by Patrick Monette-Shaw

by Patrick Monette-ShawArticle in Press Printer-friendly PDF file

Westside Observer

Newspaper

November 2017 at www.WestsideObserver.com

Will Brian Stansbury Thwart City Attorney Dennis Herrera?

City Sues, But Continues Investing in, Big Oil

by Patrick Monette-Shaw

by Patrick Monette-Shaw

Oh, the irony being handed to Exxon’s lawyers: While City Attorney Dennis Herrera is suing five Big Oil companies over global warming effects causing sea level rise in San Francisco, San Francisco’s Employees’ Retirement System (SFERS) continues to invest in fossil fuel holdings.

What a field day Exxon’s lawyers couldmake over this disconnect!

What role doesSFERS’ Board president Brian Stansbury play in this?

City Attorney Sues “Big Oil”

According to a press release issued by John Coté in the San Francisco’s City Attorney’s Office on September 20:

“San Francisco City Attorney Dennis Herrera and Oakland City Attorney Barbara J. Parker announced today that they had filed separate lawsuits on behalf of their respective cities against the five largest investor-owned producers of fossil fuels in the world.”

San Francisco City Attorney Dennis Herrera’s lawsuit filed on September 19 (separate from a lawsuit  filed by Oakland) names five “Big Oil” corporations as respondents — including BP (formerly British Petroleum), Chevron Corporation, ConocoPhillips Corporation (Conoco), Exxon Mobil Corporation, and Royal Dutch Shell PLC, and up to 10 unnamed “John Does.”

filed by Oakland) names five “Big Oil” corporations as respondents — including BP (formerly British Petroleum), Chevron Corporation, ConocoPhillips Corporation (Conoco), Exxon Mobil Corporation, and Royal Dutch Shell PLC, and up to 10 unnamed “John Does.”

Herrera’s lawsuit involves a “Complaint for Public Nuisance.”

Essentially, Herrera’s lawsuit alleges that global warming-induced sea level rise is here, and is now causing harm in San Francisco with increased flooding that must be abated by building out sea level walls and other abatement measures, at great cost.

Herrera’s lawsuit alleges the named defendants are the five-largest investor-owned fossil fuel corporations in the world, measured by their historic production of fossil fuels. Herrera’s lawsuit alleges it will cost billions of dollars to build sea walls and other infrastructure in San Francisco to protect human safety, along with public and private property, from global warming-induced sea level rise.

Herrera’s lawsuit alleges the named defendants are the five-largest investor-owned fossil fuel corporations in the world, measured by their historic production of fossil fuels. Herrera’s lawsuit alleges it will cost billions of dollars to build sea walls and other infrastructure in San Francisco to protect human safety, along with public and private property, from global warming-induced sea level rise.

Herrera alleges the defendants did not just simply produce fossil fuels. Herrera asserts defendants engaged in sophisticated public relations campaigns to promote fossil fuel usage and to portray fossil fuels as environmentally responsible and “essential” to human well-being. Herrera further alleges that the defendant’s portrayal of fossil fuels entailed downplaying mainstream climate science or downplaying global warming risks.

Herrera’s lawsuit does not seek to impose liability on the defendants, but rather seeks a court order requiring the defendants to abate the global warming-induced seal level rise by funding an abatement program to build sea walls and other infrastructure needed to protect human safety and public and private property in San Francisco. The lawsuit specifically notes that the case involves shifting the abatement costs back onto the companies named that had caused or contributed to the “public nuisance” of sea level rise harm.

Herrera’s lawsuit does not seek to impose liability on the defendants, but rather seeks a court order requiring the defendants to abate the global warming-induced seal level rise by funding an abatement program to build sea walls and other infrastructure needed to protect human safety and public and private property in San Francisco. The lawsuit specifically notes that the case involves shifting the abatement costs back onto the companies named that had caused or contributed to the “public nuisance” of sea level rise harm.

That implies public municipalities should not have to bear abatement costs alone, without assistance from the very companies that had contributed to causing the problem in the first place!

While San Francisco Burns, SFERS’ Trustees Fiddle

Although Herrera asserts defendants engaged in sophisticated public relations campaigns to promote fossil fuel usage and to portray fossil fuels as environmentally responsible and “essential” to human well-being, it appears that SFERS Board of Trustees have been towing the line for the fossil fuel companies SFERS invests in, and the Trustees are all but ignoring the human suffering those investments are likely to cause. Reasonable observers wonder whether SFERS’ Trustees and SFERS staff members are also downplaying mainstream climate science and downplaying global warming risks simply to avoid divesting from fossil fuel investments that are clearly detrimental to San Franciscans, and hoping SFERS will increase ROI on these highly-toxic investments.

Although Herrera asserts defendants engaged in sophisticated public relations campaigns to promote fossil fuel usage and to portray fossil fuels as environmentally responsible and “essential” to human well-being, it appears that SFERS Board of Trustees have been towing the line for the fossil fuel companies SFERS invests in, and the Trustees are all but ignoring the human suffering those investments are likely to cause. Reasonable observers wonder whether SFERS’ Trustees and SFERS staff members are also downplaying mainstream climate science and downplaying global warming risks simply to avoid divesting from fossil fuel investments that are clearly detrimental to San Franciscans, and hoping SFERS will increase ROI on these highly-toxic investments.

While the adage that Nero fiddled while Rome burned is more metaphor than fact, reasonable people have to wonder whether SFERS’ Board of Trustees is fiddling, while the City Attorney sues Big Fossil Fuel companies over San Francisco’s burning global warming crisis.

SFERS Delay Since 2013

SFERS Delay Since 2013

On April 23, 2013 San Francisco’s 11-member Board of Supervisors unanimously passed Resolution 126-13 urging SFERS to fully divest from its publicly-traded fossil fuel investments, to do so within five years, and immediately cease any new investments in fossil fuel companies or commingled assets that include holdings in fossil fuel companies.

Here we are four-and-a-half-years later — months away from the Board of Supervisors five-year goal to fully divest — and SFERS hasn’t divested from its fossil fuel investments. Instead SFERS continued investing in more. SFERS’ February 11 meeting minutes state the Board approved a $100 million investment in Kerogen Energy Fund II, LP during closed session on December 10, 2014.

