has plummeted, it will take awhile to turn around any increase (should that happen at all).

“2 + 2 = 5”

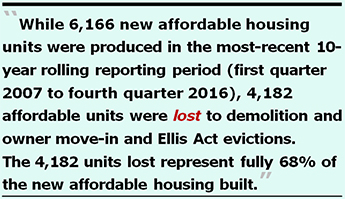

In addition to the 8% nose-dive in net new affordable housing being built, Housing Balance Report #5 shows the principal reason the cumulative housing balance stands at just 13.6% shown in Table 5 above, is that while 6,166 new affordable housing units were produced in the most-recent 10-year rolling reporting period (first quarter 2007 to fourth quarter 2016), 4,182 affordable units were lost to demolition and owner move-in and Ellis Act evictions during the same period.

The 4,182 units lost represent fully 68% of the new affordable housing built, in effect reducing the net new housing units built to just 1,984 units (an Orwellian and ironic number of 1984 that may have given George Orwell a good laugh).

The 4,182 units lost represent fully 68% of the new affordable housing built, in effect reducing the net new housing units built to just 1,984 units (an Orwellian and ironic number of 1984 that may have given George Orwell a good laugh).

The double-speak coming out of Mayor Ed Lee’s “Ministry of Truth” — Lee’s January 2014 State of the City speech in which he pledged to construct or rehabilitate at least 30,000 homes by the year 2020, claiming 50% of the housing would be affordable for middle-class households, and at least 33% would be affordable for low- and moderate-income households — apparently forgot to consider that lost housing might severely erode net new affordable housing gains. Perhaps Mayor Lee bought into the Orwellian propaganda that “2 + 2 = 5,” while the “projected housing balance” citywide still stands at just 14%.

Here we are now just three years away from the Mayor’s 2020 timeline, and we’re still getting double-speak from him regarding affordable housing.

Just after competing writing this article and while posting it on-line, 48Hills.org published another article on May 29 that also comments on the erasure of new housing built due to the lost housing. The article is titled “SF is losing affordable housing almost as fast as we can build it.”

Just after competing writing this article and while posting it on-line, 48Hills.org published another article on May 29 that also comments on the erasure of new housing built due to the lost housing. The article is titled “SF is losing affordable housing almost as fast as we can build it.”

The decline in net new “affordable” housing produced suggests that if net housing — including market-rate housing — has increased during the same ten-year rolling period, developers have been, and will continue to be, rolling in nice profits under their Sanctuary deals, even while net new affordable housing has plummeted.

It’s clear that when developers are left to their own devices, they have little interest in developing new affordable housing and prefer to pay the in-lieu fee rather than building new affordable housing.

It appears the Board of Supervisors may have caved in to the Safai-Breed-Tang deal, and the “consensus” deal reached will hand developers their 82% Sanctuary license to build more and more market-rate housing, at least for the majority of the next decade through 2027. Take that to the “anti-gentrification” bank. Let’s see if it trickles down.

It appears the Board of Supervisors may have caved in to the Safai-Breed-Tang deal, and the “consensus” deal reached will hand developers their 82% Sanctuary license to build more and more market-rate housing, at least for the majority of the next decade through 2027. Take that to the “anti-gentrification” bank. Let’s see if it trickles down.

We’ll have to see, when Land Use takes up this issue again on June 5.

Do we want to be a “Sanctuary City for Developers” to maximize their profits? Or do we want to be a Sanctuary City for all San Franciscans seeking affordable housing, without pitting neighbor against neighbor?

Contact the Board of Supervisors and urge them to increase inclusionary affordable housing requires now, and not wait until 2027 to do so.

Monette-Shaw does not presume to speak as a public policy or housing subject-matter expert. But as a reporter, he does have First Amendment opinions on this housing debate.

He’s a columnist for San Francisco’s Westside Observer newspaper, and a member of the California First Amendment Coalition (FAC) and the ACLU. Contact him at monette-shaw@westsideobserver.com.