Trustee Stansbury’ Opposition

Trustee Stansbury’ Opposition

SFERS Trustee Brian Stansbury has long opposed divestment from SFERS’ fossil fuel investments. He’s voted “No” against divestment at least three times, if not more.

During SFERS October 9, 2013 Board meeting a motion was introduced to direct SFERS’ staff to implement Levels I and Level II (shareholder engagement) under the Board’s Social Investment Policy. The meeting minutes show that Stansbury voted “No” against the motion.

Minutes of SFERS’ February 19, 2014 meeting report that Stansbury noted “there is an increasing demand for fossil fuels,” and indicated that while he was prepared to support Level I engagement, he was not prepared to support Level II or Level III (full divestment).

At SFERS March 11, 2015 Board meeting, the Board was considering an action item to move from Level I to Level II (shareholder engagement) of Carbon Tracker 200 Companies. The March 2015 meeting minutes report that Commissioner “Stansbury noted that the Board is engaged in some level of active engagement through its existing proxy policies and practices under Level I.”

During discussion of a March 2015 motion introduced by then-Trustee Herb Meiberger that was seconded by Trustee Wendy Paskin-Jordan to adopt Level II engagement of fossil fuel companies under SFERS’ Social Investment Policies and Procedures regarding fossil fuel investments and to take steps to create and establish an ESG (Environmental, Social and Governance) sub-committee of SFERS Board — a pension fund industry “best practice” — Trustee Stansbury stated his intent to oppose the motion presented due to insufficient data on whether the Level I proxy voting engagement then in place was being successful.

[Editor’s Note: Although SFERS’ ESG committee was created in March 2015, by July 2017 SFERS’ Trustees approved merging its ESG Committee with its Investment Committee, the latter of which is a “Committee of the Whole.”]

[Editor’s Note: Although SFERS’ ESG committee was created in March 2015, by July 2017 SFERS’ Trustees approved merging its ESG Committee with its Investment Committee, the latter of which is a “Committee of the Whole.”]

When the roll call vote was taken to move from Level I to Level II, Stansbury voted against the motion, which passed on a 6–to–1 vote. The March 2015 SFERS Board meeting obviously wasn’t the only time Trustee Stansbury has voted against fossil-fuel actions taken by SFERS’ Board.

A month later, during its April 8, 2015 meeting, SFERS Board considered an agenda item to consider having SFERS Staff conduct due diligence on Ex-Fossil Fuel Index Funds, and consider investing up to $100 million in one or more such index funds.

Remarkably, the audio recording of SFERS’ April 2015 meeting report Stansbury expressed concerns that developing countries should not be restricted from accessing inexpensive energy sources, and that he was opposed to denying other countries from being able to access cheap energy, such as coal. A transcript extract of Stansbury’s comments show that just before the Ex-Fossil Fuels Index Fund vote was taken, Stansbury waxed on and on, saying in part:

Remarkably, the audio recording of SFERS’ April 2015 meeting report Stansbury expressed concerns that developing countries should not be restricted from accessing inexpensive energy sources, and that he was opposed to denying other countries from being able to access cheap energy, such as coal. A transcript extract of Stansbury’s comments show that just before the Ex-Fossil Fuels Index Fund vote was taken, Stansbury waxed on and on, saying in part:

“You have a population in this world and they have energy needs, both here and in developing countries, and non-developing countries. And I think there have been some really compelling stories about how developing countries have a lot more basic energy needs than we do. And if, for example, we were — by divesting fossil fuels — we somehow would affect the supply of fossil fuels you would be hurting developing countries, say in Africa, that have real energy concerns. They have problems with access to energy and developing countries need basic energy: Coal, oil, other fossil fuels. …

So, the question is, what is the cost to extract that oil, and on the margin, every time peak oil increases, what is the cost to extract that? Fracking, etc. I mean, is the cost to extract that, is it greater than the cost of having it deployed to, say, developing countries?”

Unbelievable! It’s as if clueless Stansbury has never heard of the environmental damage from fracking-induced earthquakes caused by the oil and gas industries in places such as Oklahoma. Does Stansbury mean that the costs of damage caused by fracking-induced earthquakes in Oklahoma and other parts of the central and eastern areas of the U.S. need to be bounced off and factored in to the benefits of providing cheap, “basic” energy such as coal to developing countries and Africa? Is he trying to help Donald Trump make America great again by reviving the dying coal industry to help out developing countries?

Unbelievable! It’s as if clueless Stansbury has never heard of the environmental damage from fracking-induced earthquakes caused by the oil and gas industries in places such as Oklahoma. Does Stansbury mean that the costs of damage caused by fracking-induced earthquakes in Oklahoma and other parts of the central and eastern areas of the U.S. need to be bounced off and factored in to the benefits of providing cheap, “basic” energy such as coal to developing countries and Africa? Is he trying to help Donald Trump make America great again by reviving the dying coal industry to help out developing countries?

Some observers — including this author — were shocked by the callousness Stansbury displayed suggesting that developing countries should not be denied the harmful effects of global warming, caused in part from fossil fuels. As if since the U.S. has endured the adverse health effects caused by dirty fuels and coal, we shouldn’t deprive developing countries from the same adverse health effects, or as if developing countries who need basic energy sources should be spared the climate-change carnage that City Attorney Dennis Herrera is now suing Big Oil over.

In December 2015, SFERS’ Board held a hearing as a result of passage of California Senate Bill 185 restricting CalPERS and CalSTRS from investments in companies having a 50% threshold in revenue from coal mining.

In December 2015, SFERS’ Board held a hearing as a result of passage of California Senate Bill 185 restricting CalPERS and CalSTRS from investments in companies having a 50% threshold in revenue from coal mining.

The audio recording of SFERS December 2015 meeting shows Trustee Stansbury had noted that the “inflection” point regarding thermal coal was October 8, 2015 when SB 185 was passed by the State. Regarding SFERS’ thermal coal public equity investments value between October and December 2015, Stansbury asked:

“All of these coal companies, their stock prices have gone down, some as much as 40%. So why would we want to sell now? If we were going to do something, it should have been before this law [SB 185] was enacted. The inflection point was October 8, so why are we looking into this two months later?”

Stansbury should have asked why SFERS had not done so two years earlier, when the Board of Supervisors had SFERS to do so in 2013.

The audio recording of SFERS December 2015 meeting also shows that Brett Fleishman, of Fossil Free SF, testified about the under-performance of SFERS coal company investments. Fleishman testified:

“For the last five years coal companies in your portfolio have wildly underperformed. BPH Billiton has lost 61% of its value in the last five years, Rio Tinto 55%, Vale 90% of its value in the last five years, Black Hills Corp. 21% in the last year, Consul Energy 85% in the last five years, Glencore 84%, and Alpha Natural Resources filed for bankruptcy in August [2015]. This is an industry in structural decline. And these investments are a drag on [SFERS] portfolio [and return on investment].”

Fleishman was referring to the five-year period coal company investments had been a drag on SFERS’ portfolio dating from at least December 2011 to December 2015.

Stansbury appears to have overlooked that the investment losses since the October 8 “inflection point,” and the massive five-year period of losses Mr. Fleishman had described, making it clear Stansbury was ignoring his fiduciary duties to protect the Retirement Fund from massive losses that were not in the best financial interest of beneficiaries of the Fund.

Stansbury appears to have overlooked that the investment losses since the October 8 “inflection point,” and the massive five-year period of losses Mr. Fleishman had described, making it clear Stansbury was ignoring his fiduciary duties to protect the Retirement Fund from massive losses that were not in the best financial interest of beneficiaries of the Fund.

The December 2015 meeting minutes reported:

“Commissioner Stansbury noted that the SFERS Board’s ESG Committee has not yet reviewed this [divestment] issue. He recommended that the Committee evaluate the proposal and develop a broader strategy that takes into account the general outlook for coal, when will it be replaced, cost per kilowatt [hour], how much does it contribute to global warming, and what is currently happening with coal stock prices.”

Later during the meeting, the meeting minutes noted:

“Commissioner Stansbury recommended that the matter [motion on the floor to divest] be tabled and referred to [SFERS] ESG Committee.”

There was extensive discussion on December 9 stipulating that any plan to divest from thermal coal or fossil fuels needed to recommend which fossil fuel investments to divest, tied to a specific plan on how to reinvest an equal dollar amount in renewable energy investments.

There was extensive discussion on December 9 stipulating that any plan to divest from thermal coal or fossil fuels needed to recommend which fossil fuel investments to divest, tied to a specific plan on how to reinvest an equal dollar amount in renewable energy investments.

SFERS’ December 9, 2015 meeting minutes report that when a motion was introduced by SFERS Trustee Victor Makras, which was seconded by SFERS Trustee Malia Cohen to prudently divest only from thermal coal investments held and to consider investment in renewables instead, SFERS Trustee Brian Stansbury was again the only “No” vote against divestment from SFERS thermal coal holdings on another 6–to–1 vote.

Also of interest, SFERS’ December 9, 2015 meeting minutes also reported that “Larry Barsetti, speaking on behalf of the Veteran Police Officers Association (VPOA), spoke in support of the motion to divest from fossil fuel investments, but urged caution to maximize investment returns to the [Retirement] fund.”

Barsetti, on Behalf of VPOA, Threatens Lawsuit

Fast forward to 2017. The full Board of Supervisors passed a second Resolution on September 12, 2017 again urging SFERS to fully divest from its fossil fuel holdings. Two days later, Mr. Barsetti sent a letter on behalf of the VPOA dated September 14 to the Board of Supervisors with a copy to Mayor Ed Lee, threatening that the VPOA is fully prepared to “certainly bring a [law] suit against any politician or political body at the slightest hint of a violation of the” [California Constitution prohibiting “tampering” with pension systems under the California Pension Protection Act of 1992].

Fast forward to 2017. The full Board of Supervisors passed a second Resolution on September 12, 2017 again urging SFERS to fully divest from its fossil fuel holdings. Two days later, Mr. Barsetti sent a letter on behalf of the VPOA dated September 14 to the Board of Supervisors with a copy to Mayor Ed Lee, threatening that the VPOA is fully prepared to “certainly bring a [law] suit against any politician or political body at the slightest hint of a violation of the” [California Constitution prohibiting “tampering” with pension systems under the California Pension Protection Act of 1992].

Barsetti’s letter went on to note that “[SFERS Board of Trustees] must be able to exercise their fiduciary duty to the members [beneficiaries] of the [Retirement System] without interference from the Mayor, the Board of Supervisors or any other political body …” Barsetti alleged that SFERS’ “Board has the ability to determine which investments, or class of investments, are best suited to provide required investment income.”

Barsetti’s letter went on to note that “[SFERS Board of Trustees] must be able to exercise their fiduciary duty to the members [beneficiaries] of the [Retirement System] without interference from the Mayor, the Board of Supervisors or any other political body …” Barsetti alleged that SFERS’ “Board has the ability to determine which investments, or class of investments, are best suited to provide required investment income.”

It seems crystal clear that the VPOA has not analyzed SFERS’ fossil fuel investment losses, and that those investments are not generating investment income (gains), they’re generating investment losses — and are, therefore, ill-suited, not best-suited! Maybe the VPOA is too busy to have noticed income isn’t being generated. How the VPOA can assert that fossil fuel investment losses are somehow well suited to provide required investment income was not addressed. The VPOA needs to study the investment losses presented in fuller detail, below.

The VPOA’s letter appears to paint with a broad brushstroke that the California Pension Protection Act of 1992 prohibits elected municipal officials from “tampering” with pension systems. The VPOA appears to have missed that a reasonable person’s reading of the legislative intent of the 1992 Act change to the State Constitution was to prevent elected officials from raiding pension funds. The 1992 Act specifically provided that Article XVII, Public Finance, Section 17(g) of the State Constitution be amended to read:

The VPOA’s letter appears to paint with a broad brushstroke that the California Pension Protection Act of 1992 prohibits elected municipal officials from “tampering” with pension systems. The VPOA appears to have missed that a reasonable person’s reading of the legislative intent of the 1992 Act change to the State Constitution was to prevent elected officials from raiding pension funds. The 1992 Act specifically provided that Article XVII, Public Finance, Section 17(g) of the State Constitution be amended to read:

“Section 17(g): The Legislature may by statute continue to prohibit certain investments by a retirement board where it is in the public interest to do so, and provided that the prohibition satisfies the standards of fiduciary care and loyalty required of a retirement board pursuant to this section.”

Presumably, if the State Legislature may by statute prohibit certain types of investments by a retirement board when it is in the public interest to do so, it stands to reason that prohibiting investments that are not in the public interest — such as contributing to climate change, which is in nobody’s interest — may also extend to the elected legislative members of a municipal Board of Supervisors, particularly since San Francisco is a Charter City and County.

Presumably, if the State Legislature may by statute prohibit certain types of investments by a retirement board when it is in the public interest to do so, it stands to reason that prohibiting investments that are not in the public interest — such as contributing to climate change, which is in nobody’s interest — may also extend to the elected legislative members of a municipal Board of Supervisors, particularly since San Francisco is a Charter City and County.

Can Barsetti or the VPOA say with a straight face that it is not in the public interest to halt fossil fuel-induced climate change by prohibiting certain such investments at the municipal legislative level? Clearly, it is in the public interest to halt fossil fuel-induced climate change.

Perhaps the myopic VPOA, via Barsetti, missed that key “public interest” provision. Observers wonder whether SFERS’ Trustee Al Casciato was whispering sweet nothings into Barsetti’s ears.

Baby Step of Coal Restrictions

Baby Step of Coal Restrictions

SFERS’ ESG Committee met just four times following December 2015: On January 6, February 10, and September 14 in 2016, and again on April 19, 2017. It’s unclear just when the ESG committee submitted an implementation plan to SFERS full Board to divest from SFERS’ thermal coal companies, but it is thought that may have happened during the ESG Committee’s April 19, 2017 meeting.

[Editor’s Note: As noted above, in July 2017 SFERS Trustees approved eliminating its ESG committee by rolling it into its Investment Committee.]

It took from December 2015 until May 17, 2017 (a year-and-a-half) before SFERS full Board heard any investment restrictions on thermal coal companies and an implementation plan to do so. SFERS Board was presented with a Staff recommendation on May 17, 2017noting it involved approximately $48.1 million in thermal coal investments.

The Staff memo recommended placing Level III investment restrictions against just nine companies deriving significant revenues from thermal coal mining involving approximately $21 million in investments. It recommended placing nine other companies under Level II (shareholder engagement), ostensibly valued at $27 million in investments. It took fully four years to move just nine thermal coal investments to Level III, after the Board of Supervisors urged SFERS in 2013 to fully divest from all fossil fuel investments.

It’s not clear whether external investment managers were told on May 17 to begin “prudent” divestment from the nine companies moved to Level III, or whether SFERS has actually divested since then from those nine companies. It’s also not clear whether prudent full divestment processes takes considerably longer, whether SFERS may still hold investments in those nine Level III companies, or how long full divestment typically takes.

It’s not clear whether external investment managers were told on May 17 to begin “prudent” divestment from the nine companies moved to Level III, or whether SFERS has actually divested since then from those nine companies. It’s also not clear whether prudent full divestment processes takes considerably longer, whether SFERS may still hold investments in those nine Level III companies, or how long full divestment typically takes.

Sadly, of the nine companies moved to Level III on May 17, 2017 three of them had already filed for bankruptcy long before: Alpha Natural Resources (filed for bankruptcy in August 2015), Arch Coal (January 2016), and Peabody Energy (April 2016, after a sharp drop in coal prices left Peabody unable to service $10.1 billion of its debt).

How could Trustee Stansbury not have known in December 2015 that Alpha Natural Resources had filed for bankruptcy four months earlier in August 2015? Had Stansbury actually known that, reasonable people believe he had a fiduciary duty to have voted for, not against, divestment from thermal coal companies. Is that nonfeasance, or malfeasance, on Stansbury’s part?

Of note, all three of the companies that filed for bankruptcy had funded climate change deniers’ campaigns, in cahoots with Koch Industries — the coal, oil, and gas conglomerate owned by the Koch brothers — just as had the five fossil fuel companies City Attorney Dennis Herrera is now suing also funded climate change deniers and “fake news” climate-change-denier “research.”

Of note, all three of the companies that filed for bankruptcy had funded climate change deniers’ campaigns, in cahoots with Koch Industries — the coal, oil, and gas conglomerate owned by the Koch brothers — just as had the five fossil fuel companies City Attorney Dennis Herrera is now suing also funded climate change deniers and “fake news” climate-change-denier “research.”

Several glaring questions include: If these three companies had declared bankruptcy as early as August 2015, why did it take SFERS Board until May 2017 to place the three companies on Level III investment restrictions? Is that Board nonfeasance, not just Stansbury’s? Had SFERS Staff not noted before April 2016 that all three companies had filed for bankruptcy, had SFERS Staff failed to notify SFERS’ Trustees of the three bankruptcies, and shouldn’t the three bankruptcies have caused SFERS to divest from those thermal coal investments long before May 2017? How can SFERS’ Trustees possibly justify the ongoing investment losses due to their inaction to divest? Aren’t the Trustees supposed to maximize ROI to the Pension Fund, by ditching investment losses?

Also of note, when SFERS placed the nine thermal coal companies on Level III restrictions on May 17, 2017 there was absolutely no discussion about any “plans” to re-allocate an equal amount of those investments into renewable energy investments, suggesting that despite all of the sturm und drang in December 2015 about tying fossil fuel divestment to a plan to reinvest the same amount of funds into renewable energy, when push came to shove in May , all of the sturm und drang bleating went right out the window!

Also of note, when SFERS placed the nine thermal coal companies on Level III restrictions on May 17, 2017 there was absolutely no discussion about any “plans” to re-allocate an equal amount of those investments into renewable energy investments, suggesting that despite all of the sturm und drang in December 2015 about tying fossil fuel divestment to a plan to reinvest the same amount of funds into renewable energy, when push came to shove in May , all of the sturm und drang bleating went right out the window!

SFERS May 17, 2017 meeting minutes report that SFERS Trustee Al Casciato asked whether “ownership” of investments in the 18 thermal coal and fossil fuel companies being moved to Level II or Level III had benefited the Pension Plan. Cagily, Bob Shaw, SFERS Managing Director of Public Equity Markets answered Casciato, noting “coal firms have not been additive to the [pension fund] portfolio in the last few years.”

It would have been more accurate had Shaw stated the inverse: For the past seven years dating back to 2011, SFERS’ coal firm investments have been “subtractive” to the pension fund’s ROI. That would have far more precisely framed the investment losses.

And rather than saying “in the last few years,” as the minutes reported, Shaw should have been more precise quantifying the number of years. Shaw could have used the October 8, 2015 “inflection point” of coal losses of concern to Trustee Stansbury. Alternatively, Shaw had to have known that Brett Fleishman had testified in December 2015 that coal company investments had been a drag on SFERS’ portfolio a five-year period between December 2011 and December 2015.

Shaw — paid $218,327 annually as recently as June 30, 2017 — must have known this for at least the past seven years, and doing due diligence Shaw should have brought the on-going losses to the attention of SFERS Board of Trustees long before May 2017.

To his credit, Trustee Stansbury finally came to his senses, and on the roll-call vote to adopt the May 2017 Level III motion to place restrictions on the thermal coal investments, Stansbury voted along with the other Trustees in unanimously passing the motion to implement Level III.

To his credit, Trustee Stansbury finally came to his senses, and on the roll-call vote to adopt the May 2017 Level III motion to place restrictions on the thermal coal investments, Stansbury voted along with the other Trustees in unanimously passing the motion to implement Level III.

But wait, there’s more: It’s not just on-going losses from SFERS thermal coal investments. SFERS’ entire fossil fuel portfolio isn’t maximizing investment returns. It’s as if SFERS’ Trustees have been playing the “let’s-wait-and-see” game for at least four years before taking any action to divest anything.

Other Fossil Fuel Investment Losses

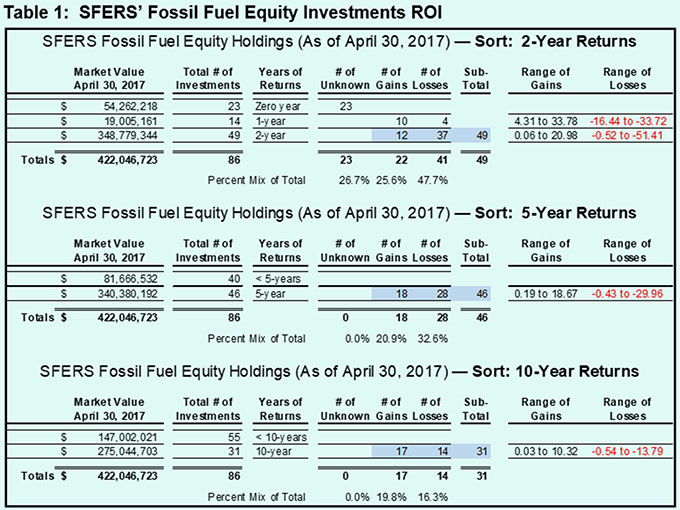

Also during SFERS’ Board meeting on May 17, 2017 the meeting minutes report that Trustee Victor Makras introduced a second motion regarding full divestment from all of SFERS’ fossil fuel public equity and fixed income holdings — not just it’s thermal coal holdings. Makras noted that on a two-year return basis there had been just 12 fossil fuel investments with gains, and 37 that had involved losses on the investments, shown in Table 1.

Between public equity holdings, fixed income holdings, and private-market equity holdings, that totals $474 million in fossil fuel investments that also appear to be losing massive returns on investments.

Between public equity holdings, fixed income holdings, and private-market equity holdings, that totals $474 million in fossil fuel investments that also appear to be losing massive returns on investments.

Makras’ second May 17 motion hasn’t been calendared yet for SFERS consideration, and has languished for over six months since then. His second motion may be heard during SFERS’ December meeting.

On September 13, the San Francisco Examiner reported that the day before on September 12 Supervisor Aaron Peskin had called on the Retirement Board of Directors to divest from SFERS’ fossil fuels at SFERS’ October 11 meeting. But there were no agenda items on SFERS October 11 agenda to do any such thing. Why not?

The Examiner’s story reported that on a five-year return basis, only 18 of the 86 fossil fuel investments were winners, and 28 of the 86 were losers. The Chronicle reported on September 12 that Commissioner Makras testified to the Board of Supervisors Government Audit and Oversight Committee on September 6 that he had put forth his motion to divest from fossil fuels on May 17 “because the returns were dismal.”

The Chronicle’s September 12 article also quoted Executive Director Jay Huish as having said the fossil fuel investments had “performed better over a 10- to 15-year window.”

The Chronicle’s September 12 article also quoted Executive Director Jay Huish as having said the fossil fuel investments had “performed better over a 10- to 15-year window.”

However, data provided by SFERS shows its 86 fossil fuel equity holdings over a 10-year period as of April 30, 2017 remain dismal, with just 17 (19.8%) showing gains, and 14 (16.3%) showing losses. [SFERS detailed list of Public Equity fossil fuel investments by investment name, and 1-, 2-, 3-, 5-, and 10-years returns that Table 1 is based on, is available here.]

Of note, of the two-year losses, the range of losses reached a negative 51.41%; of the five-year losses, the range of losses reached a negative 29.96%; and the 10-year losses reached a negative 13.79%, while the gains in the two-year, five-year, and 10-period windows only reached positive gains 20.98%, 18.67%, and just 10.32%, respectively.

Of note, of the two-year losses, the range of losses reached a negative 51.41%; of the five-year losses, the range of losses reached a negative 29.96%; and the 10-year losses reached a negative 13.79%, while the gains in the two-year, five-year, and 10-period windows only reached positive gains 20.98%, 18.67%, and just 10.32%, respectively.

Additional oddities include:

Are SFERS' Trustees Asleep at the Wheel?

The Chronicle appears to have incorrectly claimed in its September 12 article that SFERS “does not publicly disclose detailed information about what companies the fund has invested in, or how well those stocks have performed,” since data presented in this article were provided by SFERS through public records requests.

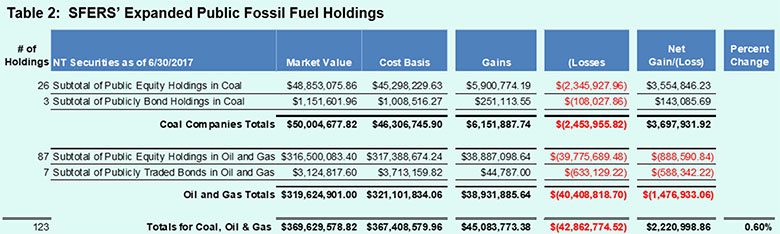

SFERS eventually provided two files in Microsoft Excel format, which were used as the data reported in this secondary analysis. The first file was used to create Table 1 above. The second file SFERS provided data on the gains and losses as of June 30, 2017 for its CU200 holdings. The data worsens, as shown in Table 2.

SFERS eventually provided two files in Microsoft Excel format, which were used as the data reported in this secondary analysis. The first file was used to create Table 1 above. The second file SFERS provided data on the gains and losses as of June 30, 2017 for its CU200 holdings. The data worsens, as shown in Table 2.

Sadly, between the cost basis and market value SFERS’ oil and gas investments totaled a net loss of $1.5 million in value as of June 30, 2017, with $40.4 million in losses outstripping $38.9 million in gains. Total investments in coal, oil, and gas combined had a net increase of just 0.60%, a meager — or “dismal,” as Trustee Makras put it — $2.2 million gain on initial costs of $367.4 million.

This cannot be considered as earning the best ROI for the overall Retirement Fund.

This cannot be considered as earning the best ROI for the overall Retirement Fund.

On August 17, I placed a records request to SFERS, including asking for:

“The projected returns SFERS anticipates earning on each holding for the next three years, stratified by each company’s investment and the projected earnings in each of the three separate years.”

SFERS’ response for documents and data on anticipated earnings indicated that SFERS “found no records responsive to this request.” How can SFERS’ Staff not provide to its Board of Trustees projected earnings on given investments?

On September 14, I placed a follow-up records request to SFERS seeking the 86 Fossil Fuel Equity holdings as of June 30, 2017 in the same format that SFERS had previously provided me with as of April 30 summarized in Table 1, but SFERS then creatively claimed:

“The information you requested is not a report produced on a routine basis by SFERS, and therefore we have no documents responsive to your request.”

Shouldn’t this be a standard, recurring report prepared and presented to SFERS’ Trustees on a routine basis? As fiduciaries to the Pension Fund, how can the Trustees perform their required due diligence in the absence of SFERS’ staff routinely providing the Trustees with this data?

Shouldn’t this be a standard, recurring report prepared and presented to SFERS’ Trustees on a routine basis? As fiduciaries to the Pension Fund, how can the Trustees perform their required due diligence in the absence of SFERS’ staff routinely providing the Trustees with this data?

The returns on these fossil fuel investments remain dismal, as Trustee Makras had rightfully asserted.

August 16, 2017 San Francisco Examiner columnist Robyn Purchia noted that while SFERS clings to its fossil fuel investments, it suffered a $120 million loss in just three months in 2017:

“From March 31 to June 30 [2017], the total market value of the pension’s fossil fuel equities fell from $442 million to $322 million. … But the dramatic $120 million drop in three months raises an important question: Are these investments helping the pension [fund]?”

Purchia’s reporting follows testimony about further fossil fuel investment losses previously provided to SFERS. The audio of SFERS’ April 8, 2015 meeting notes 350.org’s Jed Holtzman testified:

“Brett Fleishman pointed out at your last meeting that in 2014 between losses to your fossil fuel investments and lost opportunity costs from gains to Index funds that you could have invested in instead, we have $104 to $161 million in 2014 that the [Retirement] Fund lost, [from] material losses investing in fossil fuels.”

So, between Purchia noting a loss of $120 million during just three months in 2017, add in up to a $161 million loss since 2014 that Fleishman had identified, for a combined potential loss of $281 million, and that’s not including further potential losses in 2015 and 2016, or even earlier, or after April 2017.

So, between Purchia noting a loss of $120 million during just three months in 2017, add in up to a $161 million loss since 2014 that Fleishman had identified, for a combined potential loss of $281 million, and that’s not including further potential losses in 2015 and 2016, or even earlier, or after April 2017.

Weren’t Stansbury and the VPOA paying attention to these losses? Were there more losses that Stansbury and Barsetti may have ignored? Oddly, minutes of the Retirement Board may shed further light on this.

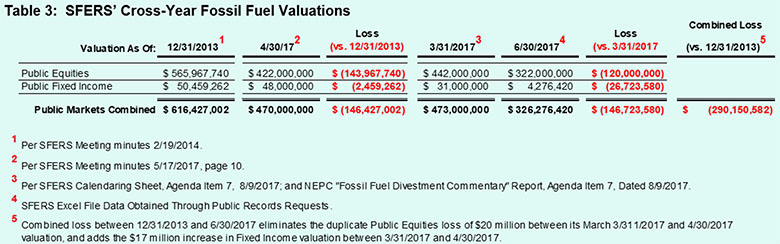

SFERS’ minutes of its October 9, 2013 meeting indicated SFERS’ total fossil fuel public market assets totaled $532 million. SFERS’ minutes of its February 19, 2014 minutes indicated its fossil fuel public market combined assets totaled $616.4 million, as of December 31, 2013. But SFERS Trustee Victor Makras noted in May 2017 that public equity holdings, fixed income holdings, and private-market equity holdings totaled $474 million in fossil fuel investments. How could the $616.4 million in public market fossil fuel assets as of December 2013 have dropped to just $470 million three years and four months later in April 2017 (excluding the $4 million in private-market fossil fuel equity holdings Makras had added in)?

It’s clear from the limited records SFERS has released shown in Table 3, the pension fund has lost at least $290.1 million in its fossil fuel investments, if not the $281 million in losses noted above, or even more. How can Stansbury and SFERS’ Board of Trustees not understand this?

It’s clear from the limited records SFERS has released shown in Table 3, the pension fund has lost at least $290.1 million in its fossil fuel investments, if not the $281 million in losses noted above, or even more. How can Stansbury and SFERS’ Board of Trustees not understand this?

Aren’t SFERS’ Trustees tracking these losses? Or are they just engaging in “willful blindness”?

Of interest, Table 3 also illustrates SFERS’ fossil fuel investments have been highly volatile. As Ms. Purchia noted in the Examiner, during the three-month period between March 31 and June 30, 2017SFERS lost $120 million in fossil fuel Public  Equities investments. Table 3 also shows that in the two-month period between April 30 and June 30, 2017 SFERS lost another $43.7 million in its fossil fuel Fixed Income investments. A staggering $163.7 million in Fixed Income and Public Equity combined losses across just a three-month period is clearly worrisome, and nothing to sneeze at.

Equities investments. Table 3 also shows that in the two-month period between April 30 and June 30, 2017 SFERS lost another $43.7 million in its fossil fuel Fixed Income investments. A staggering $163.7 million in Fixed Income and Public Equity combined losses across just a three-month period is clearly worrisome, and nothing to sneeze at.

Is this even more evidence that Stansbury and Barsetti are clearly ignoring fossil fuel investments are not contributing to SFERS’ “additive” ROI, they are contributing to “subtractive” ROI?

Are SFERS’ Trustees Violating California’s Constitution?

Are SFERS’ Trustees Violating California’s Constitution?

SFERS’ Board received a presentation about duties as fiduciaries during its November 8 meeting. Under Article XVI, Section 17 of California’s Constitution, retirement board Trustees have at least three “Duties.” The Constitution provides that retirement boards shall have a:

It’s clear that SFERS’ $290.1 million losses in fossil fuel investments may be increasing the amount of employer (and employee) contributions — paid for by taxpayers — not minimizing the employer contributions from taxpayers or minimizing the employee share of contributions.

The Duty of Loyalty means SFERS’ Trustees have a duty to act in the best interest of city employees and city retirees — from police and firefighters, to nurses, doctors, secretaries, janitors, and social workers from all walks of life — whose funds the Trustees manage. Obviously, the ongoing $290.1 million loss in fossil fuel investments is not acting in the best interests of current and former city employees.

Reasonable people and employees wonder whether the four-member “public safety” contingent of SFERS’ Board of Trustees — Brian Stansbury, Al Casciato, Joe Driscoll, and Wendy Paskin-Jordan (wife and potential beneficiary of retired Chief of Police Frank Jordan) — are exercising Trustee loyalty to first-responder police officers and firefighters, and watching the public safety members’ backs. How can the Trustees lose nearly $300 million from fossil fuel investments, and tell their members they’re being “loyal”?

Reasonable people and employees wonder whether the four-member “public safety” contingent of SFERS’ Board of Trustees — Brian Stansbury, Al Casciato, Joe Driscoll, and Wendy Paskin-Jordan (wife and potential beneficiary of retired Chief of Police Frank Jordan) — are exercising Trustee loyalty to first-responder police officers and firefighters, and watching the public safety members’ backs. How can the Trustees lose nearly $300 million from fossil fuel investments, and tell their members they’re being “loyal”?

It’s also clear SFERS’ $290.1 million losses in fossil fuel investments have not been prudent, and illustrate the Trustees are not exercising this duty carefully by performing duty-bound due diligence at the Trustee level, and the Trustees have not required SFERS Staff to perform staff-level due diligence, either — since Staff appear not to have notified the Board of Trustees in a timely manner about the three bankruptcies of fossil companies the pension fund was investing in.

It’s also clear SFERS’ $290.1 million losses in fossil fuel investments have not minimized losses or maximized returns on investments. Surely there are other public and fixed income opportunities SFERS could invest in to diversify its portfolio to minimize further losses from fossil fuels. By not investigating other diversification strategies, the Trustees are violating both its duty to diversify, and its duty of loyalty to plan participants, which is supposed to take precedence.

SFERS Trustees have a fiduciary responsibility to divest its fossil fuel investments precisely because they are not generating ROI to protect retirees’ pensions. Instead, SFERS’s Trustees appear to be contributing both to global warming and at the same time ignoring its investment losses.

SFERS Trustees have a fiduciary responsibility to divest its fossil fuel investments precisely because they are not generating ROI to protect retirees’ pensions. Instead, SFERS’s Trustees appear to be contributing both to global warming and at the same time ignoring its investment losses.

What part of this problem are VPOA, Larry Barsetti, and SFERS Trustee Stansbury not understanding? A $120 million loss over just three months in 2017, or a $290.1 million combined loss between 2013 and 2017, cannot be “helping” the pension fund.

Given the advent of socially-responsible investing, it’s time to stop debating whether Trustees of pension funds have a positive fiduciary duty requiring them to take ESG issues into account on their investments. ESG (Environmental, Social and Governance) criteria are standards that socially conscious investors use to screen and evaluate investments. Environmental criteria consider how investors are performing as stewards of the natural environment.

Clearly, SFERS investments in fossil fuels are contributing to global warming — at issue in Mr. Herrera’s lawsuit — suggesting that SFERS’ Trustees are failing miserably as stewards of the environment. It’s probably time California’s constitution be amended to require that pension fund Trustees also have a duty to consider ESG factors in investments.

And it’s long past time SFERS’ Trustees stop splitting hairs over “shareholder engagement” of its fossil fuel investments.

Potential Trustee Nonfeasance: Due to Staff’ Failure to “Book” Losses?

Word has it that the reason SFERS’ Staff don’t want to divest from its fossil holdings is that they would have to “bank” or “book” the already existing fossil fuel investment losses, and one reason they don’t want to have to book those losses is because it would smirch their resumes as having managed portfolio’s that involved investments losing substantial sums of pensioner’s money! Better to hide the losses by keeping them on the books, rather than sully their lily-white resumes.

Word has it that the reason SFERS’ Staff don’t want to divest from its fossil holdings is that they would have to “bank” or “book” the already existing fossil fuel investment losses, and one reason they don’t want to have to book those losses is because it would smirch their resumes as having managed portfolio’s that involved investments losing substantial sums of pensioner’s money! Better to hide the losses by keeping them on the books, rather than sully their lily-white resumes.

Another potential reason for not booking the losses is that it might affect whether a Staff member might be able to apply for future employment opportunities with investment companies that specialize in fossil fuel investments.

If SFERS’ Board doesn’t fully divest from the losers Trustee Makris identified on May 17, SFERS’ Trustees will be failing its fiduciary duty to minimize these risks from even further investment losses.

The SFERS Staff recommendation to reject Commissioner Makras’ May 17 motion for full divestment claims doing so would “exacerbate the potential losses from divestment.” SFERS’ consultant, NEPC, and SFERS staff appeared to be saying on May 17 that the two-year and five-year return losses would be “exacerbated” by completely divesting from them. Does that mean — reading between the lines — that adding more losses on top of existing losses will just exacerbate the losses, not solve it? Why is not “exacerbating” a loss somehow preferable to getting rid of the underlying loss? Is this some sort of new math that only Stansbury, the VPOA, and Barsetti could love?

The SFERS Staff recommendation to reject Commissioner Makras’ May 17 motion for full divestment claims doing so would “exacerbate the potential losses from divestment.” SFERS’ consultant, NEPC, and SFERS staff appeared to be saying on May 17 that the two-year and five-year return losses would be “exacerbated” by completely divesting from them. Does that mean — reading between the lines — that adding more losses on top of existing losses will just exacerbate the losses, not solve it? Why is not “exacerbating” a loss somehow preferable to getting rid of the underlying loss? Is this some sort of new math that only Stansbury, the VPOA, and Barsetti could love?

Exxon Lawyers’ Glee

Given that City Attorney Dennis Herrera filed a lawsuit on September 19 against “Big Oil/Big Fossil Fuel” companies, the SFERS Retirement Board now faces an interesting conundrum: Since the City Attorney was worried enough to file a lawsuit regarding climate change and global warming as a result of oil, natural gas, and coal extractions, how could the City be suing Big Fossil Fuel with its left hand (City Attorney), while SFERS’ Board of Trustees stubbornly continues investing in harmful investor-owned fossil fuel companies like those Herrera is suing? This makes no sense.

Given that City Attorney Dennis Herrera filed a lawsuit on September 19 against “Big Oil/Big Fossil Fuel” companies, the SFERS Retirement Board now faces an interesting conundrum: Since the City Attorney was worried enough to file a lawsuit regarding climate change and global warming as a result of oil, natural gas, and coal extractions, how could the City be suing Big Fossil Fuel with its left hand (City Attorney), while SFERS’ Board of Trustees stubbornly continues investing in harmful investor-owned fossil fuel companies like those Herrera is suing? This makes no sense.

Do both hands know what the other hand is doing? Or have both hands simply tied the laces of both shoes together, all but ensuring a nasty fall?

Were I an Exxon lawyer, I’d be salivating over the disconnect between San Francisco suing Big Oil via the City Attorney, while SFERS continues investing in the very same climate change-inducing Big Oil companies contributing to sea level rise in San Francisco.

Yes siree, were I that Exxon lawyer, I’d make great hay Herrera’s lawsuit should be dismissed because SFERS has not only been an investor in investor-owned fossil fuel corporations, SFERS has continued investing in fossil fuels despite knowing it was not seeing “additive” ROI, but was seeing the inverse for at least four years: Sustaining “subtractive” ROI of at least $290.1 million in losses. (Obviously, on-going subtractive ROI implies SFERS’ Trustees are not performing its fiduciary duty to maximize revenue for beneficiaries!)

Yes siree, were I that Exxon lawyer, I’d make great hay Herrera’s lawsuit should be dismissed because SFERS has not only been an investor in investor-owned fossil fuel corporations, SFERS has continued investing in fossil fuels despite knowing it was not seeing “additive” ROI, but was seeing the inverse for at least four years: Sustaining “subtractive” ROI of at least $290.1 million in losses. (Obviously, on-going subtractive ROI implies SFERS’ Trustees are not performing its fiduciary duty to maximize revenue for beneficiaries!)

As a hypothetical Exxon lawyer, I’d call into question why SFERS has known for at least the past six years between 2011 and 2017 (or longer) that it had been sustaining massive investment losses on its fossil fuel holdings, but SFERS’ Board did nothing to mitigate those losses by divesting before now. How could Big Oil be responsible for abating Herrera’s “problem,” when SFERS continues to invest, despite its losses, to the detriment of Plan beneficiaries?

Why should taxpayers, and City employees, be footing the bill for SFERS to continue losing massive funds simply to buy a seat at the table, lying (or hoping) it is trying to influence corporate behavior using Level II “shareholder engagement”? Isn’t that something else only an Exxon lawyer could love?

Why should taxpayers, and City employees, be footing the bill for SFERS to continue losing massive funds simply to buy a seat at the table, lying (or hoping) it is trying to influence corporate behavior using Level II “shareholder engagement”? Isn’t that something else only an Exxon lawyer could love?

Is the price of “admission” to encourage changes in Big Oil corporate practices through shareholder engagement, the same cost of massive, on-going losses to the pension fund? Must investors suffer losses to sit at the shareholder engagement table? If so, how different is that from extorting a ransom?

The time to act — not fiddle while Rome and San Francisco burns — is by divesting now! Will Stansbury and other SFERS Trustees thwart Herrera’s lawsuit?

The time to act — not fiddle while Rome and San Francisco burns — is by divesting now! Will Stansbury and other SFERS Trustees thwart Herrera’s lawsuit?

Monette-Shaw is a columnist for San Francisco’s Westside Observer newspaper, and a member of the California First Amendment Coalition (FAC) and the ACLU. He operates stopLHHdownsize.com. Contact him at monette-shaw@westsideobserver.com.

_______________

1 Photo of SFERS’ current Board of Trustees president Brian Stansbury — who is a Sergeant in the San Francisco Police Department — is from the July 12 videotape on SF GovTV during the agenda item to approve the meeting minutes of SFERS’ May 22, 2017 Special Meeting/Board Retreat.